Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 10, 2015

European rates converge in wake of QE

The ECB QE policy has seen yield curves in Europe flatten across the board, although the ECB's pledge to limit purchase to assets priced above -0.2% has caused a price floor.

- 1 and 2-yr bund yields have already hit the -0.2% price floor, something the 5-yr notes are approaching

- Yields in periphery bonds are already catching up with their German peers

- Longer dated periphery bonds are also narrowing relative to the near end of the curve

The ECB's QE programme commenced yesterday, which European bonds investors had been actively positioning themselves for.

Spreads tighten across the board

The QE programme's €60bn per month purchasing plan, intended to stoke inflation and economic activity in the eurozone, had an immediate impact as borrowing costs fell across the region. German ten year yields shed around 5bps to end the day at 0.32%, near all time lows. The ECB will be buying bonds with maturities from two to 30 years.

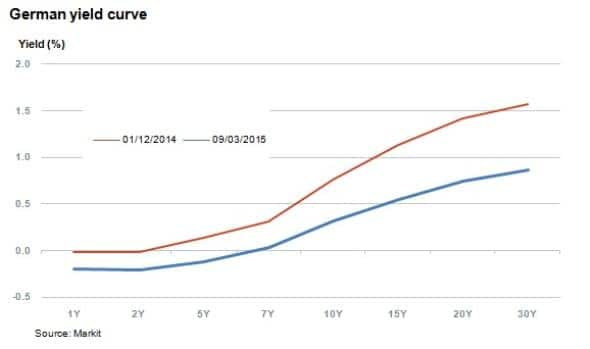

Investors have long been anticipating the price effect QE would have on European government debt as evident by the general tightening seen in European sovereign bonds since rumours of the program first started in November of last year. The near end of the German government yield curve has since moved into negative territory. While the shift has been across the maturities, longer dated bonds have seen their yields fall by a greater margin then their shorted dated peers, causing the yield curve to flatten. The yield gap between two and 30 year bonds has fallen from 1.58% at the start of December last year to 1.07% today.

The ability to essentially front run the ECB has been a feature of the sustained rally in European government debt. Demand has remained strong, aided by the complexities of the programme and the scarcity of eligible bonds. The ECB will be competing against other long term investors such as pension funds and banks and some have posited that there isn't enough supply of high quality debt to meet demand. The ECB is also limited to buying 25% of any single issue with constraints on issuers too.

The ECB also announced that it wouldn't be buying bonds that yield below the ECB's deposit facility rate, -0.2%, promoting the 2-yr German Schatz to retreat, effectively putting a peg on short term European bond yields. Looking further down the curve may be the only option for the ECB and with German yields negative to a maturity of six years, the possibility of negative ten year bunds grows stronger.

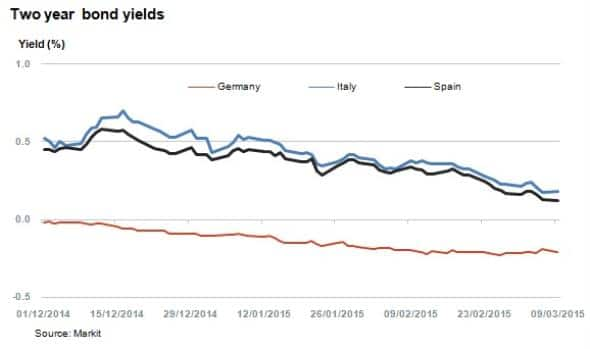

Currently, only German two year bonds trade in and around -0.2%, but the trend seems to be having a major effect on lower quality Southern European issuers. Two year government bond yields in Italy and Spain have dropped around 20bps over the last month and are nearing zero, whereas comparable German yields have remained stagnant. This spread compression is a sign that the ECB may be implicitly underwriting much of the credit risk associated with eligible Southern European nations.

Meanwhile Greece, whose government bonds don't meet the criteria for QE eligibility, has seen its 2-yr bond back up to yields of 15.5%, a two week high.

Curve flattens

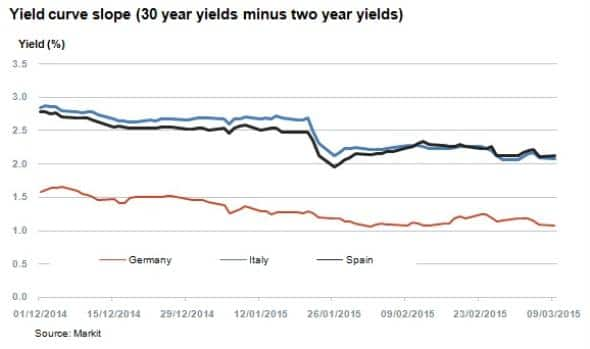

An interesting way to look at the implications of ECB action and the distortions created in the market is to look at the steepness of associated yield curves. Yield curves in the region are much more flat compared to four months ago.

This trend usually marks economic slowdowns, which is ironic given that the ECB is trying to revive growth. Periphery Europe flattened sharply after the initial QE announcement in January and the slope has remained relatively constant since.

Without a change in the deposit facility rate, inflation expectations or a fundamental shift in the supply/demand complex, one might assume further tightening between two year and thirty year yields based on the current trend. This could make for a hard landing when rates finally decide to rise.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-Credit-European-rates-converge-in-wake-of-QE.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-Credit-European-rates-converge-in-wake-of-QE.html&text=European+rates+converge+in+wake+of+QE","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-Credit-European-rates-converge-in-wake-of-QE.html","enabled":true},{"name":"email","url":"?subject=European rates converge in wake of QE&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-Credit-European-rates-converge-in-wake-of-QE.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+rates+converge+in+wake+of+QE http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f10032015-Credit-European-rates-converge-in-wake-of-QE.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}