Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 10, 2016

Signs of political stalemate impacting on Spanish economy

The Spanish economic recovery is showing signs of being held back by political uncertainty. The end of last week saw the Spanish Socialist Party leader Pedro Sanchez fail in his bid to become Prime Minister after lengthy talks following December's election, thus extending the period of political uncertainty in Spain. We are now in a two-month period of consultation between the political parties after which a new election will be called if the talks are unsuccessful, as seems likely to be the case. This note looks at the effects that political uncertainty has had on the Spanish economy so far, and looks at companies' expectations for the future.

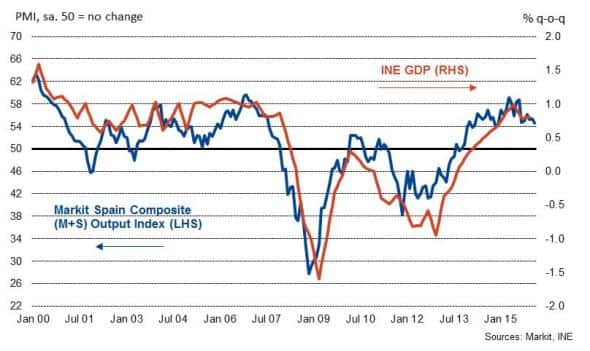

The Markit Spain Composite PMI, a combined index covering activity in the manufacturing and service sectors, signalled continuing economic growth in February, extending the current sequence of expansion to nearly two-and-a-half years. However, growth slowed to the weakest since the end of 2014 in February.

Spanish GDP v PMI

Delving deeper into the latest data highlights some differences between the two sectors covered by PMI surveys. While manufacturing production continued to rise sharply (the monthly expansion being the second-largest seen in the past nine months), a further slowdown was recorded at service providers. The rate of expansion in services business activity has eased in each of the past three months, with the sector seemingly more impacted by political uncertainty than its manufacturing counterpart.

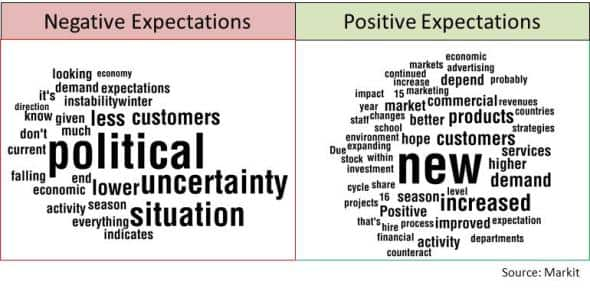

Anecdotal evidence from service providers indicated that new business levels had been affected by the political situation, with some clients reluctant to commit to new projects in the current climate.

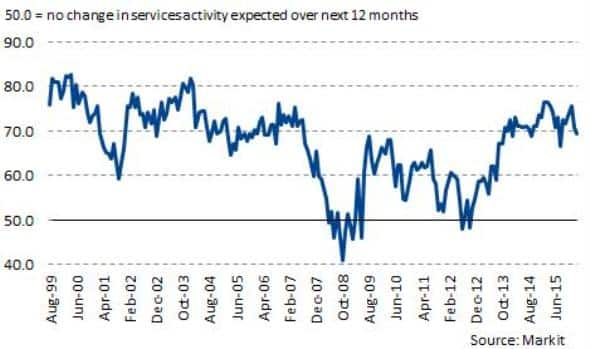

Meanwhile, optimism among services companies dipped to the lowest since August last year, with a number of survey respondents linking pessimism to the political situation.

Spain Services PMI Future Activity Index

Reasons behind services companies' expectations

Investor sentiment weakens at start of 2016

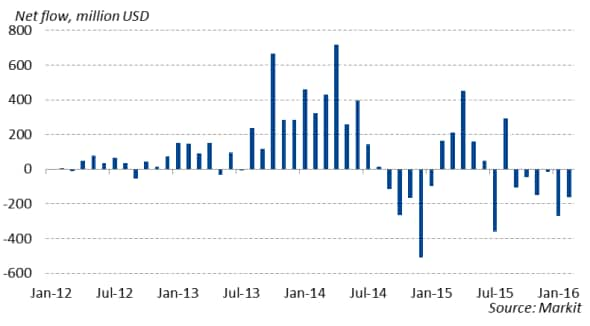

There have also been signs that investors have been cooling with regards to their attitude to Spain in recent months. Funds exposed to Spain had seen net inflows through much of 2015 as the economy posted solid growth. While output in the economy continues to expand, investors seem to be looking elsewhere, with funds exposed to Spain having registered net outflows in each of the past six months, and at a stronger pace post-election.

Funds exposed to Spain see net outflows at start of 2016

The monthly PMI data will continue to track the effects of the ongoing political stalemate on the Spanish economy, providing the first insights each month as to how businesses are being affected. The next PMI releases will be on the 1st of April (manufacturing) and 5th of April (services) respectively.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-economics-signs-of-political-stalemate-impacting-on-spanish-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-economics-signs-of-political-stalemate-impacting-on-spanish-economy.html&text=Signs+of+political+stalemate+impacting+on+Spanish+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-economics-signs-of-political-stalemate-impacting-on-spanish-economy.html","enabled":true},{"name":"email","url":"?subject=Signs of political stalemate impacting on Spanish economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-economics-signs-of-political-stalemate-impacting-on-spanish-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Signs+of+political+stalemate+impacting+on+Spanish+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032016-economics-signs-of-political-stalemate-impacting-on-spanish-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}