Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 12, 2015

Finding value in fallen angels

Investors have been able to find value in the twilight zone of investment grade bonds, which have subsequently been downgraded.

- "Fallen angel" bonds have managed to outperform both investment grade and high yield bonds since April 2012

- These bonds trade more in line with high yield ones, but have proven to be more resilient in recent downtimes

- Losing investment grade status often comes after the market has already priced this in, as seen in recently downgraded Tesco

Index additions and deletions are key market liquidity events as investors reallocate their assets to ensure compliance to their benchmarks. In the equities world, this has led to the phenomenon which sees shares marked for an index deletion underperform in the lead up to the event, only to regain most of that lost ground in subsequent weeks.

A parallel event in the bond world with so called "fallen angel" bonds, instruments that start their lives with investment grade ratings which they subsequently lose. Falling from the elysian heights of the credit world does create some opportunities for investors however, as bonds which have lost their investment grade status have gone on to outperform both investment grade and high yield benchmarks over the last couple of years.

Fallen angels outperform

Using the returns of the Market Vectors Fallen Angel High Yield Bond ETF (ANGL) as a benchmark, it can be seen that bonds which have lost the hallowed investment grade certification do go on to subsequently outperform. The ETF whose current constituents consist of 149 listings which have lost their investment grade since being issued has posted a compound total return of over 30.6% since its inception in April 2012. This compares to a return on 20.4% posted by the largest high yield ETF (HYG), the iShares iBoxx $ High Yield Corporate Bond ETF and 17% for the iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD).

While the fund has managed to attract some interest from investors, as evident by a doubling of its AUM base since its 2012 launch, its $21.9m size still makes it a niche product despite its recent strong performance.

Trades like high yield, but better downside

The market trades ANGL much closer to high yield bonds than investment grade, as its daily total return has a much closer correlation to the HYG than its investment grade peers.

Fallen angel bonds seem to come into their own in times of relative strains in high yield markets as the ANGL proved much more resilient to the recent pullback seen among high yield bonds, evident by the fact that ANGL fell by just half the margin seen in the HYG, which fell by over 6% between August and December of last year.

A closer look at the ANGL constituents sees that energy firms, which led the recent downturn, are a much smaller part of the fund than HYG.

Market already prices moves in

Much like in the equities world, much of the outperformance can be attributed to markets having already priced in a downgrade ahead of the credit agencies and the reallocations in the wake of a rerating offer some short term opportunities.

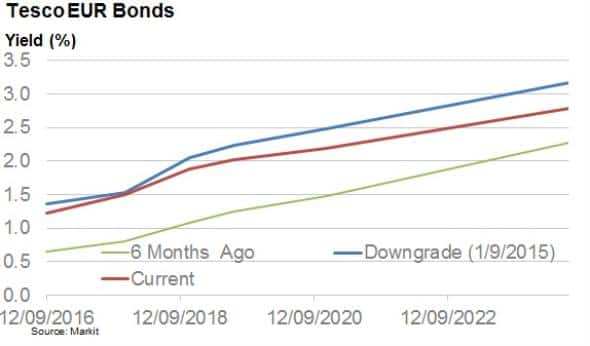

Tesco, a British grocery retailer also experienced a similar phenomenon. It was downgraded to 'junk' status by rating agency Moody's on January 9th on the back of what were seen as a challenging operating conditions, in spite of significant restructuring actions. The EUR bonds were subsequently shifted to HY indices according to iBoxx. Yield performance since then has seen the curve tighten but is around 100bps off across the term from around six months ago.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-credit-finding-value-in-fallen-angels.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-credit-finding-value-in-fallen-angels.html&text=Finding+value+in+fallen+angels","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-credit-finding-value-in-fallen-angels.html","enabled":true},{"name":"email","url":"?subject=Finding value in fallen angels&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-credit-finding-value-in-fallen-angels.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Finding+value+in+fallen+angels http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12022015-credit-finding-value-in-fallen-angels.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}