Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 10, 2016

UK construction upturn in April belies weakening building sector trend

As with the better than expected official manufacturing data for April, official construction data paint a brighter picture of the economy at the start of the second quarter than the business surveys. But dig deeper and there's good reason to treat the better news with caution. The underlying trend in fact appears to be one of weakening output, albeit to some extent due to what will hopefully be temporary uncertainty surrounding the EU referendum.

We therefore continue to expect to see the pace of economic growth slowing in the second quarter, down to 0.2%.

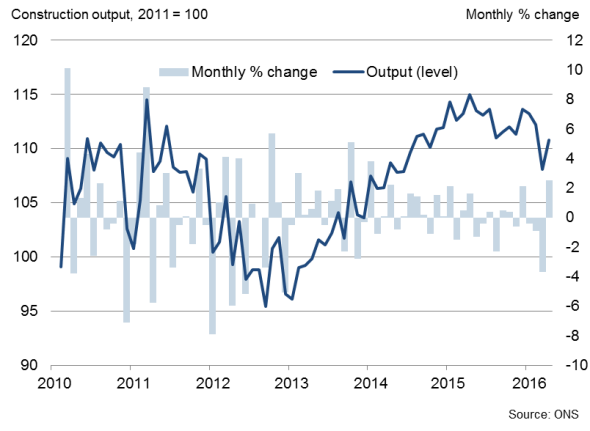

ONS monthly construction output

April building surge

Data from the Office for National Statistics showed construction output rising 2.5% in April, but when looked at in the context of a 3.6% decline in March, the shine is taken off the latest numbers. It seems possible that the early timing of Easter has led to usual fluctuations in building activity.

Looking at the three months to April, output was down 2.1% compared to the prior three months, suggesting that the sector has suffered the largest drop in output for three years.

Compared to a year ago, output was down 3.7% in April. Over the last three months, it is down 2.8%, which is also the worst performance for three years.

The ONS data also showed construction sector orders falling 1.2% on a year ago in the first quarter; the sharpest decline for almost two years.

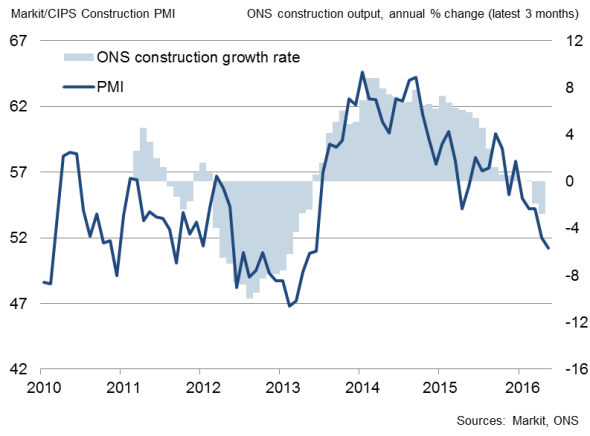

This weakening trend supports the message from the business surveys, which have shown the building sector struggling in recent months. The Markit/CIPS Construction PMI found inflows of new work falling for the first time in just over three years in May, linked in part to uncertainty about Brexit.

PMI v ONS annual construction growth

Brexit worries cause delays

One-in-three companies reported that uncertainty about the referendum has adversely affected their businesses, in many cases suggesting that projects had been delayed until after the June 23rd vote. There are also indications that changes to stamp duty introduced in the Budget could be pulling the residential housing market down.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Economics-UK-construction-upturn-in-April-belies-weakening-building-sector-trend.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Economics-UK-construction-upturn-in-April-belies-weakening-building-sector-trend.html&text=UK+construction+upturn+in+April+belies+weakening+building+sector+trend","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Economics-UK-construction-upturn-in-April-belies-weakening-building-sector-trend.html","enabled":true},{"name":"email","url":"?subject=UK construction upturn in April belies weakening building sector trend&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Economics-UK-construction-upturn-in-April-belies-weakening-building-sector-trend.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+upturn+in+April+belies+weakening+building+sector+trend http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10062016-Economics-UK-construction-upturn-in-April-belies-weakening-building-sector-trend.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}