Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 10, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

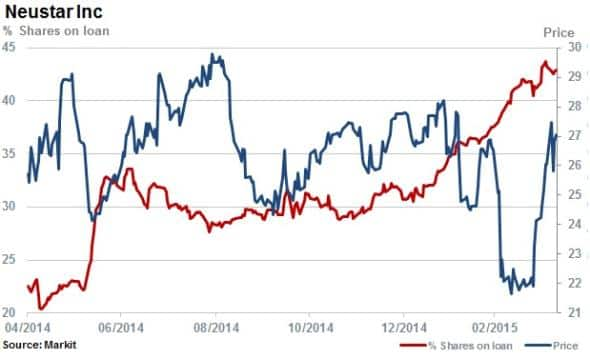

- Demand to borrow has soared in Neustar as short interest rises to 42%

- Recent M&A activity has squeezed out shorts in Bang & Olufsen

- Japanese West holdings has seen short interest double in the last quarter

North America

Short sellers have increased positions in Neustar, remaining the most shorted stock in the week it announces earnings for a consecutive quarter in North America.

Since the end of January 2015, shares outstanding on loan have increased by 22% for Neustar while the share price has risen 2%. This represents an interim recovery after it shares slumped 17% at the end of February.

Short sellers' resilience seems to have been bolstered by these price movements. The demand to borrow stock in Neustar has increased dramatically. Gauged by the benchmark fee to borrow, demand to short Neustar has risen from ~2% at the beginning of March 2015, touching levels of 20% recently.

Oil and gas producer Triangle Petroleum has been impacted by depressed oil prices and a glut in North American oil supplies. Operating in the Williston Basin in North Dakota and eastern Montana, short interest in the firm has increased to 22.8% with demand to borrow increasing as the fee edged towards 15% while utilisation of available stock to borrow reached 90%.

Among the most shorted ahead of earnings this week is Intertain Group which is the third most expensive to borrow ahead of earnings. The Toronto based gaming company operates online casinos, bingo and poker games.

Short sellers have targeted Intertain since the beginning of 2014 but there has been a marked increase in the demand to borrow since the end of February 2014. The benchmark fee increased suddenly from below 0.5% to above 10% over a few days. The share price has however continued to rally and has risen 40% in the last three months and over 300% over the last 12 months.

Western Europe

Most shorted ahead of earnings in Europe this week is Nordic Semiconductor with 8.5% of shares outstanding on loan. Spun out of the Technical University of Trondeim in 1983, the company manufactures ultra-low power wireless chips. Short sellers have increased positions by 42% over the last 12 months, unconvinced by the parallel 48% rally in the share price over the same period.

Short sellers have been squeezed out of positions in Bang and Olufsen as the stock rallied over a third after it was announced that the company plans to sell its automotive division. Shares outstanding on loan have decreased 32% since the announcement with the stock up 28% on the March 31st 2015, the day of the announcement.

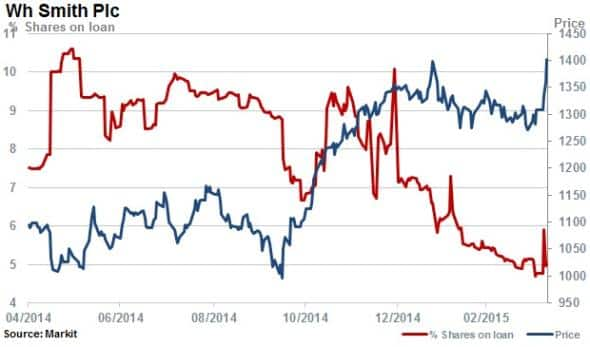

Third most shorted in Europe ahead of earnings is WH Smith, whose rising stock price has continued to send short sellers covering since November 2014. Despite a decline in high street and overall sales, the company has been able to increase underlying earnings for almost ten years by cutting costs and focusing intently on travel locations. Shares outstanding on loan have halved since the end of February 2015 to 5.5%.

Asia Pacific

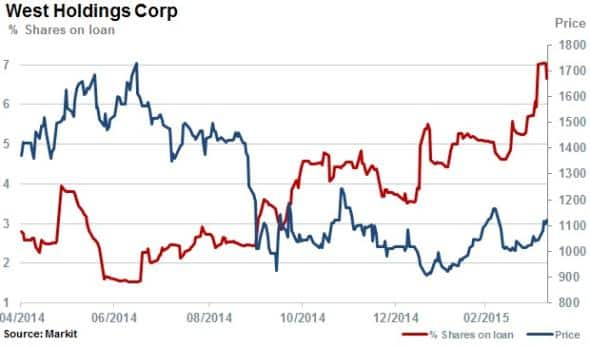

Appearing in the top three most shorted ahead of earnings in Apac for a consecutive quarter are Japanese auto component manufacturer U-Shin and publisher Singapore Press Holdings. Joining the top three most shorted is West Holdings, a Japanese housing and green energy developer which is also involved in large scale solar projects.

Shares outstanding on loan in West Holdings have increased by 120% in over the last six months while the share price has remained stagnant.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10042015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}