Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 10, 2015

Markit economic overview

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

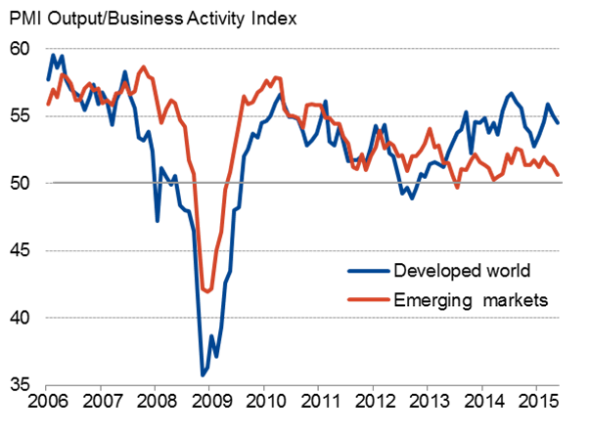

Record outperformance of developed world versus emerging markets

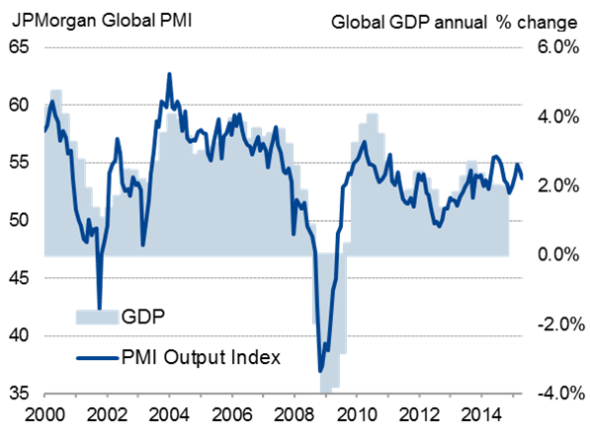

Global economic growth held steady in August in spite of volatile financial markets, according to Markit's PMI survey data. The JPMorgan Global PMI" was unchanged at 53.7, signalling a robust but unspectacular annual rate of global GDP growth of just over 2% per annum. Solid developed world growth contrasted, however, with a marginal contraction in the emerging markets, the biggest such outperformance on record.

Global PMI and economic growth

Developed v emerging markets

Emerging market manufacturing acts as drag on global growth

Global growth is being led by expanding services activity in the developed world, buoyed in turn by central bank stimuli, low oil prices and rising employment. Manufacturing is also faring well in the developed world, boosted by competitive exchange rates in the eurozone and Japan. Emerging market services meanwhile remain near stagnation, in part because manufacturing is seeing one of its steepest downturns since 2008.

Developed world

Emerging markets

Emerging markets slide into contraction

At 49.6, the Markit Emerging Market PMI" signalled a contraction for the second time in three months. Recent months have seen the worst emerging market performance since the height of the financial crisis, with GDP set to grow at a mere 4% annual rate in the third quarter. An ongoing deep downturn in Brazilwas accompanied by renewed contractions in China and Russia, leaving India as the only expanding 'BRIC'.

Emerging market economic growth

Four largest emerging markets

Use the download link below to access a full overview of the August PMI surveys, including details of all major economies, policy implications and the market impact.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-economics-markit-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-economics-markit-economic-overview.html&text=Markit+economic+overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-economics-markit-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Markit economic overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-economics-markit-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Markit+economic+overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092015-economics-markit-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}