Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 10, 2014

Most shorted ahead of earnings

We review how short sellers are reacting to companies due to announce earnings in the second week of the third quarter results season.

- Athenahealth is the most US shorted company ahead of earnings

- Semiconductors are the target of heavy short interest in Europe

- Japanese firms make up the majority of heavily shorted firms announcing earnings

North America

Last week saw former Dow constituent Alcoa kick off the third quarter earnings season with a strong improvement on its results from last year. While the company's announcement was somewhat overshadowed by larger market movements, this week sees the earnings season gather pace with 52 constituents of the S&P 500 index reporting results along with 300 other firms across North America. Of these, 19 see heavy shorting activity with more than 6% of shares out on loan.

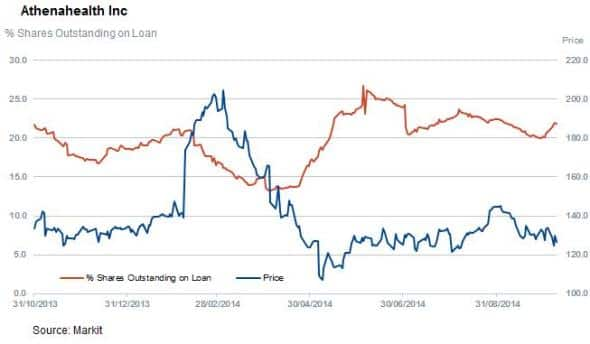

Topping this week's list of the most shorted companies announcing earnings is medical technology firm Athenahealth, which had just under 22% of its shares out on loan ahead of its Thursday earnings announcement. While the firm is no stranger to short sellers, its demand to borrow has increased in recent months after a bout of covering in the wake of the company's outstanding fourth quarter results. The company's inability to consolidate on its strong results in the closing months of last year has seen demand to borrow climb over the last three quarters from the lows seen at the start of April. Shares in the company have also faltered as they currently trade a third lower than at the highs in March.

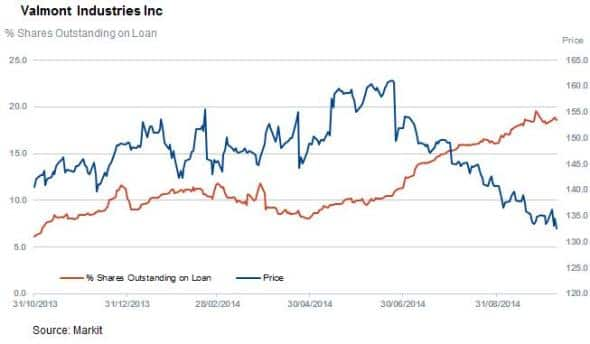

Lacklustre results also look to be behind the surging demand to borrow shares in metal fabrication firm Valmont which has 18.6% of its shares out on loan, nearly four times the number seen a year ago.

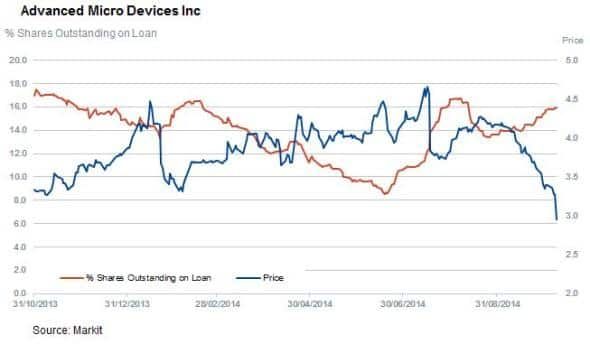

Another firms seeing a surging demand to borrow is chipmaker Advanced Micro Devices which has just under 16% of shares out on loan. That number has nearly doubled in the last few months as the firm put out weaker than expected guidance for the coming quarter which has sent its shares down by 40% in subsequent weeks.

Fellow semiconductor company Cypress joins AMD in the heavily shorted list after seeing analysts trim their expectations for the company's upcoming results.

The largest rise in the month leading up to results was seen in Winnebago Industries, with the RV manager seeing a 38% increase in the proportion of its shares out on loan in the last month to take its short interest to 6% of shares outstanding.

