Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 09, 2016

Investors reassess eurozone bonds ahead of ECB news

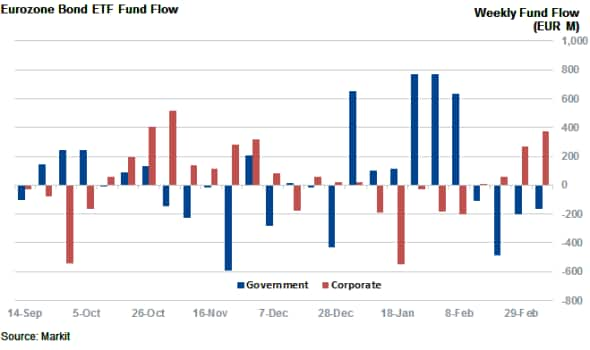

Investors have been selling off eurozone government bond ETFs and loading up on corporate debt ahead of the ECB meeting tomorrow.

- Investors have sold "960m of eurozone government bond ETFs in the last four weeks

- Corporates have fallen back into favour as credit risk abates from multi-year highs

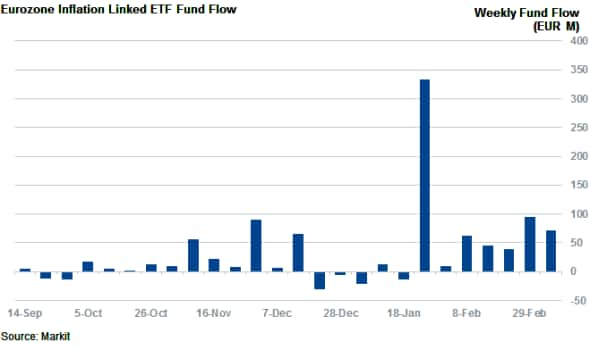

- Inflation bond ETFs have been the only consistently popular trade of the last two months

Investors have been bidding down eurozone government bond rates to hit new recent lows since the start of the year. But it appears that the asset class's low yields, and the growing associated risks, have turned off investors ahead of Thursday's ECM meeting. This meeting, which is tipped as a key indicator of the rate setting committee's appetite for further monetary easing in light of the recent setback in global growth, has seen investors sell out of their eurozone government bond ETFs with increased vigour in the weeks leading up to tomorrow's announcement.

These strong outflows, which started in the second week of February, have reached "960m and show no signs of slowing down, as investors withdrew "165m yesterday alone. ECB meetings have sparked plenty of volatility in the past as the bank failed to live up to expectations, and it appears that a growing portion of investors are choosing to sit on the sidelines ahead of Thursday's announcement.

While these outflows represent a setback for the asset class, it's worth noting that the net inflows are still very much positive and the asset class is still sitting on a "2.06bn of net inflows for the year to date.

Corporates back in the fold

While sovereign bonds ETFs have been actively shunned in the last few weeks, their corporate bond peers have proven much more popular as euro denominated corporate bond ETFs have seen "706m of net inflows in the last four weeks. The asset class now offers a relative higher yield compared to government bonds as well as a lower duration risk, which could explain why investors have warmed to it over the last month. However, these strong inflows have yet to overtake the strong outflows seen in the opening weeks of the year and investors have trimmed "426m of corporate bond holdings year to date.

The extra yield offered by these bonds, which was driven by a surge in credit risk, has also been retreating from the recent highs which has helped them to outperform government bonds since the lows in January.

Inflation linked bonds still popular

While corporate and government bonds have fallen in and out of favour with investors over the last two months, inflation linked bonds have continued to prove popular. ETFs linked to the asset class have seen a record "530m of inflows so far this quarter, and the trade shows no signs of losing popularity heading into the ECB meeting.

This should be viewed as a vote of confidence for the ECB as inflation linked bonds stand to outperform should inflation start to pick up in earnest. Inflation has yet to manifest itself however which has seen the largest inflation linked European government bond fund, the iShares Euro Inflation Linked Government Bond UCITS ETF, underperform its conventional peer, the iShares Core Euro Government Bond UCITS ETF, this year to date. Investors seem to be willing to double down on this losing trade however as seen by the steady strong inflows into inflation linked ETFs.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-credit-investors-reassess-eurozone-bonds-ahead-of-ecb-news.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-credit-investors-reassess-eurozone-bonds-ahead-of-ecb-news.html&text=Investors+reassess+eurozone+bonds+ahead+of+ECB+news","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-credit-investors-reassess-eurozone-bonds-ahead-of-ecb-news.html","enabled":true},{"name":"email","url":"?subject=Investors reassess eurozone bonds ahead of ECB news&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-credit-investors-reassess-eurozone-bonds-ahead-of-ecb-news.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+reassess+eurozone+bonds+ahead+of+ECB+news http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-credit-investors-reassess-eurozone-bonds-ahead-of-ecb-news.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}