Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 10, 2015

Beaten down stocks surge

A review of key factors driving returns across markets during October, which saw the S&P 500 surge over 8% while investors pile into the worst performers of the third quarter in Europe and Apac.

- US stocks rally as energy names fuel October bounce and risk appetite increases

- Investors flock to underperformers as price reversals occur with winners losing momentum

- High trailing yields still a strong hit with investors as the factor provides solid returns

To receive this months' full Key Drivers report from Markit Research Signals, please contact us.

Optimism creeping through

During the month of October, US markets moved against short sellers with the second largest month of average price increases seen across high conviction names. The recovery rally was broad and saw the S&P 500 increase by over 8%. However, some energy names soared over 30%. The index is currently tracking to finish 1% higher year to date, representing a significant improvement post August's steep selloff.

Last week, the release of strong jobs and wage growth data now points to an increased probability of a 2015 rate hike and to some extent, gives credence to the October equity rally.

Globally, however, investors have been faced with mixed signals with developed industrial nations contributing to a positive global manufacturing PMI reading of 51.4 in October, offset by an ongoing slump in emerging Asian markets.

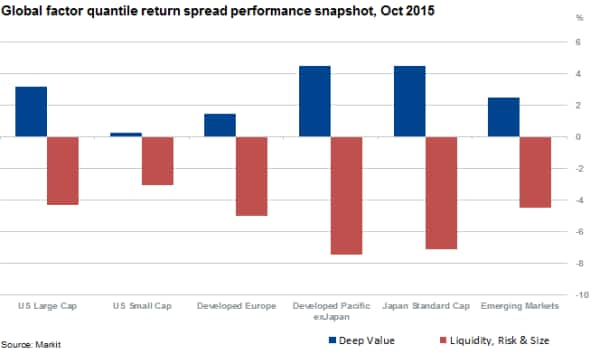

Markit Research Signal's factor performances indicate in October that a strong theme of price reversal was seen across markets, with names that had fallen out of favour previously begin to represent value (even names highly shorted), while price momentum factors underperformed.

Overall, investors' risk appetite increased as they shed less risk (quality) winning names and those with positive price momentum for downtrodden names that have seen consistent price declines, most notably in the energy sector.

US manufacturing and energy rebounds

Despite headwinds from a stronger dollar in the US, PMI data posted its strongest improvement since April while stocks recorded their biggest monthly gain since 2011.

Longterm price reversal and valuation factors took the lead for the US Large Cap universe in October. At the top of the list is the Price Momentum factor 60-Month Alpha, whose monthly performance of 6.7% was impacted by its large active exposure to the Energy sector.

Using the 60-month Alpha factor and ranking by individual names reveals that Energy and material stocks represent the majority of names whose returns are not explained by the general market movements and responsible for the price reversals.

Energy's biggest gainers

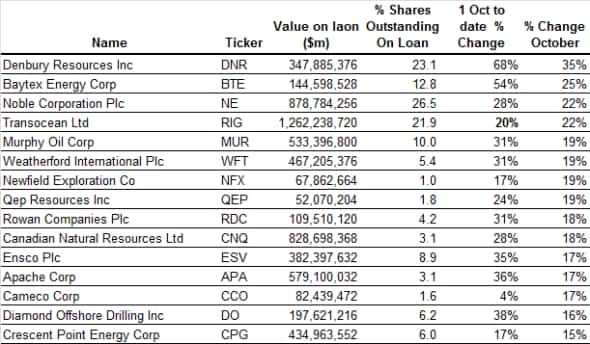

Four energy names in a US Large Cap universe rallied by more than 20% during October, despite all having material levels of shorts interest. Three have fallen over 35% in the last 12 months and Canadian Baytex Energy is down an astonishing 80% (rally inclusive).

The rally has continued across these energy names with only three names losing some ground in the first weeks of November.

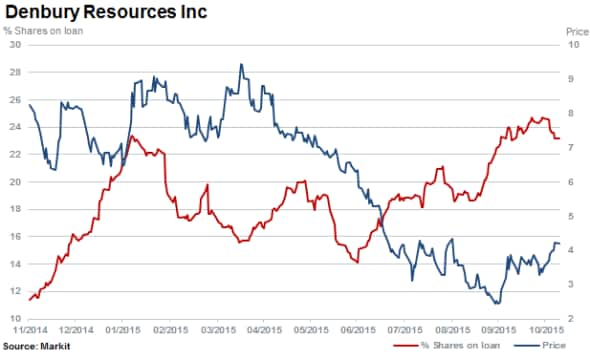

Rising 35% in October and another 33% since is Denbury Resources, an independent oil and natural gas company, which has seen a marginal reduction in short interest recently with shares outstanding on loan reducing to 23%.

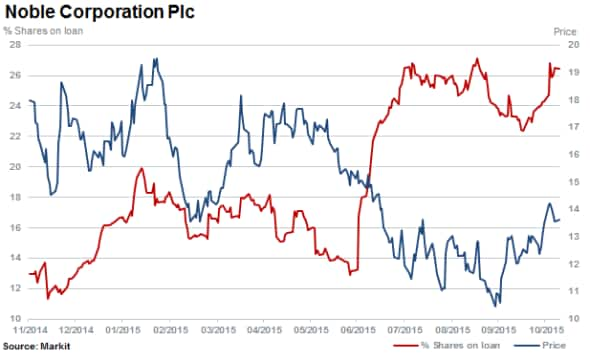

Not to be confused with Noble Group in Singapore, Noble Corporation rallied by 22% in October and a further 6% since. The increase in share price has, however, attracted additional short sellers to the offshore deep-water driller with 26% of shares currently outstanding on loan.

Largest of the three by market capitalisation is 2014 top energy short Transocean with 21.9% of shares outstanding on loan. The share has retreated marginally and currently represents the largest short position on aggregate by value in stocks that rallied at $1.26bn.

Relte Stephen Schutte, Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112015-equities-beaten-down-stocks-surge.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112015-equities-beaten-down-stocks-surge.html&text=Beaten+down+stocks+surge","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112015-equities-beaten-down-stocks-surge.html","enabled":true},{"name":"email","url":"?subject=Beaten down stocks surge&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112015-equities-beaten-down-stocks-surge.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Beaten+down+stocks+surge http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10112015-equities-beaten-down-stocks-surge.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}