Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 09, 2016

Reflation reflection

Inflation is back on the agenda and investors are rushing to hedge against it.

- Last week saw inflation linked ETFs experience their largest inflows on record

- US TIPS were the favoured inflation hedge both domestically and abroad

- UK inflation hedged products fail to catch on despite strong return

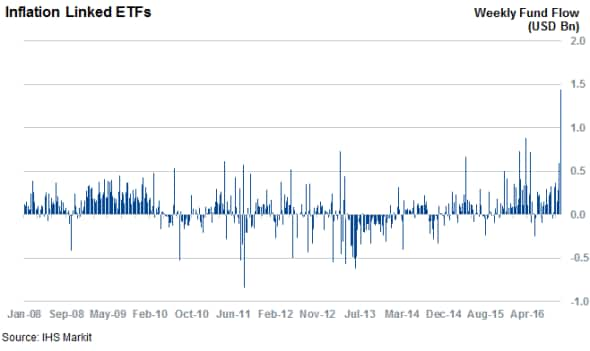

The current resurgence of inflation in the markets has led to investors seeking the perceived safety of inflation ETFs that invest in inflation linked bonds. News that US core inflation reached a two and a half year high of 1.7% prompted investors to rush to the 45 globally listed inflation linked bond ETFs last week, with these funds registering a record weekly inflow of $1.44bn for the week starting October 30th.

The record haul is particularly significant as it smashed the previous inflow record set back in the first week of April by over $500m which underscores inflation's growing prominence among investors' priorities after two years of commodities driven moderation.

This growing focus was not isolated to last week however as inflation linked ETFs have registered inflows in all but five weeks this year. These steady inflows total up to a notable $10bn which puts inflation linked funds within touching distance of the previous yearly record set back in 2009.

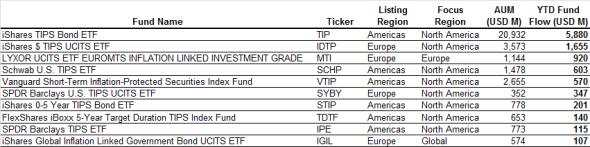

TIPS most popular

TIPS, inflation linked US treasuries, have been the most popular way to play this reflation. The lion's share of inflows have gone to funds that track the asset class with a combined $9.3bn of inflows year to date (ytd). Most of these new assets have been gathered by the iShares TIPS Bond ETF. The fund has outperformed its conventional peer, iShares Core US Treasury Bond ETF by 2.59% so far this year as inflation bounced back from its commodities driven slumber.

US inflation concerns are not the sole remit of domestic investors as the European listed iShare $ TIPS UCITS ETF now sits in second place of the year to date inflow tally with a $1.6bn haul.

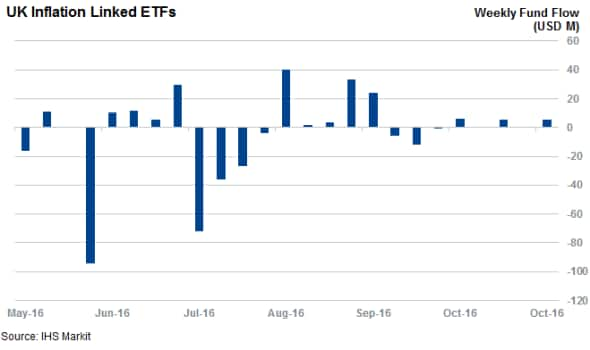

UK inflation funds fail to catch on

The rush to hedge against surging inflation has not extended to the UK as funds which invest in UK inflation linked gilts despite their strong performance since the Brexit referendum back in June. The pound's plunge following the vote saw among other things electronics manufacturers raise the price of their goods by double digits and, perhaps most shockingly, forced Kraft foods to shrink the size of its Toblerone bar. The country's currency driven surge in inflation has propelled inflation linked gilts to the top of the fixed income earnings table with the largest such fund, the iShares " Index-Linked Gilts UCITS ETF, delivering a massive 27.3% of total returns ytd. The majority of these strong returns have come in the weeks since the referendum.

Despite this world beating performance, the asset class has failed to resonate with investors given that the four UK inflation linked ETFs have actually seen $30m of net outflows in the months since the referendum.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-equities-reflation-reflection.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-equities-reflation-reflection.html&text=Reflation+reflection","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-equities-reflation-reflection.html","enabled":true},{"name":"email","url":"?subject=Reflation reflection&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-equities-reflation-reflection.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Reflation+reflection http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09112016-equities-reflation-reflection.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}