Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 09, 2017

EU sector PMI data hint at rising capex but also highlight subdued consumers

Growth was recorded in all 22 of the sub-sectors covered by IHS Markit's European Union sector PMI data in April, though the best performance was seen in sectors which hint at rising capex.

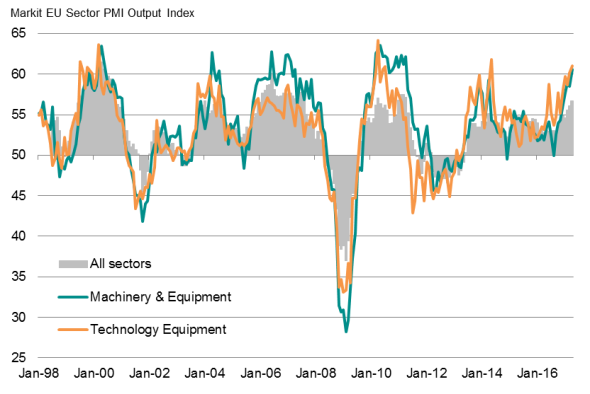

The fastest growth of output at the start of the second quarter was recorded among manufacturers of tech equipment, with producers of machinery and equipment close behind. Both sectors are bellwethers of capital investment spending by companies, and as such bode well for the sustainability of the current upturn.

Economic growth is accelerating in Europe, with the Eurozone PMI hitting a fresh six-year high in April and the UK PMI surveys showing a hat-trick of faster growth in services, manufacturing and construction.

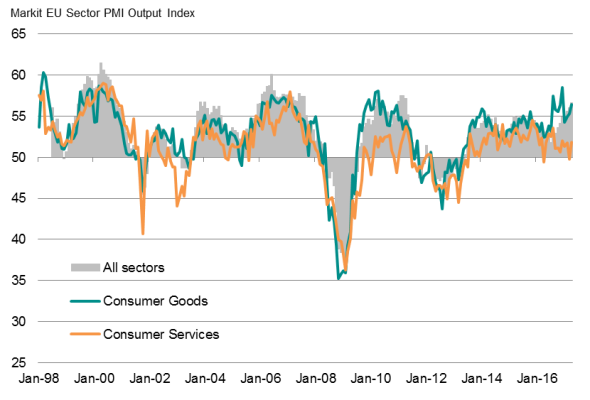

There are signs, however, of the upturn continuing to be subdued by weak consumer spending. Although coming down, unemployment across the region remains at 8%, wage growth is stubbornly subdued and rising prices are eating into households' spending power. Not altogether surprising, therefore, the weakest growth of the major sectors covered by the PMI data was seen among providers of consumer services for the sixth successive month in April. On one hand, the weak expansion represented an improvement on the slight drop in activity seen in March, in part likely a reflection of a recent upturn in hiring, but the ongoing sluggish trend in the consumer services signifies an important missing element from the upturn.

Healthcare services and tourism & leisure were the worst performing of the 22 sub-sectors in April, with media companies also seeing a substantially sub-par performance.

Producers of consumer goods fared better, but that in part reflected strong export growth, in turn buoyed by the historically weak euro.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052017-Economics-EU-sector-PMI-data-hint-at-rising-capex-but-also-highlight-subdued-consumers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052017-Economics-EU-sector-PMI-data-hint-at-rising-capex-but-also-highlight-subdued-consumers.html&text=EU+sector+PMI+data+hint+at+rising+capex+but+also+highlight+subdued+consumers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052017-Economics-EU-sector-PMI-data-hint-at-rising-capex-but-also-highlight-subdued-consumers.html","enabled":true},{"name":"email","url":"?subject=EU sector PMI data hint at rising capex but also highlight subdued consumers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052017-Economics-EU-sector-PMI-data-hint-at-rising-capex-but-also-highlight-subdued-consumers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=EU+sector+PMI+data+hint+at+rising+capex+but+also+highlight+subdued+consumers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09052017-Economics-EU-sector-PMI-data-hint-at-rising-capex-but-also-highlight-subdued-consumers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}