Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 09, 2015

Securities Finance research update

Markit Securities Finance teamed up with Markit Research Signals to highlight the value of incorporating global short interest data into the investment process.

Please contact us at press@markit.com to access the full report

- Borrow Costs and Utilization factors provide the strongest returns in US & Europe

- Utilisation provided the best returns in developed Pacific

- Unattractively ranked stocks tend to be the key driver of the results across all three regions

The report analyses the performance of the most popular Securities Finance metrics including: Lending Supply, Short Interest, Utilisation, Daily Cost of Borrow Score (DCBS) and Days to Cover.

Coverage includes three broad Markit equity universes; the US Total Cap Universe, the Developed Europe Universe and the Developed Pacific Universe. Markit Research Signals calculates constituents and returns including dividends on a monthly basis.

US Performance

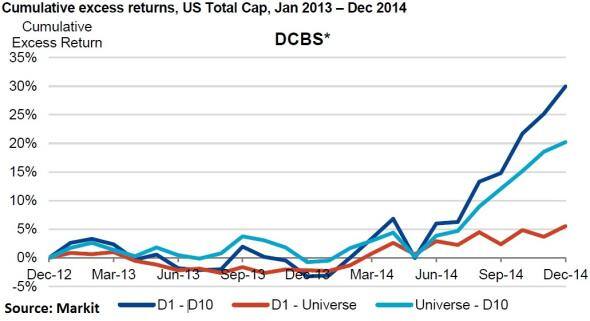

The top performing Securities Finance metric for the US market was the Daily Cost of Borrow Score (DCBS). The cumulative return spread between the top decile and bottom decile was 30% while annual return spreads were 14% with an annual volatility of 11%.

80% of the DCBS returns were driven by bottom decile stocks (the most expensive to borrow), and this was particularly so in the last seven months of 2014. During this period, the factor had the highest information ratio (IR) of 1.27 compared with the other four factors. The information ratio measures the risk adjusted performance of factors by incorporating the volatility of returns.

Portfolio applications

While paper returns are appealing, actual returns depend on many factors. To account for this, returns are adjusted for borrow costs, borrow availability and outliers.

Despite a decrease in the overall returns following these adjustments, the return spread exceeded the return volatility resulting in an appealing IR of 1.05.

Regional differences

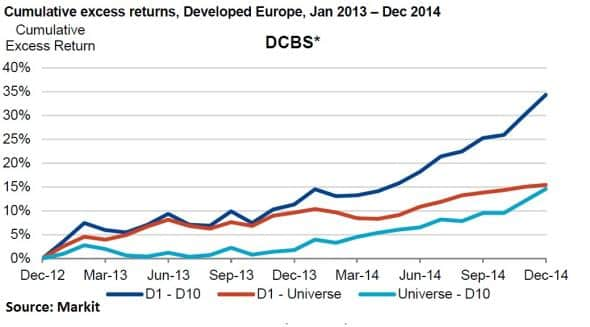

The DCBS is also the top performing factor in developed Europe, edging out the US with cumulative returns of 34% and a higher IR of 2.53. Europe's returns were more even over the test period.

Across the Developed Pacific universe, the top performing Securities Finance metric was Utilization, with an impressive cumulative two year return of 57%. Annual returns were above 25% with return volatility below 11%.

Top ranked securities

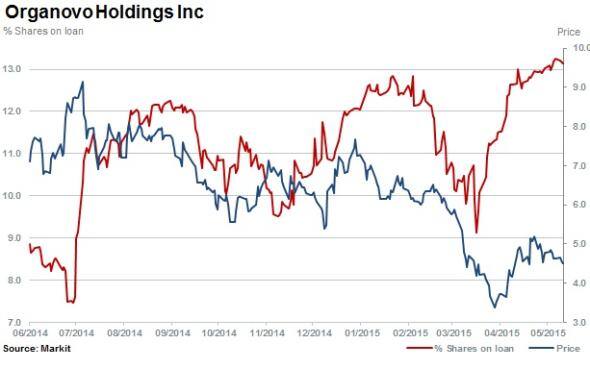

The top ten securities in each market were ranked by low and high Daily Cost to Borrow Score. The top ten ranked securities in the US market represent the most expensive to borrow securities.

The average cost to borrow currently for this group of popular shorts is in excess of 25% per annum.

Short interest ahead of earnings

3D bio printing firm Organovo, among the top ten, saw significant short interest ahead of earnings.

Securities Finance data

Covering over $15 trillion of securities in lending programs across 20,000 institutional funds, Markit Securities Finance data provides detail on global shorting activity using over 10 years of daily transactional activity.

Research Signals

With investment signals covering more than 30,000 securities in 80 countries to support security selection and strategy development, Research Signals provide tools to enable performance analysis, research, idea generation, back testing, portfolio exposure analysis and bespoke model development.

Please contact us at press@markit.com to access the full report.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-equities-securities-finance-research-update.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-equities-securities-finance-research-update.html&text=Securities+Finance+research+update","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-equities-securities-finance-research-update.html","enabled":true},{"name":"email","url":"?subject=Securities Finance research update&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-equities-securities-finance-research-update.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+research+update http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09062015-equities-securities-finance-research-update.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}