Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 14, 2014

French economy mired in stagnation

The French economy continued to stagnate in the second quarter of 2014, signalling an on-going lack of growth in the euro area's second-largest member state. The data was accompanied by the French finance ministry slashing their 2014 growth forecast from 1.0% to 0.5%. However, a poor start to the third quarter suggests that even this lowered estimate may prove optimistic.

Economy stalls as private sector output declines

Data from France's official statistics body INSEE showed gross domestic product unchanged in the second quarter. The stagnation follows a stalling of growth in the first quarter, prior to which the economy had expanded by a modest 0.2% in the final three months of last year.

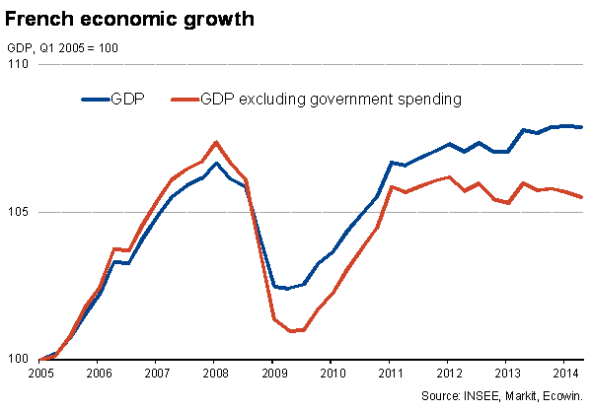

The French economy has grown just 0.5% since the start of 2012, but is nevertheless 1.2% larger than its pre-crisis peak seen in the first quarter of 2008.

However, once government spending is stripped out, the situation looks very different. Excluding the public sector, GDP fell 0.2% in the second quarter of 2014. Having also fallen 0.1% in the first three months of the year, France's private sector is technically back in recession.

Non-government GDP is in fact still 1.7% below its pre-crisis peak. Government spending has, in contrast, risen by 11.1% over this period.

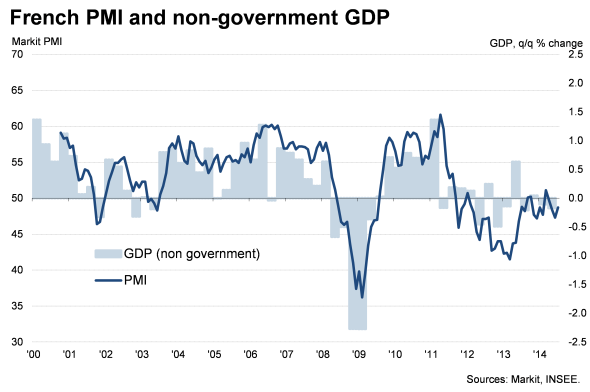

The strong growth of government spending since the financial crisis has been one of the reasons why the headline official GDP data have suggested a better economic performance on average in recent years than the PMI surveys, which only cover private sector activity. Markit's French all-sector PMI has signalled almost continuous contraction of the French economy since early 2012, with only one month of notable growth in March.

With the PMI averaging 48.4 in the second quarter, the surveys had signalled the slight decline in private sector activity and stagnation of overall GDP in advance.

The comparison with the PMI therefore suggests that, while the 0.2% contraction of GDP in Germany in the second quarter looks to have been largely driven by the official data not fully accounting for the smaller than usual number of working days, this is not likely to have been the case in France. In contrast, the GDP weakness in the second quarter is likely to have been an accurate representation of the underlying poor health of the French economy.

While Germany is likely to see GDP rebound in the third quarter (barring any escalation of the crisis in Ukraine), France looks to be headed for on-going stagnation at best.

Poor start to third quarter

To even achieve the French government's 0.5% growth target for the year would require economic growth to average 0.3% in the final two quarter of the year. Such modest growth is clearly achievable, but there are both downside and upside risks to the economy in coming months. First, the situation in Ukraine poses risks associated with damaged business and consumer confidence, as well as the direct impact of sanctions. On the plus side, it will take some time for the stimulus measures announced by the ECB in June to take effect, especially the discounted bank lending programme, or TLROs, which will not commence until September.

August's flash PMI data, published on 21 August, will provide important insights into how the economy is faring in the third quarter. With the all-sector PMI rising to just 48.7 in July, the French economy is also off to a poor start to the third quarter, on course for another marginal contraction of non-government GDP and already set to miss the government's downwardly revised 0.5% growth target.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-french-economy-mired-in-stagnation-.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-french-economy-mired-in-stagnation-.html&text=French+economy+mired+in+stagnation","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-french-economy-mired-in-stagnation-.html","enabled":true},{"name":"email","url":"?subject=French economy mired in stagnation&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-french-economy-mired-in-stagnation-.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=French+economy+mired+in+stagnation http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10092014-french-economy-mired-in-stagnation-.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}