Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Feb 11, 2015

The winter of green investments

Lower fossil fuel prices continue to impact energy markets, with environmental and alternative investment strategies and ETFs under pressure as investor sentiment shifts and the financial cost of carbon emissions decrease in the short term.

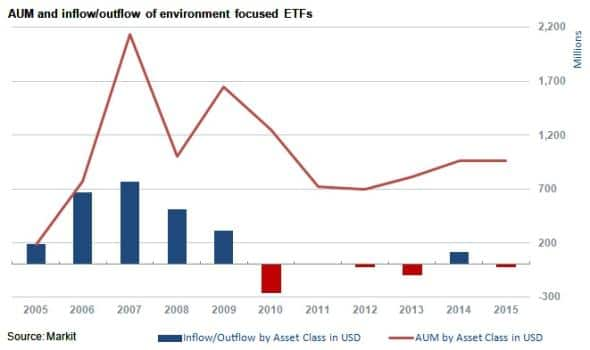

- Environmental sector ETFs' AUM half of peaks reached in 2007

- ETF investors continued to reduce exposure to alternative energy ETFs in 2014

- Short sellers doubled down on short positions in TAN solar ETF and Solarcity

Environmental ETFs continued to lose their appeal among ETF investors as fund flows and price performance have continued to stagnate since record highs were reached in 2007. Five ETF products represent over 60% of AUM in the environmental sector, with a large proportion of funds focused towards alternative energy companies.

Solar Cities

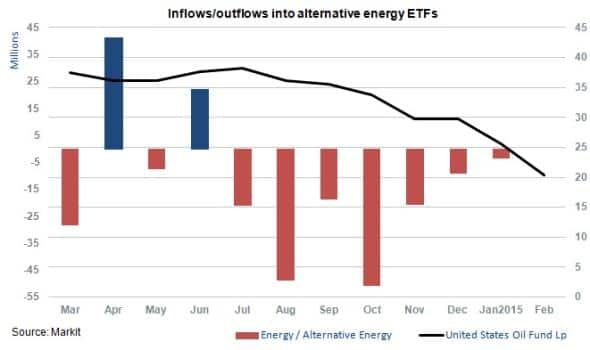

Alternative energy strategy ETFs (which are categorised separately to environmental or green ETFs) have seen consistent outflows since July 2014 totalling $174m; representing 27% of current AUM. This has occurred while oil, energy and basic material prices globally continued to decline as increased supply and weaker demand fundamentals continued to impact markets.

Solar energy companies have been especially hard hit, despite electricity prices being largely fixed as analysts and industry participants debate the correlation between electricity prices and fossil fuels. Investor's action in market data reveal apprehension, as detailed below.

Short interest continues to remain high in solar firms with residential players stealing the spotlight. The average percentage of shares outstanding on loan stands at 6.8% for the top ten holdings of the largest solar ETF, the Guggenheim solar ETF (TAN). TAN is the largest alternative energy ETF by AUM with $322m - representing almost 70% of the sub sector.

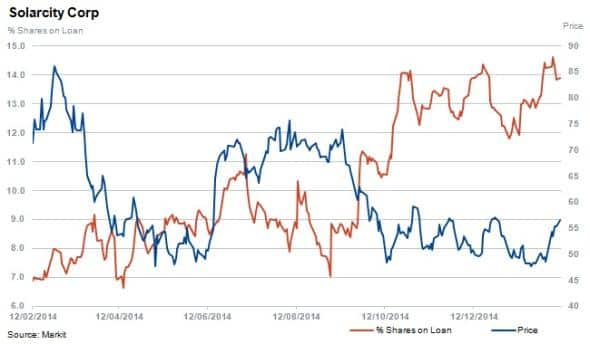

Solarcity, a residential solar panel business that was founded in 2006 on the suggestion of Tesla's Elon Musk, cousin to founders Lyndon and Peter Rive, now contracts 894 MW of electricity from 168,000 customers in the US.

Shares in the company are down by 34% over the last 12 months and short sellers have increased positions in the stock by 97%, with shares outstanding on loan increasing to 14%.

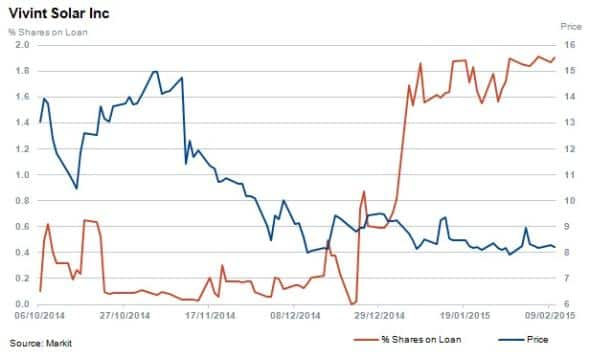

Competitor and residential solar systems seller Vivent Solar recently ran a successful IPO in October, raising $330m and valuing the company at $1.7bn.

Since going public, Vivent shares have declined by 37% and short interest in the stock has increased to 1.9% of shares outstanding.

Electricity prices in the US actually increased in 2014 on average, despite lower production costs due to lower coal and oil prices. Accordingly, the decline in solar companies' shares prices and valuations may have more to do with fundamentals specific to the individual firms, rather than the competing energy sources pricing.

In the case of Solarcity and Vivent Solar, consensus forecasts do expect aggressive revenue growth figures over the next few periods, however accompanying this for both firms is negative earnings and negative free cash flows over the same time frame as the two carve out market share in the US energy market.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-equities-the-winter-of-green-investments.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-equities-the-winter-of-green-investments.html&text=The+winter+of+green+investments","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-equities-the-winter-of-green-investments.html","enabled":true},{"name":"email","url":"?subject=The winter of green investments&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-equities-the-winter-of-green-investments.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+winter+of+green+investments http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f11022015-equities-the-winter-of-green-investments.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}