Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 12, 2016

Dividends challenged heading into 2016

The economic developments that rocked global markets last year are filtering through to dividend policies in 2016, putting a damper on payment growth.

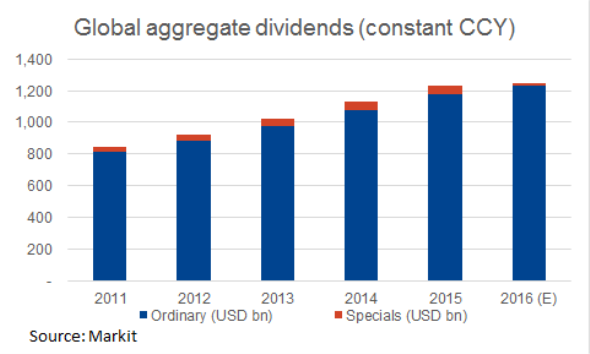

- Pace of global dividend growth forecasted to nearly halve in 2016 to 5%

- Commodities payments set to fall globally, with UK and Australian investors most impacted

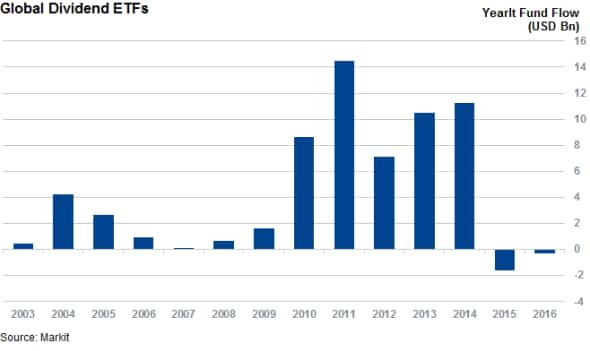

- Dividend ETFs suffered their first ever yearly outflows in 2015, 2016 sees trend continuing

Please click link to read the full reports on Asian, UK, European and US 2016 dividend outlooks

Investors seeking solace in dividends as a bulwark from market volatility may be disappointed in 2016, as global economic headwinds look set to impede payment growth in the next 12 months according to Markit's global dividend forecast.

2016 will see the pace of ordinary dividend growth paid by firms in Europe, the UK, Asia and the US fall to 5% on a constant currency basis; nearly half the 9.3% growth seen in the previous four calendar years.

The US is forecast to be the bright spot on a regional basis as the 500 largest US companies by market cap are expected to grow their ordinary dividend payments by 6.9% year on year, hitting $425bn.

Commodities headwinds

The average stalling dividend growth expected is in part driven by the commodities slump which has seen some of the of the most generous dividends payers across the world cast payouts aside in order to cope falling prices. Oil & gas and natural resources companies across are set to make even smaller aggregate payments across the globe than the already trimmed 2015 total.

In the most severe cases, such as Australia and the UK, this trend is actually set to see the aggregate dividends paid across these markets come in less than last previous year's total. Australian basic resourced companies are set to cut their aggregate dividends by 45% in the coming 12 months which will contribute to the country's 2.2% fall in aggregate dividends.

UK basic materials firms are set to cut their payments much more aggressively with a 56% forecasted cut which will contribute to a 1% fall in aggregate ordinary dividends in 2016. Mining company BHP Billiton is the driving force in both countries as the firm is forecast to more than halve its payments in order to protect its credit rating.

Pockets of global growth

Although headline growth may appear disappointing, in Europe and Asia it's worth noting that the global dividend tide is not expected to hit every country globally as several countries are still set to grow their payments by the 10% pace seen in the last few years.

In Asia, South Korea is expected to be the top dividend payer as the country's Chaebol conglomerates look set to bend to longstanding government pressures to unlock their cash hoards. This will see aggregate payments made by the country's firms grow by 20.9% to KRW 16.9tr; over ten times the growth seen in the rest of the region.

The other dividend bright spots in Asia are New Zealand, the Philippines and India which are all forecast to grow their aggregate dividend payments by more than 10%.

In Europe, five countries are set to boost aggregate payments by more than 10% in the coming 12 months, with Denmark leading the way with a 21% increase in aggregate payments. The other countries whose firms are expected to boost payments by more than 10% are Italy, the Netherlands, France and Poland.

Dividends lose momentum in 2015

The slowing dividend growth faced by many former strong payers seems to have turned some investors away from dividend investing altogether. Dividend ETFs experienced their first yearly outflow ever in 2015. The 62 dividend maximising ETFs globally experienced $1.8bn of net outflows, the first time the asset class has withdrawn over a 12 month period. This trend has also continued in the new year, with investors have already withdrawing nearly $300m from these funds in the opening week of 2016.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-Dividends-challenged-heading-into-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-Dividends-challenged-heading-into-2016.html&text=Dividends+challenged+heading+into+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-Dividends-challenged-heading-into-2016.html","enabled":true},{"name":"email","url":"?subject=Dividends challenged heading into 2016&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-Dividends-challenged-heading-into-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Dividends+challenged+heading+into+2016 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f12012016-Equities-Dividends-challenged-heading-into-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}