Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 10, 2015

Credit markets respond well to Greece proposal

Credit markets have reacted positively to Greece's new proposals, while easing macroeconomic tensions elsewhere have prompted investors to pile back into high yield assets.

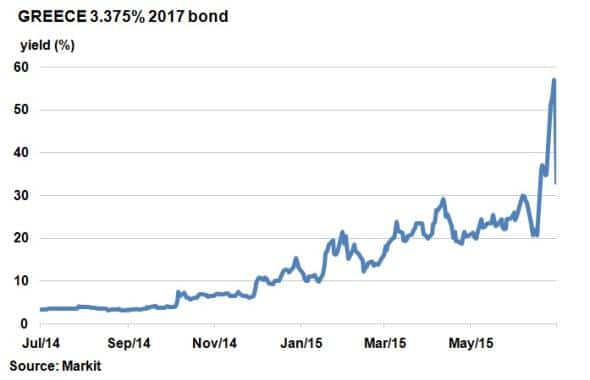

- New proposal sends Greece's 2-yr bond yield down 24%; lowest since June 26th

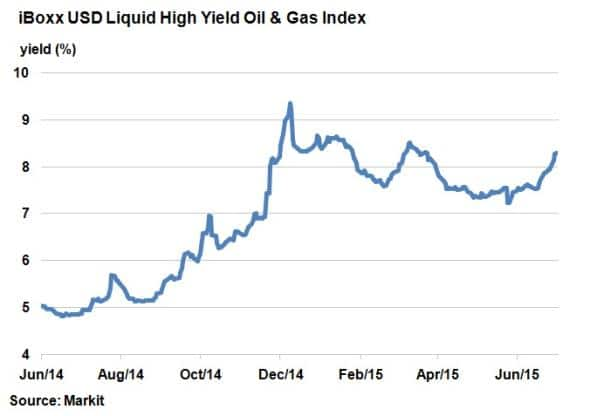

- Markit iBoxx USD Liquid High Yield Oil & Gas Index is 40bps wider than start of July

- After six consecutive weeks of outflows, high yield ETFs bounce back with $474m inflow

Imminent Grexit fears waning

Yesterday evening, the Greek government submitted a new set of proposals to its creditors with the aim of finally putting an end to the drawn out saga. The new bailout plan would provide around €53.5bn over three years, has a tougher stance on austerity and will involve tax rises and pension improvements.

European leaders will now consider the offer ahead of this weekend's summit, and optimism seems high with Francois Hollande describing the package as "serious and credible".

Credit markets have reacted positively but cautiously. Greece's government bond due 2017 has seen its yield fall 2400bps to 33%, the lowest level post referendum announcement but still around 12% higher than two weeks ago.

European periphery sovereign CDS spreads have also tightened with Italy, Spain and Portugal seeing spreads tighten 15bps, 12bps and 16bps respectively. In corporate credit, the iTraxx Europe main, which tracks 125 investment grade single name CDS spreads, is 5bps tighter; a two week low.

High yield names in the US oil and gas sector have sold off amid the recent drop in crude oil prices. July has seen WTI oil prices drop around $7 to three month lows. Naturally, the effect on high yield oil and gas credits has been negative; the Markit iBoxx USD Liquid High Yield Oil & Gas Index has widened 40bps this month so far.

The last time the iBoxx USD Liquid High Yield Oil & Gas Index touched 8.3% was on the March 30th, when the price of WTI ended the day on $47. Interestingly, yesterday's end of day price for WTI was actually $5 higher than this figure, suggesting that either the state of the US high yield oil and gas sector is weaker now, or that prices are expected to drop further.

The return of high yield

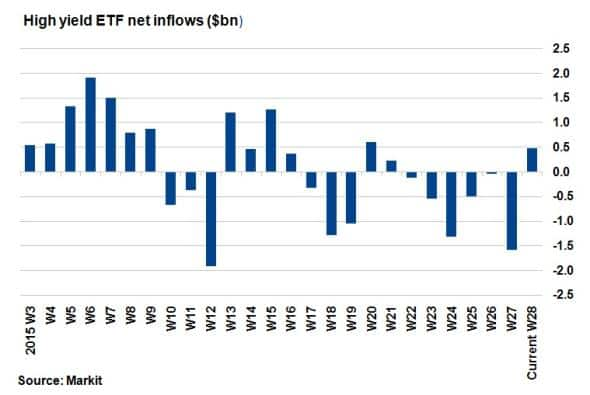

Macroeconomic developments in Greece, Puerto Rico and China have had a huge impact on global credit markets over the past few months, prompting high yield bonds to be dumped. From the week starting May 25th to the end of June, high yield ETFs witnessed $4.1bn of net outflows and a six week run of consecutive outflows. The run ended this week with an inflow of $474m.

High yield bonds in the US still offer 6.45% in annual yield, around 458bps over treasuries according to the Markit iBoxx $ Liquid High Yield Index. With global macro tensions easing somewhat this week, investors have piled back into the asset class.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Credit-Credit-markets-respond-well-to-Greece-proposal.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Credit-Credit-markets-respond-well-to-Greece-proposal.html&text=Credit+markets+respond+well+to+Greece+proposal","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Credit-Credit-markets-respond-well-to-Greece-proposal.html","enabled":true},{"name":"email","url":"?subject=Credit markets respond well to Greece proposal&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Credit-Credit-markets-respond-well-to-Greece-proposal.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+markets+respond+well+to+Greece+proposal http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10072015-Credit-Credit-markets-respond-well-to-Greece-proposal.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}