Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 12, 2015

Investors retreat from China

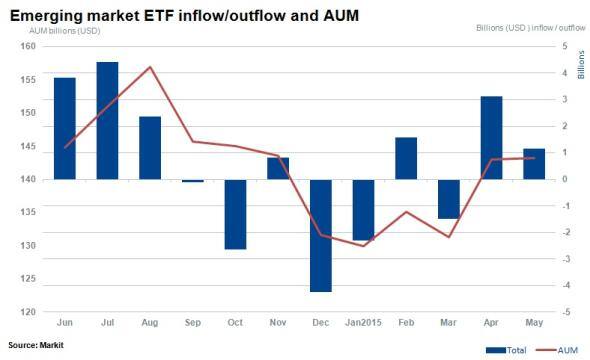

In the wake of dollar strength and slowing economic growth, investors continue to pull capital from Chinese ETFs whereas emerging markets funds see positive inflows in April and May.

- April inflows of $2.4bn into emerging market ETFs reverse Q1 outflows

- But Chinese and Hong Kong tracking ETFs seen $7.2bn of outflows in April

- Net $18bn withdrawn from Chinese and Hong Kong ETFs in last 12 months

Emerging market inflows return in Q2

Reports of large fund outflows from emerging economies in the first quarter of the year are in step with ETF fund flows over that period. Emerging market ETFs have seen significant outflows since the end of August last year.

But this trend has slowed in recent weeks, driven by US dollar weakness and a recovery in global oil prices.

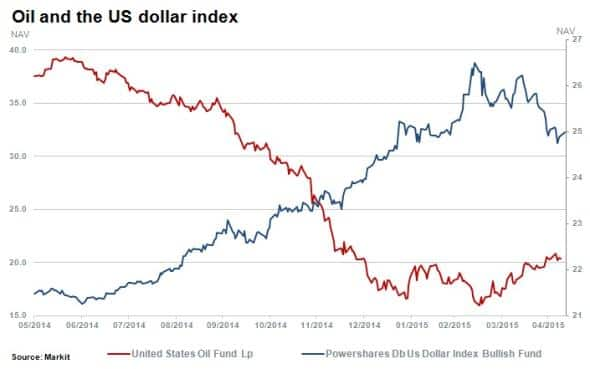

Unwinding of the carry trade

Dollar strength and emerging market currency depreciation continued uninterrupted from June 2014 up until March 2015. During this time, the US dollar appreciated by 23% as measured by Powershares DB US Dollar Bullish fund.

The fund invests in a basket of physical currencies tracking the performance of the DB Long US Dollar Index. The ETF's NAV has receded by 6% since March, trimming its 12 month increase to16%.

The US dollar strength during 2014 and 2015 was accompanied by oil's almost synchronised price collapse, due to record production levels in the US. The fracking revolution in shale oil & gas resulted in a North American glut in oil supply, placing downward pressure on prices.

Oil prices have only just started to recover, but the price movements have already impacted dependant emerging markets like South American and Nigeria.

Although dollar strength and oil price weakness has affected most countries dependant on oil exports, China's slowing growth looks to have had the biggest impact on investor sentiment in the segment.

Emerging markets ETF flows turn positive

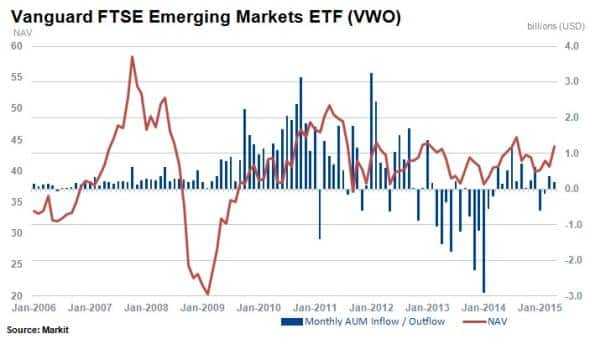

One of the largest ETFs tracking emerging markets is the Vanguard Emerging Markets ETF (VWO).

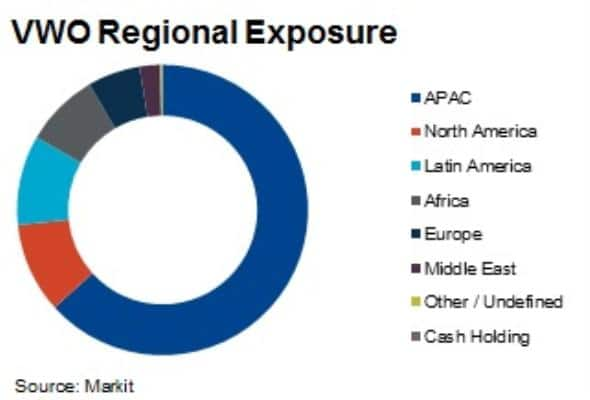

Launched in 2005, the VWO currently has almost $50bn in AUM. The majority of assets track Apac exposure with large Chinese, Hong Kong and Taiwanese securities exposures.

The fund witnessed $740m of outflows in the opening two months of the year. Despite subsequent inflows of $560m since then, the fund is still over $180m down from the start of the year.

Chinese and HK outflows continue

The net overall outflows out of emerging market funds since the start of the year match those seen in Chinese and Hong Kong focused funds.

Combined ETFs tracking China and Hong Kong have seen investors pull a net $18bn over the last 12 months; a trend which has continued since the end of Q1.

These outflows highlight negative sentiment as concerns mount over worrying data points in the Chinese economy; a potential economic slowdown may occur faster than previously expected.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-equities-investors-retreat-from-china.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-equities-investors-retreat-from-china.html&text=Investors+retreat+from+China","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-equities-investors-retreat-from-china.html","enabled":true},{"name":"email","url":"?subject=Investors retreat from China&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-equities-investors-retreat-from-china.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+retreat+from+China http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-equities-investors-retreat-from-china.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}