Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 12, 2016

iTraxx net notional spikes post-ECB QE decision

The prospect of the ECB buying up corporate bonds, potentially squeezing supply in the sector, has meant investors have looked for alternative ways to take on risk exposure.

- Markit iTraxx Europe Main index has seen its 5-yr CDS spread tighten to 77bps, from 91bps

- Net notional outstanding on the Markit iTraxx Europe Main index increased by 20%

- Net notional outstanding remained flat for credit indices tracking European high yield and US investment grade

The European Central Bank's (ECB) decision to extend monthly QE purchases to investment grade corporate bonds has seen a rise in investors using credit derivatives to gain credit risk exposure, with a jump in net notional outstanding in European investment grade credit indices.

Credit risk wanes

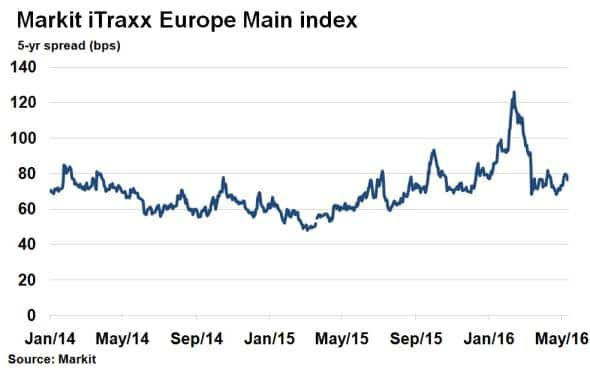

Credit risk among European corporates has fallen significantly since the ECB's decision on March 10th. The Markit iTraxx Europe Main index, which compromises of 125 investment grade single name credits, has seen its 5-yr CDS spread tighten to 77bps, from 91bps on March 9th. The impact of QE was already made evident last year when sovereign bond purchases in Europe sapped credit risk among names such as Portugal and Spain, bringing down bond and CDS spreads.

The prospect of the ECB buying up large chunks of corporate bond issues, potentially squeezing supply in the sector, has meant investors have looked for alternative ways to take advantage of the new risk-on optimism. The Markit iTraxx Europe Main index spread was 59bps just last July, 18bps tighter than today's according to Markit's CDS pricing service.

Increase in exposure

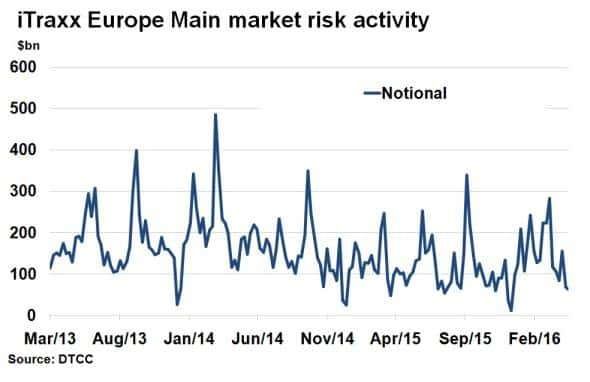

The CDS market offers a liquid alternative to cash bonds to gain risk exposure, and market activity in the European corporate bond sector saw trading volumes spike in March. According to DTCC, weekly CDS trading volumes on the on the Markit iTraxx Europe Main index rose $233bn, from $132bn between the first two weeks of March. Volumes remained elevated throughout the month, with the week ending March 25th seeing activity hit a six month high, although this did coincide with index roll, when activity typically spikes.

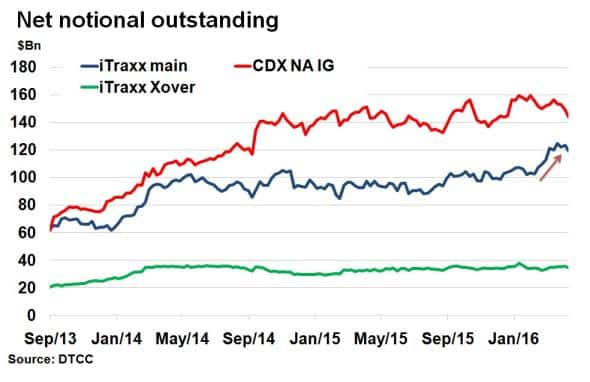

The increased CDS activity also give rise to the net notional outstanding (maximum possible net funds transfers between net sellers of protection and net buyers of protection) on Markit iTraxx Europe Main contracts. Having been fairly stagnant since mid-2014 at around $100bn, the figure has risen to around 20% since the beginning of March. The figure is a good representation of the size of the CDS market in question, as well as credit investors' bias towards being long or short risk.

Interestingly, the spike in net notional on the Markit iTraxx Europe Main index was isolated versus other major credit indices (who rolled at the same time), suggesting the ECB's decision may have had a pivotal impact. The Markit iTraxx Xover index and the CDX NA IG index, which represent the European high yield and US investment grade markets, respectively, saw net national outstanding either remain flat or fall in March.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Credit-iTraxx-net-notional-spikes-post-ECB-QE-decision.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Credit-iTraxx-net-notional-spikes-post-ECB-QE-decision.html&text=iTraxx+net+notional+spikes+post-ECB+QE+decision","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Credit-iTraxx-net-notional-spikes-post-ECB-QE-decision.html","enabled":true},{"name":"email","url":"?subject=iTraxx net notional spikes post-ECB QE decision&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Credit-iTraxx-net-notional-spikes-post-ECB-QE-decision.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=iTraxx+net+notional+spikes+post-ECB+QE+decision http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052016-Credit-iTraxx-net-notional-spikes-post-ECB-QE-decision.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}