Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 12, 2016

New indicators provide deeper global macro insights

The New Year sees the launch of new economic indicators designed to provide fresh insights into global economic trends. Markit, on behalf of J.P.Morgan, has developed new monthly PMI indices of global trends in various broad sub-sectors of manufacturing and services intended to specifically highlight the extents to which businesses, households, investment and the financial sector are driving the economy.

Global manufacturing: output

Global services: output

Compiling the new indices

The new indices are based on existing PMI survey data collected by Markit from over 30 countries, including all major developed and emerging nations (see appendix). Monthly data are available back to 2009. The indices cover several key variables from output and orders through to employment, prices and inventories (see appendix). As with all PMI indices, an index value in excess of 50 signals an increase/improvement on the prior month while readings below 50 point to a decrease/deterioration. The data are presented in seasonally adjusted format.

Each national survey panel is carefully constructed by Markit to accurately reflect the true structure of the economy and national data are weighted together according to each county's contribution to global value added.

We have developed three new manufacturing indices: consumer goods, investment goods and intermediate goods. The first covers producers of both durable and non-durable consumer goods, from food & drink to white and brown goods such as refrigerators and TVs. Investment goods data are based on responses from producers of machinery, plant and equipment, which will therefore cover a large proportion of global capital expenditure.

Producers of intermediate goods are firms that supply inputs into the manufacturing process of other firms, such as car tyres, electronic components and packaging.

In the service sector, we split out firms whose customers are predominantly households from those that serve corporate customers, with a third category of financial service providers such as banks and insurance companies also monitored.

The industry sectors included in each new index is shown in the appendix. Some firms will naturally fall into two categories. Car firms for example provide vehicles to both households and companies, and hotels will cater to both holidaymakers as well as corporate guests, and likewise a manufacturing company may also provide consulting or support services to its customers. These firms are either dealt with by collecting data from more than one representative of the company to cover the different markets, or determining (often in consultation with the company) which is the most appropriate sector to assign the company to.

Interpreting the manufacturing data

The sub-sector data broadly aggregate to the currently published J.P.Morgan Manufacturing and Services PMI indices, therefore helping to explain the monthly movements in these indicators.

Looking at manufacturing, the new indices show that producers of consumer goods, which account for one-third (32%) of global manufacturing value added, have been an important driver of the wider manufacturing recovery over much the past five years, especially during 2015. Low inflation, falling oil prices, resurgent real wage growth, higher employment and rising consumer confidence have all helped boost demand for consumer goods. Production of consumer goods also appears to be less cyclical than for other types of good (see chart).

Production of investment goods (some 22% of global manufacturing value added) acts as a proxy for capex, and it was interesting to see output exceeding the average rate of expansion seen across total manufacturing in the early stages of the post-recession recovery, most likely reflecting pent up demand from the downturn. Since mid-2010, the data suggest that global capex spend has broadly followed the manufacturing cycle, with the exception of 2012, when global production of investment goods fell sharply, attributable in part to increased economic uncertainty at the time amid the spiralling eurozone crisis.

Intermediate goods production is the largest of the three manufacturing sectors (accounting for 46% of global manufacturing value added) tends to fall to a greater extent than overall manufacturing output in times of weaker growth or downturns, possibly reflecting increased efforts by manufacturers to wind-down inventory levels.

Interpreting the services data

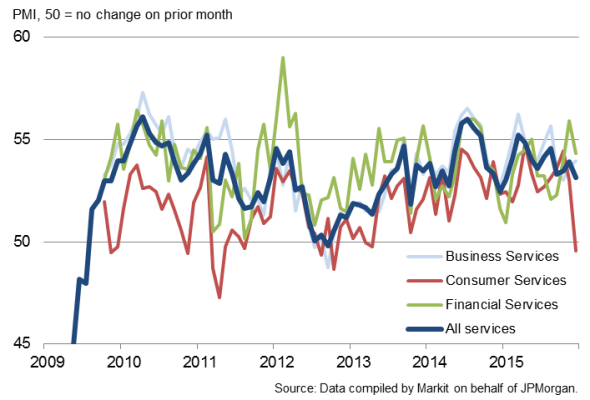

The services PMI data are split into three sub-divisions, the largest of which is business services (accounting for almost two-thirds (64%) of services value added). Business services activity is highly correlated with manufacturing output (see chart), more so than the other two services sub-sectors, which highlights the dependence of certain services companies (personnel, transport, marketing etc) on the health of the manufacturing economy and to some extent illustrates why manufacturing remains an important bellwether of an economy's health even in countries where goods production only accounts for a small proportion of GDP.

Financial services, accounting for 17% of global services value added, generally correlate closely with the general economic cycle (see chart), albeit at times showing different levels of activity. Stronger financial services growth relative to the wider economy was seen consistently in the two years following mid-2011, for example.

While consumer goods producers have enjoyed stronger-than-average manufacturing growth over the past five years, providers of consumer services (accounting for 20% of services value added) have seen a weaker pace of expansion and lagged overall services growth over the same period. Whereas goods producers have been able to woo consumers with lower prices, this has not been the case for service providers, whose costs are often largely related more to wages than commodity prices.

Broad data set

While this note is primarily concerned with output trends, the survey data can also be used to analyse employment, pricing, order books, inventory and supply-chain performance. Employment growth, for example, has in recent months been strongest in consumer goods manufacturing and financial services.

Meanwhile, new orders for intermediate goods has now fallen for two consecutive months, suggesting global manufacturers were reducing their demand for inputs at the end of 2015 (which corresponded with the steepest drop in inventories of manufacturing inputs for almost two years in December).

On the price front, the discounting-led growth of consumer goods activity may be showing signs of ending soon, as prices changed by producers of consumer goods rose (albeit only modestly) at an increased rate in December, contrasting with price falls for investment and intermediate goods.

Business services

Financial services

Global services: employment

Global manufacturing: employment

Further information

Further information on how to access the new J.P.Morgan PMI indices can be obtained by contacting economics@markit.com.

Appendix Attached

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-economics-new-indicators-provide-deeper-global-macro-insights.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-economics-new-indicators-provide-deeper-global-macro-insights.html&text=New+indicators+provide+deeper+global+macro+insights","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-economics-new-indicators-provide-deeper-global-macro-insights.html","enabled":true},{"name":"email","url":"?subject=New indicators provide deeper global macro insights&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-economics-new-indicators-provide-deeper-global-macro-insights.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+indicators+provide+deeper+global+macro+insights http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-economics-new-indicators-provide-deeper-global-macro-insights.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}