Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 11, 2014

A Greek tragedy in the final act

Images of the Greek default in 2010 and 2011 are back and investors have been quick to move funds out of the country as scenarios of political and fiscal demise start to resurface.

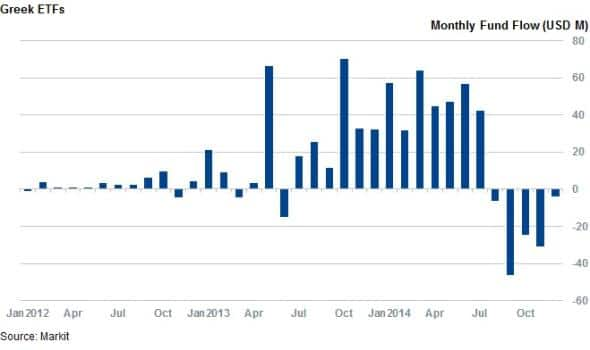

- Greek ETF outflows have seen AUM decrease by 20% July to date

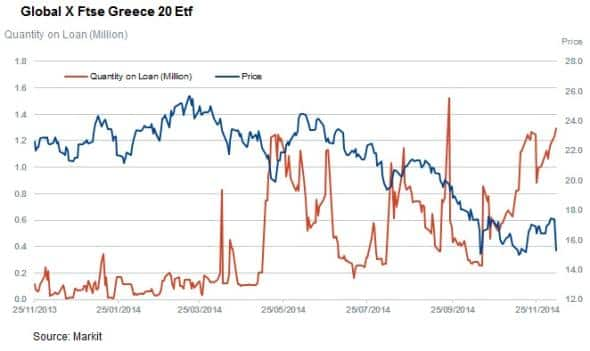

- The second largest ETF exposed to Greece has seen increased short selling

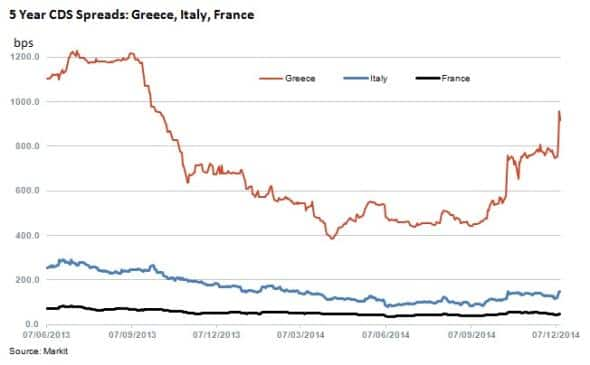

- Greek CDS spreads have increased 139% from lows reached in April 2014

Here we go again

PIGS seemingly fly again as reports of the Greek economy coming out of recession released in November have been overshadowed by news of the prime minister announcing a snap election in December. This brings expected election proceedings forward by two months in an effort to shore up support sooner rather than later as the radical left party Syriza is gaining support amid high unemployment and austerity measures.

The fall in stocks and bonds in Athens has startled investors and pushed the borrowing costs of surrounding countries in the eurozone higher, displaying the growing concerns and contagion not seen in a number of years.

Global investors are concerned that if Syriza comes to power, there could be a conflict between their current political policies and fiscal agenda and the country's ability to serve long term debt holders, especially foreign holders. These concerns are impacting debt yields and stock markets are pushing to the surface yet again the debate around the Euro state's membership.

The stock market declined by 12.8% on Tuesday the 11th of December, which is the biggest fall since 1987.

ETF investors flee early

Unabated fund outflows from ETFs exposed to Greece started in August 2014 after thirteen consecutive months of inflows. Total outflow over this period reached $111m, representing a 20% decrease in total AUM.

Current AUM in the region in terms of ETF assets stands at $415m and is spread across four funds with the majority, 66%, sitting in the Lyxor ETF FTSE Athex Large Cap UCITS listed on Euronext, Paris.

Due to limited liquidity in the stock market locally, global investors wanting to take a bet on Greece's turmoil have turned to the second largest ETF by AUM exposed to the region, the NYSE based, Lyxor ETF FTSE Athex Large Cap UCITS.

Increased shorting activity has occurred with the quantity of ETF shares on loan increasing dramatically towards the end of year reaching 1.25m shares.

Rise in CDS spreads

Greek CDS spreads have increased by 139% from 384bps to 918bps. The increase comes as investors uncertainty and demand to reduce exposure to default is priced into the market ahead of the elections.

CDS and bond yields increase as insurers and investors require more in return as sentiment and risk increase in the current environment. The rising cost of debt impacts the countries already fragile position on its road to recovery.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Equities-A-Greek-tragedy-in-the-final-act.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Equities-A-Greek-tragedy-in-the-final-act.html&text=A+Greek+tragedy+in+the+final+act","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Equities-A-Greek-tragedy-in-the-final-act.html","enabled":true},{"name":"email","url":"?subject=A Greek tragedy in the final act&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Equities-A-Greek-tragedy-in-the-final-act.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=A+Greek+tragedy+in+the+final+act http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11122014-Equities-A-Greek-tragedy-in-the-final-act.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}