Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 12, 2016

Week Ahead Economic Overview

The week sees important insights into inflation trends in the US, UK and China, as well as fourth quarter economic growth figures for Japan.

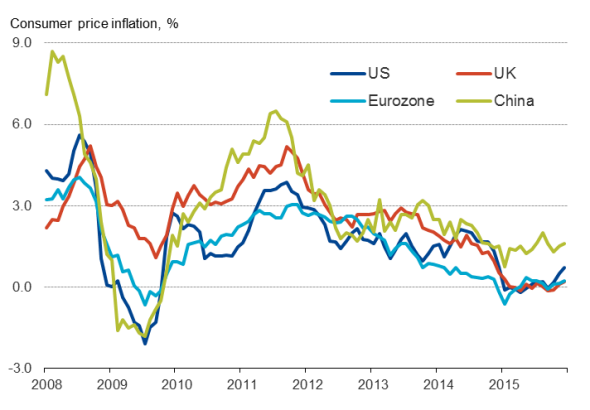

Inflation rates

Sources: US BLS, ONS, Eurostat, NBS

Market expectations are for more gloom to be announced at the start of the week as Japan publishes its initial estimate of fourth quarter economic growth. Analysts are predicting a 1.2% annualised rate of decline, suggesting the economy slipped back into contraction after reviving in the third quarter with 1.0% growth. Weak data will spur further hopes of more stimulus from the Bank of Japan, but Japan's GDP data need to be treated with caution as revisions are often heavy. The Markit-compiled Nikkei PMI data indicate a modest expansion rather than a decline.

Bank of England watchers will be eager to see UK inflation and labour market data releases. UK inflation rose to an 11-month high in December, but at 0.2% was still way off the Bank of England's target of 2%. Little change is expected in January as low oil prices keep the headline inflation rate down.

However, the wage data released on Wednesday will be more important than the January inflation number. UK unemployment is likely to fall from 5.1% to 5.0%, but despite the tighter labour market, wage growth looks likely to remain disappointingly weak. Economists are worried that the current muted inflation outlook is feeding through to low annual salary reviews, which would in turn lead to a further downgrading of inflation expectations.

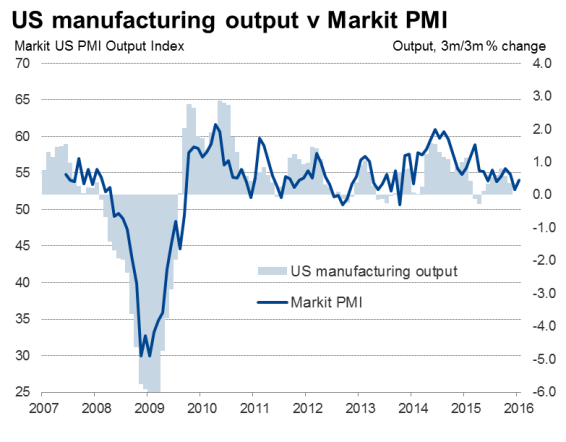

Wednesday also hopefully sees industrial output in the US rebounding from a 0.4% fall in December, helped in part by rising demand for oil amid colder weather and modest improvement in manufacturing, as signalled by Markit's PMI.

The US inflation numbers due out on Friday will also be a major data point to watch. The headline rate hit a one-year high of 0.7% in December, while the policy-sensitive core inflation has risen to 2.1%. Any further uplift will strengthen the case for the Fed to hike rates again soon, potentially as early as March. Clearly, weak numbers will add to the growing clutch of data which suggest the Fed may need to be more patient.

China's inflation numbers, published on Thursday, will likewise be important to watch, as low inflation in China is a key factor behind global deflationary trends. Inflation hit a three-month high of 1.6% in December and any signs of a soft number will pile more pressure on the authorities to do more to stimulate the economy.

Finally, UK retail sales due out on Friday should hopefully show a firmer trend after falling 1.0% in December as low fuel prices help boost spending on other goods.

Monday 15 February

Fourth quarter GDP figures and industrial production data are out in Japan.

Trade data are released in China.

Inflation figures are meanwhile published in India.

Industrial production numbers are issued in Russia.

In Brazil, updates on payroll job growth data and federal tax revenue will be made available.

Tuesday 16 February

German economic sentiment and current conditions data are issued.

Trade balance numbers are meanwhile released in Italy.

Latest inflation data are released in the UK by the Office for National Statistics.

Retail sales numbers are updated in Brazil.

In the US, the NAHB housing market index is released.

Wednesday 17 February

Data on Japanese machinery orders are out.

In Greece and Russia, latest inflation figures are published.

The UK sees the release of unemployment numbers alongside wage data.

The Central Bank of Brazil releases its IBC - Brazilian Economic Activity Index. There are also announcements on service sector growth and foreign exchange flows.

The US publishes its latest industrial production and mortgage data.

Thursday 18 February

The Australian Bureau of Statistics releases its latest employment figures.

In China, France and South Africa, latest inflation data are issued.

Capital investment and central bank reserve data are issued in Russia alongside latest retail sales, unemployment and real wages figures.

Retail sales numbers are updated in South Africa.

The ECB publishes its latest current account figures as well as data on net investment flows.

Friday 19 February

Indian bank lending data are announced, including information on bank loan growth, foreign exchange reserves and deposit growth.

Germany publishes data on its producer prices.

Latest consumer confidence figures are released for the eurozone.

UK retail sales figures are issues by the Office for National Statistics in the UK.

Unemployment data are meanwhile published in Brazil.

Latest inflation and retail sales data are released in Canada.

Finally, the US makes an announcement on latest CPI and real earnings data.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}