Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 11, 2015

South Africa credit risk soars; loans continue slide

South Africa's economic woes deepened this week on the ousting of the finance minister, while leveraged loans have continued their downward spiral across the second half of the year.

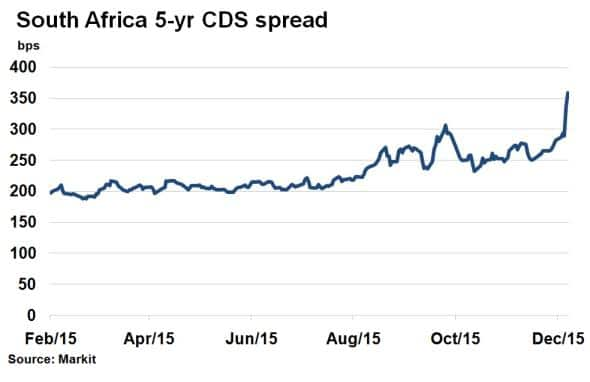

- Departure of SA's finance minister sends sovereign CDS spread soaring above 350bps

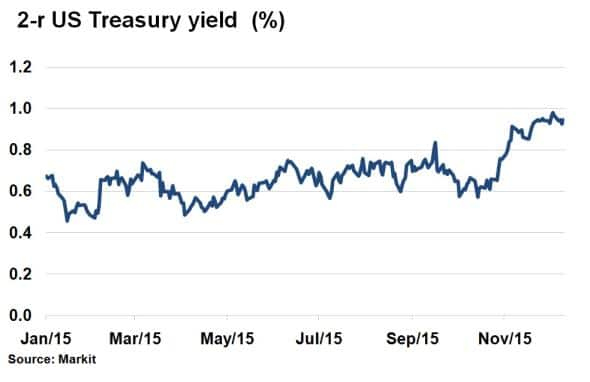

- Commodity related volatility has done little to derail 2-yr treasury yields

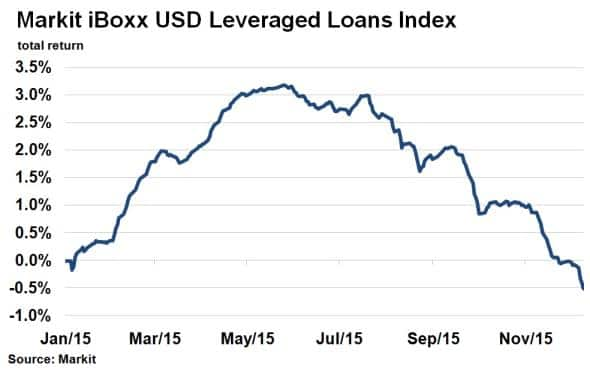

- Markit iBoxx USD Leveraged Loans Index's total return for 2015 turns negative

More EM risk

After seeing South Africa's government debt rating downgraded by Fitch to BBB- last week, President Jacob Zuma this week unexpectedly ousted the country's finance minister, Nhlanhla Nene.

Credit markets reacted with South Africa's 5-yr sovereign CDS spread, a proxy for credit risk, widening 69bps over the last two days. This places the cost to insure South Africa's government debt on par with the likes of Bahrain, and above that of Russia. Credit spreads surpassed 300bps in September amid commodity related volatility, only to resurface this week.

Adding political uncertainty to the mix has seen spreads surpass 350bps according to latest levels from Markit's CDS pricing service. These developments come in the wake of Turkey, Brazil, and Russia, which have all also felt the hefty impact of socio-political turmoil on their economies and financial markets in 2015.

Treasuries remain firm

This week saw the Bloomberg commodities index and the price of oil fall to a new post financial crisis low. High yield bond spreads have widened as a result and emerging market credit risk has resurfaced after the mid-year volatility.

Back in September, the volatility generated in September caused the Fed to delay the inaugural interest rate hike. 2-yr treasuries, the most sensitive to rates, dropped from 0.83% to 0.7% on the day of the announcement. This time around, latest 2-yr rates are 0.95%; highlighting stronger conviction from the market that the Fed won't back down next week, even amid the current resurgent commodities glut.

No joy for loans

There has been no letting up for the riskiest end of the fixed income market in the second half of this year. US high yield bonds, as represented by the Markit iBoxx $ Liquid High Yield Index, have returned -4.3% this year to date.

Leveraged loans, as represented by the Markit iBoxx USD Leveraged Loans Index, turned negative for the year on November 23rd on a total return basis. In total, leveraged loans have lost investors 3.5% since July.

Despite this performance for the year, leveraged loans may prove to be a favourable risky asset given the asset class' minimal exposure to rising interest rates and relative lower commodity exposure compared to high yield bonds.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-credit-south-africa-credit-risk-soars-loans-continue-slide.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-credit-south-africa-credit-risk-soars-loans-continue-slide.html&text=South+Africa+credit+risk+soars%3b+loans+continue+slide","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-credit-south-africa-credit-risk-soars-loans-continue-slide.html","enabled":true},{"name":"email","url":"?subject=South Africa credit risk soars; loans continue slide&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-credit-south-africa-credit-risk-soars-loans-continue-slide.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=South+Africa+credit+risk+soars%3b+loans+continue+slide http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122015-credit-south-africa-credit-risk-soars-loans-continue-slide.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}