Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 12, 2016

Investors short the hard drive

After years of hype around cloud computing, its rising adoption rates and profits are fuelling a wave of competition and consolidation impacting hard drive manufacturers and attracting rising short interest.

- Sandisk's acquisition of Western Digital has attracted short sellers

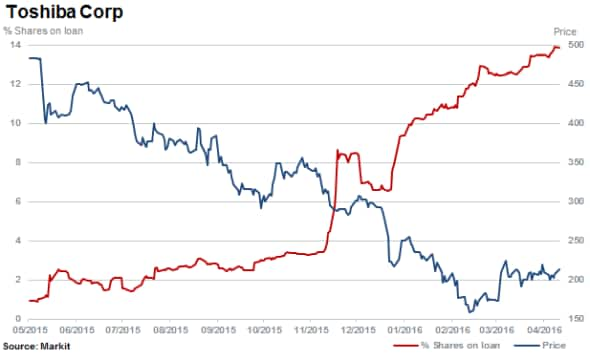

- Toshiba the most short sold hard drive maker, adding to company's other woes

- Pure play cloud provider Rackspace under pressure as tech titans battle for cloud share

'FANG' constituent, Amazon, and others material cloud clout are impacting smaller rivals as well as hardware manufacturers who have seen spikes in short interest levels.

As an industry pioneer, Amazon Web Services (AWS) currently dominates cloud services with almost a third of market share. However fellow FANG Google, along with tech 'stalwarts' Microsoft, IBM and Oracle have made significant strides to catch up in recent years. Combining large investment into cloud based services with plummeting physical storage costs has created a difficult environment for some cloud and physical storage providers.

Increased consumption of streaming services by end users, mean less sales for hard drive (HDD) manufacturers. Additionally, major clients are collaboratively driving the costs of their storage down, themselves. HDD manufacturing has already gone through intense consolidation with a graveyard of 'defunct' companies disappearing through bankruptcy and M&A. Short sellers are bracing for more pain in the sector given that all three of the remaining players have seen short interest spike in recent months.

Western Digital, now the largest storage company by revenue undertook in 2015 to acquire flash storage specialist Sandisk, which has joint ownership with Toshiba of flash memory manufacturing facilities.

Since late 2015, short sellers have aggressively increased positions in Western Digital highlighted by its recent spike and 6% of shares currently outstanding on loan. The company's stock has fallen 55% in the past year with Moody's recently updating their view, rating the company's outlook as stable based on the debt required to fund the Sandisk acquisition.

Sandisk shares have fared marginally better, trading flat after rising in the weeks preceding the acquisition.

Down by 40% in the past 12 months Seagate's stock has fallen significantly with short interest currently at 11.5% of shares outstanding on loan with short sellers gradually covering. However, struggling Toshiba leads the three HDD makers at the moment with 13.9% of shares sold short with its stock falling almost 60% in the past year.

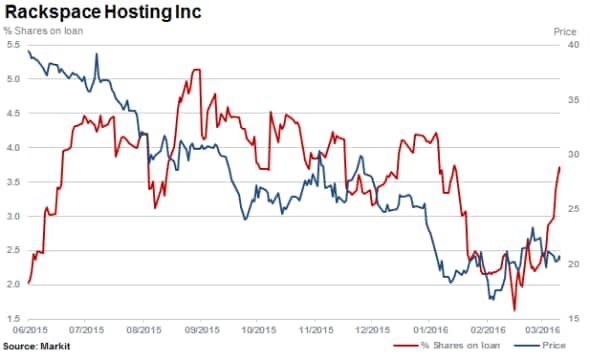

The major players in cloud services and storage have not only impacted the HDD makers but have squeezed smaller 'pure play' cloud businesses. Rackspace, driven by increased competition and pricing, pivoted their strategy and is now a partner to Microsoft and Amazon providing managed services using the companies' respective cloud infrastructure platforms. The company's shares have shed 57% in the past 12 months with short interest rising to above 5% of shares outstanding on loan.

Economies of scale and supply and demand seem to be playing out in the cloud storage space as much as in hard drives as the top company's battle for market share.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-equities-investors-short-the-hard-drive.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-equities-investors-short-the-hard-drive.html&text=Investors+short+the+hard+drive","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-equities-investors-short-the-hard-drive.html","enabled":true},{"name":"email","url":"?subject=Investors short the hard drive&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-equities-investors-short-the-hard-drive.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+short+the+hard+drive http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12042016-equities-investors-short-the-hard-drive.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}