Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 10, 2017

Most shorted ahead of global earnings

We reveal how short sellers are positioned in global companies announcing earnings this week

- Eros International is most shorted North American firm

- Scandinavian firms dominate the European short market

- Japanese software firms see heavy shorting activity

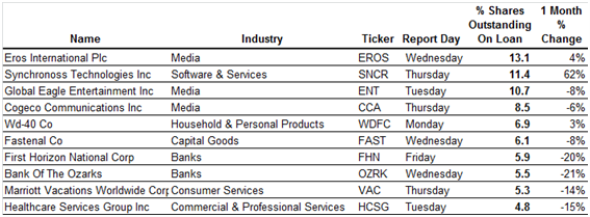

North America

The top North American short of this relatively quiet earnings week is Indian distributor Eros International. The company has been a top target for short sellers ever since 2015, when allegations surfaced that its accounts have been as creatively managed as the films it produces. Despite the lack of prosecutions or a smoking gun in this case, short sellers have shown little signs of relenting; demand to borrow Eros shares has increased by over 50% in the last six months to a new all-time high.

Accounting problems are also the driving force behind this week's second highest conviction short, cloud software provider Synchronoss Technologies, which has 11.4% of its shares out on loan. Most of this shorting activity came in the wake of the company's disastrous first quarter that led to the ouster of its CEO and CFO, as well as a restatement of the company's accounts for the two previous years.

Recent news that Synchronoss is up for sale hasn't deterred short sellers -the demand to borrow the firm's shares increased by nearly two thirds in the last month, and is now the highest level on record.

Regional US banks also feature prominently on this week's list of top short targets. First Horizon National Corp and Bank Of The Ozarks have more than 5% of their shares out on loan ahead of earnings. Both firms benefited from the post-election rally, but short sellers have yet to give up, as both firms have seen a sharp increase in the demand to borrow their shares over the last 21 months.

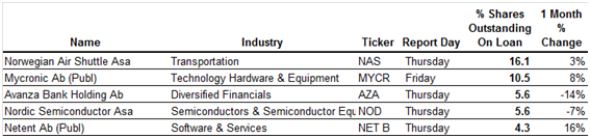

Europe

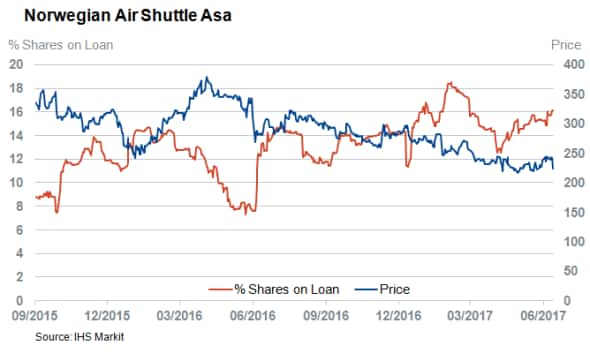

Scandinavian firms make up the entirety of the five heavily shorted European companies announcing earnings next week. This relatively small group is led by airline firm Norwegian Air Shuttle (NAS) which has over 16% of its shares outstanding on loan; this is a third higher than the levels seen three months ago. Rising short interest puts the airline at odds with its peers considering that most other European airline short targets, including NAS rival SAS, have seen some sustained short covering in recent weeks. NAS's continuing high short interest speaks to the company's relatively high exposure to the UK market, which has suffered due to the pound's post-Brexit fall. There have also been questions about the company's ability to execute its ambitious plans to expand its low cost offering to transatlantic routes.

Short sellers may not be up for much of a payday come Thursday: last week's news that Norwegian's CFO Frode Foss was stepping down sent its shares lower by over 10%.

The region's tech firms will also weigh heavily on short seller's minds. Electronics manufacturer Mycronic joins NAS as the only other European firm to see more than 10% of its shares out on loan ahead of earnings. Nordic Semiconductor and Netent also make this week's list, even though the demand to borrow their shares is relatively lower.

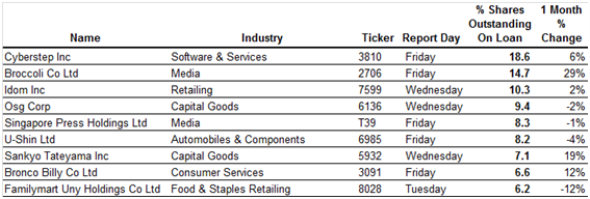

Asia

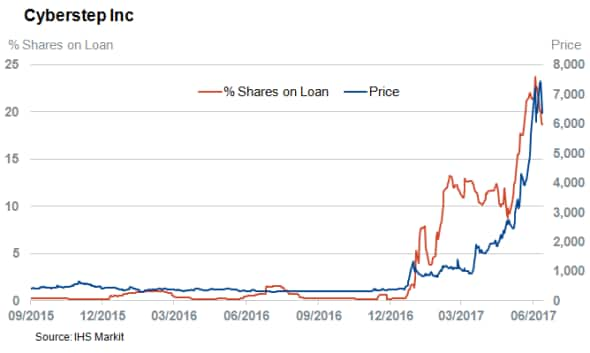

Japanese mid cap Games designer Cyberstep comes in as the most shorted Asian stock announcing earnings this week. The company announced earlier this year that it was developing an app for Hello Kitty publisher Sanrio, which sent its shares up by a staggering 1,600% YTD. Short sellers seem unimpressed by this recent run of form and have continued to increase their positions, despite the pain incurred by the recent rally.

Short sellers have been equally resolute in manga firm Broccoli, the second most shorted Asian company announcing earnings next week. The company's shares have nearly doubled year to date, while demand to borrow its shares has tripled.

The only non-Japanese company to make this week's list of high conviction short targets is Singaporean newspaper publisher Singapore Press Holdings, with 8.3% of its shares out on loan. Short sellers have steadily increased their positions in the last 12 months after headwinds in its media business lost over a quarter of its profits in the first half of its fiscal year.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072017-equities-most-shorted-ahead-of-global-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072017-equities-most-shorted-ahead-of-global-earnings.html&text=Most+shorted+ahead+of+global+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072017-equities-most-shorted-ahead-of-global-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of global earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072017-equities-most-shorted-ahead-of-global-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+global+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072017-equities-most-shorted-ahead-of-global-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}