Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 11, 2015

Chinese property developers' bonds widen

China's property sales volumes have fallen sharply in the opening months of the year, which has seen the credit market treat bonds issued by property developers with increasing bearishness.

- Evergrande, Time Property and China SCE have all seen their bonds widen relative to the wider offshore RMB market

- Yields in the Hang Seng Markit iBoxx Offshore RMB China Bond Index have widened by 60bps over this period

- But Kaisa bonds have rebounded since it announced a restructuring

China property transactions for the opening two months of the year fell by over 15% from the same period ago in 2014. This marks the largest fall in three years and will be adding to speculation of a deflating Chinese property market.

Despite efforts by the Chinese government to stabilise the market, the current top three associated searches for Chinese property according to Google trends all have "bubble" in their title. In addition, the top related searches under the "property bubble" headline are those with China in the title.

The Chinese property market is still expected to contract in the first half of this year which could put the country's already lowered growth target at risk, as property is responsible for 15% of Chinese economic activity.

In the face of these recent developments, bonds issued by Chinese property firms have widened significantly.

Bond yields jump

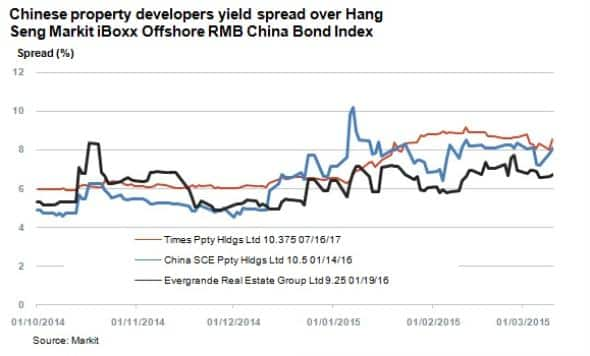

Offshore bonds issued by Chinese property developers in local currency have widened by a wider margin than the rest of the offshore RMB market in the last six months. The extra yield required by investors to hold bonds issued by Time Property, China SCE and Evergrande Real Estate Group have reached new recent highs since the start of October. Bonds investors are now requiring 6.5% or more extra yield over the rest of the RMB universe, which reflects concern about China's property market.

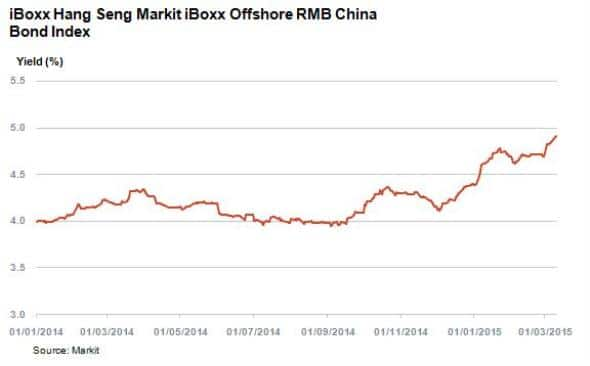

The rest of the RMB offshore market, as measured by the Hang Seng Markit iBoxx Offshore RMB China Bond Index, has also widened, but the index still yields less than 5% compared to over 11.5% for the previously mentioned property developers.

Kaisa rebounds

Bonds in property developer Kaisa Group, which was on the cusp of defaulting on its debts a few weeks ago, have risen since the company announced a bond restructuring. Kaisa's dollar denominated bonds due October 2015 fell below 40 cents on the dollar as the company failed to make a $26m interest payment. The firm has since caught up on its late payment within the 30 day grace period, and the company has kicked off restructuring talks.

Kaisa bonds have since rebounded sharply and the 2015 issue is now trading at 69 cents on the dollar.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-credit-chinese-property-developers-bonds-widen.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-credit-chinese-property-developers-bonds-widen.html&text=Chinese+property+developers%27+bonds+widen","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-credit-chinese-property-developers-bonds-widen.html","enabled":true},{"name":"email","url":"?subject=Chinese property developers' bonds widen&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-credit-chinese-property-developers-bonds-widen.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+property+developers%27+bonds+widen http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11032015-credit-chinese-property-developers-bonds-widen.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}