Europe

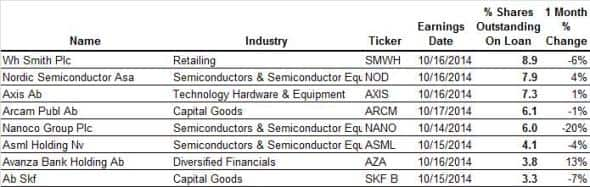

Europe also sees strong earnings activity next week with eight firms announcing results with over 3% of their shares out on loan.

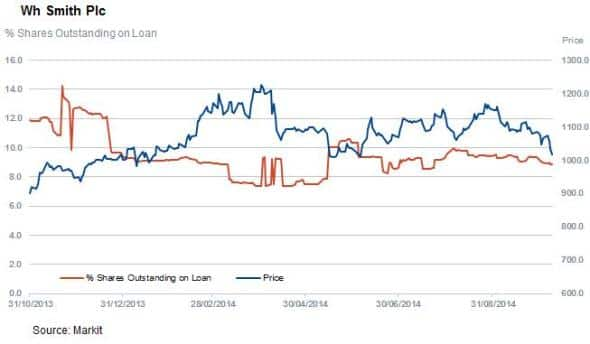

Topping this week's European most shorted list is Wh Smith which has just under 9% of shares out on loan. While the company has by and large weathered the troubles it experienced a couple of years ago by shifting its attention to higher yielding travel retail, the continuing weakness in the UK high street division, where sales are down by over 30% in the last decade, has seen the firm continue to see heavy demand to borrow.

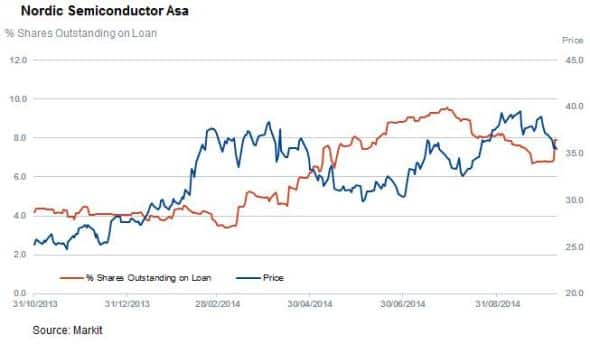

The recent bearish sentiment in semiconductor firms in North America is also echoed in Europe with three semi firms making this weeks' heavily shorted list.

Of the three firms, Nordic Semiconductor sees the largest demand to borrow of this week's lot with 7.9% of shares out on loan. The firm had seen some short covering in the last few months, but Samsung's recent earnings disappointment looks to have seen shorts return in the last few days.

The other two firms in the sector making the list is early stage development firm Nanoco and equipment firm ASML whose short interest has doubled in the last 12 months.

Asia

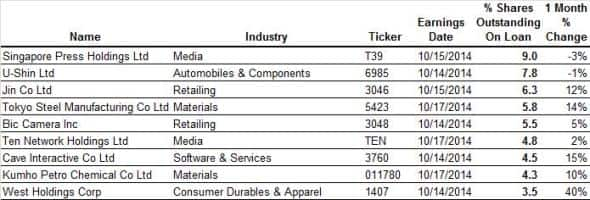

In Asia, Japanese firms continue to make the majority of firms seeing heavy demand to borrow in the early stages of this earnings season with six of the nine companies with more than 3% of shares out on loan ahead of results.

The country's ongoing consumer spending and currency woes continue to drive short behaviour with retailers and materials firm making the most shorted list.

Retailers are led by Jin Co which has 6.3% of shares out on loan, while steel firm Tokyo Steel Manufacturing has seen its short interest rise 14% in the last month as the yen weakened to five year lows against the dollar.

While Japanese firms make up the majority of heavily shorted companies in the run up to results, the most shorted honour goes to Singapore Press Holdings which has 9% of shares out on loan. Shorts have been very active in the name over the last few years, but the company's consistent run of results look to have discouraged some, as demand to borrow is down by 15% since the start of the year. Shares in the company have also remained very steady around the SGD 4.2 mark.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10102014-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}