Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 11, 2015

Chinese dividend growth stalls despite stock rally

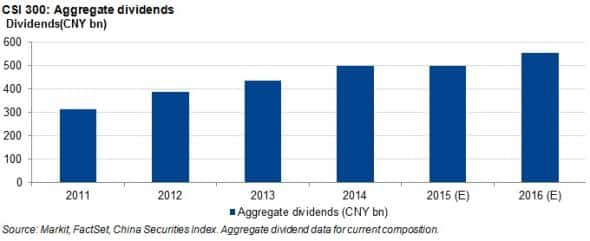

The aggregate dividends paid by constituents of the CSI 300 index are expected to stall out in the coming fiscal year; a sign that Chinese corporate results are not keeping up with buoyant share prices.

For a copy of the full CSI 300 dividend report please contact press@markit.com

- CSI 300 constituents are forecast to pay out just under CNY 500bn in dividends, roughly the same as last year

- Banks' dividends starting to stall, but remain almost half of the index total at CNY 239.3bn

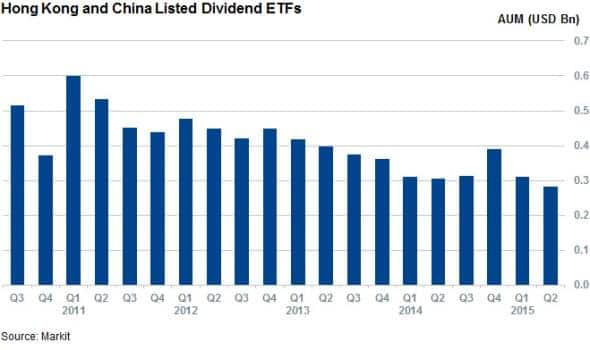

- Dividend investing has yet to take hold among Chinese investors, gauging from ETF flows

Talk of a possible Chinese equity market bubble has grown louder over the last six months, as the country's headline CSI 300 index surged by over 80%. The alleged lack of underlying economic strength has been the cornerstone of these views. The recent weak manufacturing PMI reading, which indicated that the health of the export heavy Chinese manufacturers had deteriorated for the second month in a row in April, further catalysed the debate.

The weakening economic growth is also reflected in the dividends paid by Chinese companies as forecasted to be paid by constituents of the CSI 300.

Dividends flat in 2015

Markit is forecasting headline dividends from CSI 300 constituents to remain roughly flat in 2015. Aggregate dividends are expected to rise by just 0.13% year on year (yoy) to CNY 497.5bn. This low rise, combined with the surging equity market means that the index will yield just under 1.41% in the coming 12 months.

This moderate outlook contrasts with the previous three years of cumulative growth totalling 60% from 2011 to 2014. The slowdown is being driven by top paying sectors, with the top five by aggregate dividends expected to show slower to negative growth in 2015.

Half of top paying sectors fall

Dividends from banks are expected to grow by only 2.5% to CNY 239.3bn, compared with 12.6% and 21.8% yoy growth seen in 2014 and 2013 respectively. This weak growth is driven by a cut in payout ratios mandated to the four largest banks by Central Huijin Investment, a subsidiary of China's sovereign wealth fund which holds a controlling stake in the four banks.

Oil & gas constituents, the second largest contributor to the dividend total, are forecast to perform even worse. The aggregate payment from the sector is expected to reflect the recent oil price slum with an expected 43.2% decline from last year's total. The two drivers of this trend are Petro China and China Petroleum which are forecast to trim payments by 49.5% and 39% respectively.

Downturn in manufacturing

On the manufacturing side, the industrial goods & services sector is forecast to see the aggregate dividend payout slide marginally to CNY 23.0bn. The largest driver in that trend is Zommlion Heavy Industry which is expected cut its payment by two thirds in the coming year.

Financial services enjoy market rally

China's securities industry is reaping the benefits of the recent market rally. Six of the 17 financial services firms in the CSI 300 are expected to more than double dividends this year. This will see the dividends paid by the sector grow by 74% from last year's total.

Citic Securities, exemplifies this trend after it declared a 106.7% yoy higher cash dividend of CNY 0.31, with ex-date unconfirmed yet. Another two firms, Huatai Securities and Northeast Securities, tripled their dividends this year.

Dividends yet to see investment focus

The Chinese market seems relatively less focused on dividends than its western peers, as there are only five Hong Kong and China listed dividend focused ETFs. These funds have seen AUM shrink to half the levels managed at the start of 2011.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-Equities-Chinese-dividend-growth-stalls-despite-stock-rally.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-Equities-Chinese-dividend-growth-stalls-despite-stock-rally.html&text=Chinese+dividend+growth+stalls+despite+stock+rally","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-Equities-Chinese-dividend-growth-stalls-despite-stock-rally.html","enabled":true},{"name":"email","url":"?subject=Chinese dividend growth stalls despite stock rally&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-Equities-Chinese-dividend-growth-stalls-despite-stock-rally.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+dividend+growth+stalls+despite+stock+rally http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11052015-Equities-Chinese-dividend-growth-stalls-despite-stock-rally.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}