Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 11, 2017

Week Ahead Economic Preview

A number of countries see second-quarter GDP data releases, while retail sales and housing statistics will help gauge consumer resilience in the US, and therefore future Fed policy. Other key highlights include UK employment, retail sales and inflation, which could influence the timing of the first rate hike by the Bank of England, as well as China's credit, fixed investment and industrial output data.

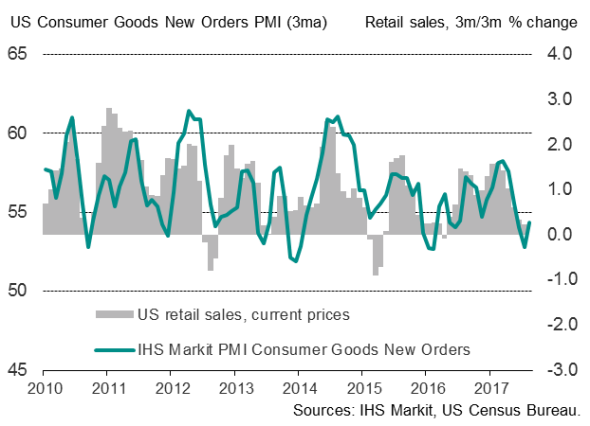

US retail sales will be eagerly awaited for clues as to whether the recent signs of strain on the consumer have continued into the second half of the year. The decreases in retail sales in May and June had tempered expectations of a significant rebound in GDP during the second quarter; however, recent nonfarm payrolls have surprised on the upside and July's IHS Markit PMI showed an economy gaining growth momentum. Other key highlights include the FOMC minutes, housing data and industrial output numbers, which will provide signals as to the overall health of the US economy.

US retail sales and US consumer goods new orders

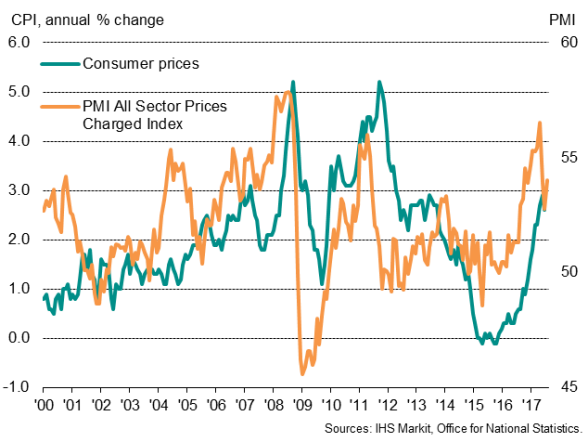

In the UK, the focus is on labour market and wage data, alongside inflation numbers, for further guidance on consumption trends and future monetary policy. Earnings growth slowed to the lowest seen since late-2014 in May, falling further behind inflation. Recent recruitment survey data, however, has shown a combination of demand for staff and deteriorating candidate available leading to stronger pay growth. Overall price pressures also picked up in July alongside an increase in the rate of job creation, according to the latest PMI data.

UK inflation

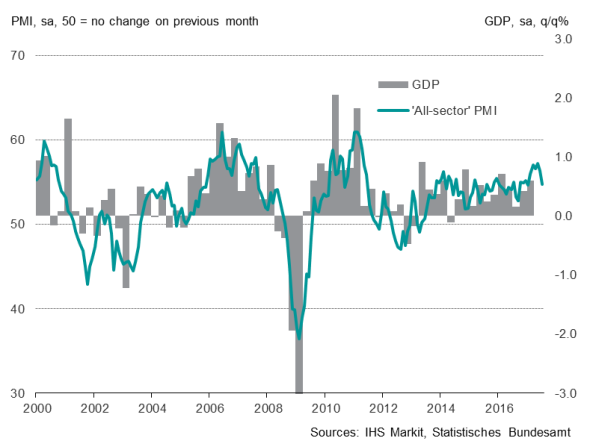

Meanwhile, second-quarter GDP numbers are released for several developed countries: Germany, Italy and Japan. Expectations are for Germany and Italy to show quarterlygrowthof 0.6% and 0.3% respectively. More recent PMI data indicated that Italy recorded faster growth in July while a slowdown was seen in Germany. Japan watchers are expecting GDP growth to pick up from the annualised rate of 1% in the first quarter to 2.5%. However, the latest survey data indicated signs of slowing momentum at the start of the third quarter, in part due to slower export growth.

Germany PMI and economic growth

Finally, in China attention will be on investment, retail sales and industrial production for trends in key growth drivers. Recent Caixin PMI data showed that the Chinese economy started the third quarter on a firm footing, led by a pick-up in manufacturing activity.

Download the report for a full diary of key economic releases.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082017-Economics-Week-Ahead-Economic-Preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11082017-Economics-Week-Ahead-Economic-Preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}