Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 09, 2016

PMI data reveals global financials in a bind

Distressing Chinese trade data agrees with Markit PMI data which contradicts the recent market rally.

- Financials register the first decline in activity since 2012

- Short interest in US and UK financials rises ytd, yet Chinese financials experience falls

- LendingClub among the most shorted financial stocks globally above $2bn in market cap

Financial activity declines

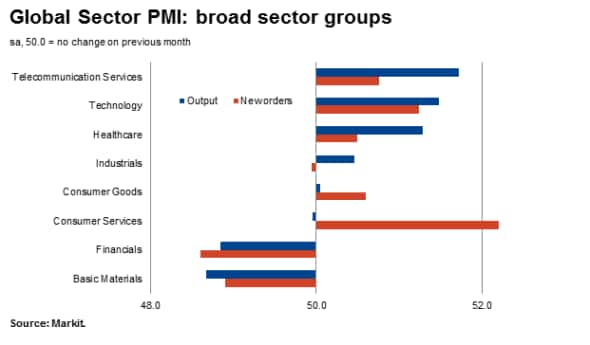

Data released from China this week indicates that exports plunged in February at the fastest rate since 2009. Coupled with weak Global Sector PMI data which indicates further evidence of waning economic growth in 2016 - the past week's rally may be short lived.

Negative signals coming out of the financial sector, specifically emanating from Asia and the US are of particular concern as financial institutions continue to come under pressure with central banks struggling to stimulate economic growth.

Contrasting scenarios exist however, where margins are being squeezed by NIRP in Europe and Japan squeezing paper thin margins. However, in the US the prospect of a rise in interest rates might cause an unexpected spike in defaults at overextended regional banks.

Broad financial weakness

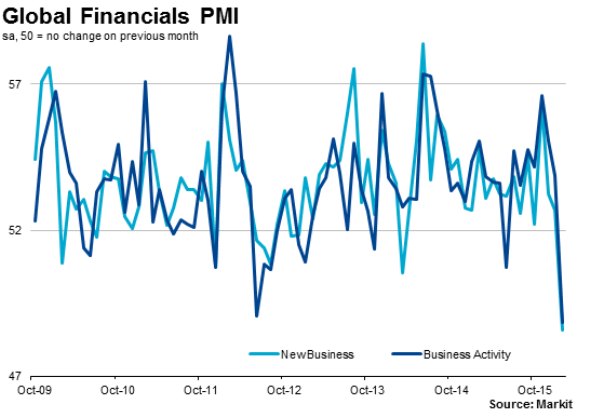

The drop registered in financial activity according to PMI data is only the second such fall seen since the data series began in October 2009. Despite the data showing that new business declined for the first time financial services employment remained strong.

The sharpest fall in financial PMI data was registered in other financials which includes consumer financial services, investment services and speciality financials.

Shorts increase positions in financials

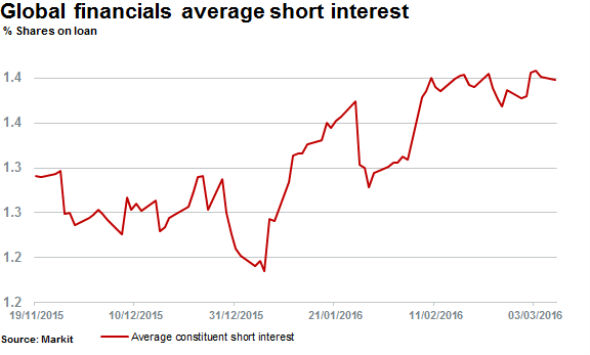

The deteriorating PMI activity data has been accompanied with a rise in shorting activity across the sector globally. Average short interest for global financials has increased by 16% ytd with approximately 1.4% of shares out on loan on average.

According to PMI data, financial activity in Asia signalled is fastest rate of decline in over four years. Interestingly, however, across Chinese financials, short sellers have largely cut positions by 20% on average ytd. This is while increased positions are seen in the UK and US financials, rising by 36% and 12% respectively. Together with Japan these four countries represent over 50% of the listed financial stocks with more than $2bn in market cap.

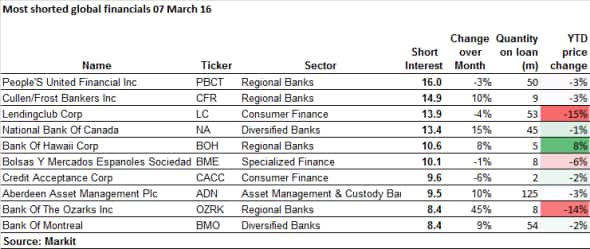

It seems that short sellers are in step with PMI activity data as the top ten most shorted financials globally are crowded by US regional banks and consumer finance firms.

The most shorted financial stock across this universe is People's United Financial, a savings loan and wealth services company with 16% of shares outstanding on loan.

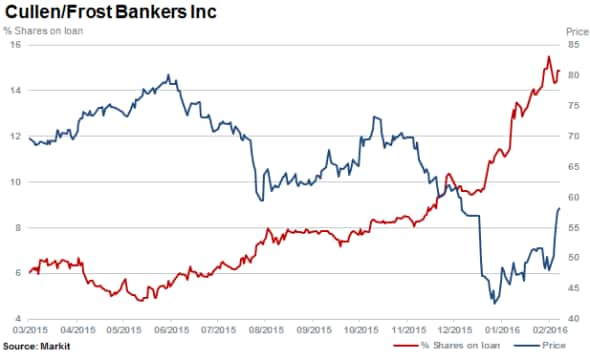

With exposure to fall out due to possible energy exposure, Texas based regional bank Cullen/Frost continues to attract short sellers with 15% of its shares outstanding on loan.

With 14% of shares outstanding on loan alternative lender LendingClub has attracted increasing levels of short interest since mid-2015.

ETF investors pull funds from financials

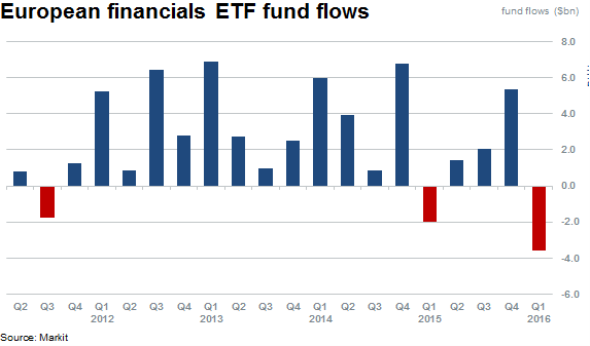

The largest quarterly outflow from financial ETFs was recorded in 2016 as investors pull funds from the sector. However, with some strong weekly inflow since the end of February, ETF investors may be buying on recent weakness.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-equities-pmi-data-reveals-global-financials-in-a-bind.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-equities-pmi-data-reveals-global-financials-in-a-bind.html&text=PMI+data+reveals+global+financials+in+a+bind","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-equities-pmi-data-reveals-global-financials-in-a-bind.html","enabled":true},{"name":"email","url":"?subject=PMI data reveals global financials in a bind&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-equities-pmi-data-reveals-global-financials-in-a-bind.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+data+reveals+global+financials+in+a+bind http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-equities-pmi-data-reveals-global-financials-in-a-bind.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}