Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 12, 2016

German economic growth remains sluggish in fourth quarter

It was an unspectacular end to 2015 for the German economy, with growth failing to accelerate from the 0.3% seen in the third quarter. PMI survey data meanwhile point to further sluggish growth in January. The start to the year has also seen investors' exposure to German exchange-traded funds (ETF) deteriorate as the outlook darkens.

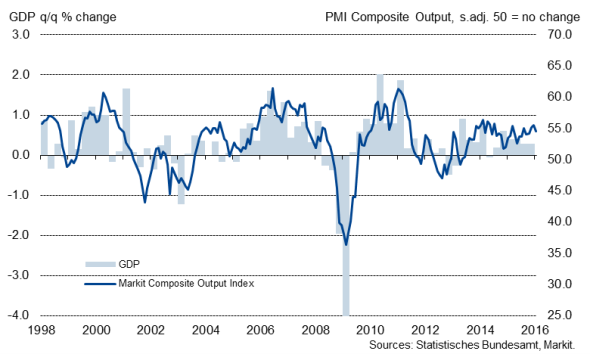

German GDP growth and the PMI

Germany's economy continued to grow at a steady pace in the fourth quarter, according to data from Statistisches Bundesamt Destatis. Gross domestic product (GDP) rose 0.3% in the three months to December, unchanged from the rate recorded in the previous quarter but down from 0.4% in each of the first two quarter of the year. Over 2015 as a whole, the German economy grew 1.7%.

Although economic growth in Germany was above the average over the last ten years (+1.4%), if you strip out the 5.6% decline in 2009, growth has actually been running below this trend (+2.1%) since 2012.

Domestic demand remains main growth driver

While no details were revealed in its press release, Destatis reported that general government final expenditure consumption and household final consumption continued to rise over the quarter. A strong labour market, low inflation, a low interest rate environment and higher real disposable household incomes are likely to have had a positive effect on consumption.

A booming construction sector also appears to have been one of the drivers of growth. Gross capital formation in construction "was markedly up on the third quarter of 2015", according to the release. Markit's Germany Construction PMI has correctly anticipated this upturn, with the average PMI reading over the fourth quarter the best in four-and-a-half years. The PMI rose even further in January, driven largely by a substantial upturn in residential building. Large inflows of refugees, housing shortages in many cities and government plans to support investments in the sector are likely to further stimulate growth of construction output.

Construction output and the PMI

However, the official data also showed some weakness in trade, with growth of exports down on the previous quarter. Net trade therefore had a negative contribution to overall GDP. The data are a further reminder that, despite the weak euro, German exporters are facing several headwinds, from uncertainty stemming from the VW emissions scandal to slowing growth in some of its key export markets.

However, Markit's PMI data (which measure trade in volume terms) have shown stronger growth than the official exports data, perhaps suggesting that although the weak euro is depressing trade revenues, unit sales continue to expand, albeit only modestly.

Slow start to the New Year

Germany's malaise appears to have persisted into 2016. Despite strong construction growth, Markit's PMI data signalled a muted start to the year, with the pace of economic growth slowing since the fourth quarter. This was highlighted by the "all-sector" PMI (which covers the combined output of construction, manufacturing and services) falling from December's 20-month high of 55.5 to 54.7 in January. However, the index remained above the 2015 average, thereby signalling ongoing modest growth of the eurozone's largest economy.

There remain several downside risks to the economic outlook in the year ahead. The effect of the migrant crisis is uncertain, global demand could remain sluggish and it is likely that currency and stock markets will remain volatile.

Bundesbank economists expect German GDP to rise 1.7% in 2016 and 1.9% in 2017, according to its latest semi-annual projection. The bank's president, Jens Weidemann, commented that a "favourable labour market situation and substantial increases in household's real disposable income" are the main drivers of growth. While he also said that "frail" demand from emerging markets hampers foreign trade, "export markets outside the euro area [are] expected to rebound and economic growth within the euro area gaining a little more traction."

Investor sentiment deteriorates

Investors don't seem to share Weidemann's guarded optimism. Appetite for exchange-traded funds exposed to Germany has fallen in February, suffering net outflows of $861 million so far during the month, following net inflows in each of the previous two months.

Exchange traded funds (ETF) provide investors with easy, liquid exposure to various markets. Fund flows consequently provide a valuable and timely insight into how investor appetite towards different markets is changing.

Germany-exposed ETF flows (monthly)

Flash composite PMI data, published on 23rd February, will provide further insight into the economy's performance in the first quarter.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Economics-German-economic-growth-remains-sluggish-in-fourth-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Economics-German-economic-growth-remains-sluggish-in-fourth-quarter.html&text=German+economic+growth+remains+sluggish+in+fourth+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Economics-German-economic-growth-remains-sluggish-in-fourth-quarter.html","enabled":true},{"name":"email","url":"?subject=German economic growth remains sluggish in fourth quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Economics-German-economic-growth-remains-sluggish-in-fourth-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+economic+growth+remains+sluggish+in+fourth+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022016-Economics-German-economic-growth-remains-sluggish-in-fourth-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}