Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 12, 2015

Emerging market bonds continue pull in investors

Emerging market dollar denominated bonds have bucked the recent bond slump, encouraging investors to flock to the asset class.

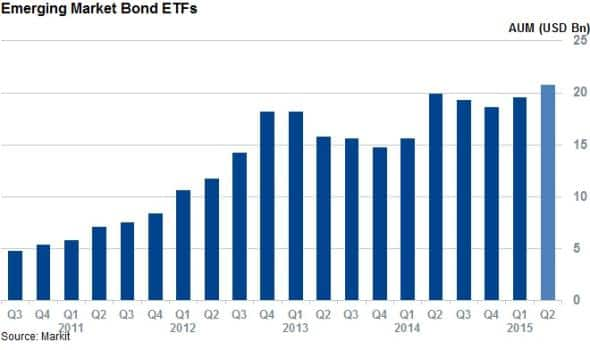

- Emerging market bond ETFs now manage a record $20.7bn

- Both Markit iBoxx USD Emerging Market Sovereign and Corporate indexes have seen spreads tighten year to date

- But Turkish bonds have not seen the same improvements

Last month saw dollar denominated emerging market corporate and sovereign bonds post total returns of 1.2% and 2.1% respectively, according to Markit iBoxx. This performance defied the broader sell off seen at the end of last month and puts dollar denominated emerging market sovereign and corporate bonds 2% and 3.3% ahead of US government bonds for the year to date.

The two key factors behind this recent trend are oil price stabilisation, which has seen investors view bonds issued by oil dependent foreign issued bonds in a more favourable light, and the recent pullback in the dollar which had provided headwinds for emerging market dollar borrowers.

In the wake of these developments investors have flocked to emerging market bonds and the extra yield they provide in the current low interest rate environment.

ETF investors notice EM bond appeal

The recent strong run in emerging market bonds has not gone unnoticed by ETF investors as the 42 emerging market bond ETFs have seen just under $1bn of inflows over the last six weeks. These continued inflows into the asset class mean that emerging market bond funds have experienced inflows for every month this year, with $2.1bn of net new assets in 2015 to date.

Although the asset class is relatively new, the recent strong inflows have taken aggregate AUM for the 42 emerging market bond funds to a new all-time high of $ 20.8bn. This represents roughly 5% of all bond ETF AUM.

EM bonds offer extra yield

These recent strong inflows are no doubt driven by the relative attractive yield offered by dollar denominated emerging market bonds. The Markit iBoxx $ Treasury index is currently yielding 2.2%, despite its recent price slump. This is far lower than the current 4.87% yield of the Markit iBoxx USD Emerging Markets Sovereigns index. Additionally, emerging market corporate bonds offer roughly 1% of extra yield on top of that delivered by their sovereign bond peers.

Investor appetite, as gauged by ETF flows, has been strong despite the recent robust performance of emerging market bonds has eroded some of the extra yield offered by the. The Markit iBoxx USD Emerging Markets Corporate index used to offer around 400bps of extra yield over US treasuries in mid-March, but that number has since tightened to less than 350bps. Sovereign emerging market bonds have experienced the same trend.

The tightening has been pretty unanimous with over 87% of constituents by weight of sovereign index are now trading at a lower spread to reference US treasury bonds than at the start of January.

Bonds which have led the tightening since the start of the year are Russian and Venezuelan issued bonds. The most extreme tightening has been seen in the Venezuelan 2018 13.625 issue whose spread over treasuries has fallen from 38% to 22.6% since the start of the year.

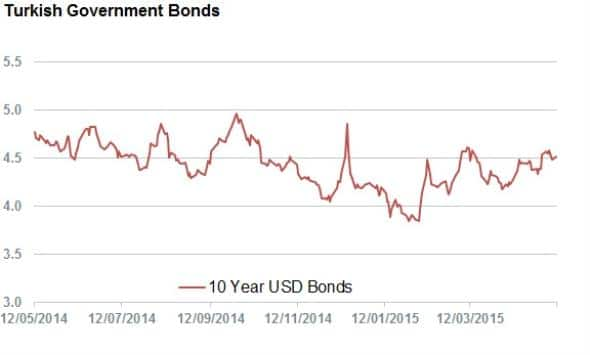

Turkey bucks the trend

The tightening is not universal however with Turkish bonds largely bucking the recent trend. The country's 10 year dollar bond yields has widened by over 40bps since January 1st. Turkish bonds make up half of the sovereign emerging market constituents bonds which are now trading wider for the year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-credit-emerging-market-bonds-continue-pull-in-investors.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-credit-emerging-market-bonds-continue-pull-in-investors.html&text=Emerging+market+bonds+continue+pull+in+investors","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-credit-emerging-market-bonds-continue-pull-in-investors.html","enabled":true},{"name":"email","url":"?subject=Emerging market bonds continue pull in investors&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-credit-emerging-market-bonds-continue-pull-in-investors.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+bonds+continue+pull+in+investors http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12052015-credit-emerging-market-bonds-continue-pull-in-investors.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}