Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 09, 2016

Faltering US economy leads global slowdown

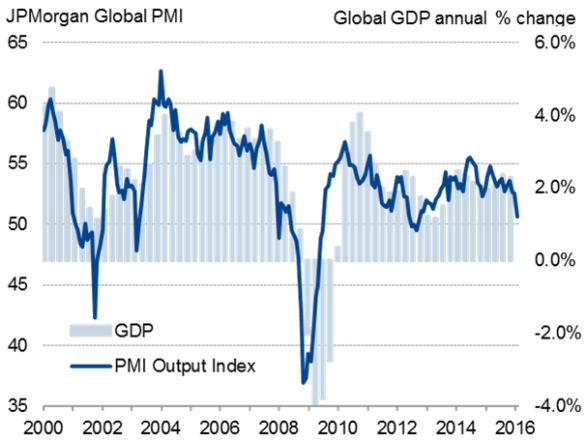

Global economic growth slowed to near-stagnation in February, according to PMI data. The JPMorgan Global PMI, compiled by Markit from its worldwide business surveys, sank to its lowest since October 2012. The headline PMI is broadly consistent with annual global GDP growth of just over 1% (compared to a long-run average of 2.3%). Weakness was broad-based across both the developed and emerging markets.

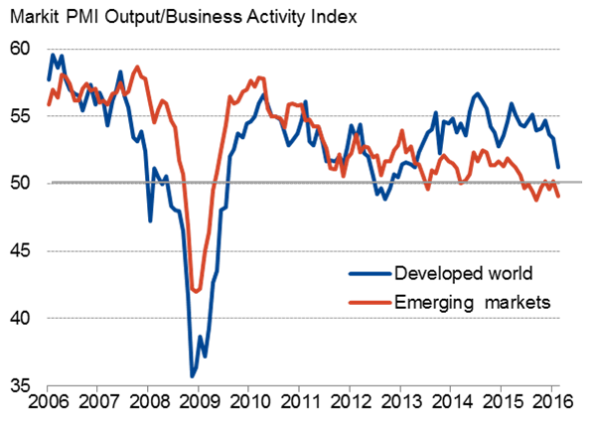

The emerging market PMI Output Index (covering both manufacturing and services) hit its second lowest reading since March 2009. Emerging markets have acted as a drag on the global economy by historical standards over the past three years, with the emerging market PMI indicative of only 3.5% annual GDP growth in February. Of the BRIC nations, India is seeing the strongest expansion but only Russia saw faster growth in February.

The developed world PMI fell to its lowest since April 2013, signalling just 0.5% annual GDP growth. Rates of expansion slowed in all four largest developed economies, with a steep slowdown in the US the most worrying, pushing the US down to stagnation and below the equivalent index for Japan. Slower growth was also seen in the UK, which is now seeing the same modest pace of expansion as the eurozone.

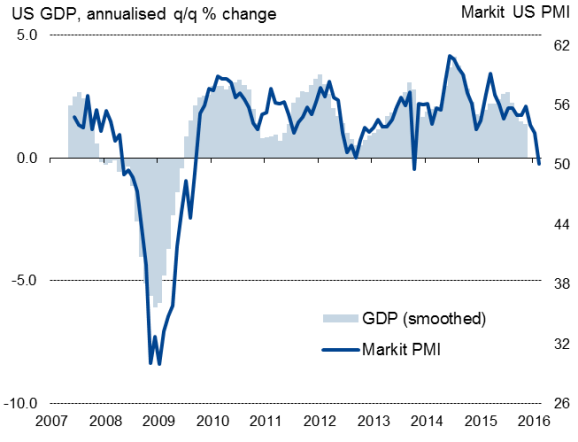

Markit's US PMI series for both manufacturing and services fell sharply again in February. Bad weather was partly to blame, but weaker underlying demand meant February was the second-worst month since the global financial crisis. Although both the surveys and official data showed job creation remaining robust, and keeping further rate hikes on the table, slower economic growth may soon feed through to weaker hiring.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-Economics-Faltering-US-economy-leads-global-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-Economics-Faltering-US-economy-leads-global-slowdown.html&text=Faltering+US+economy+leads+global+slowdown","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-Economics-Faltering-US-economy-leads-global-slowdown.html","enabled":true},{"name":"email","url":"?subject=Faltering US economy leads global slowdown&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-Economics-Faltering-US-economy-leads-global-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Faltering+US+economy+leads+global+slowdown http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09032016-Economics-Faltering-US-economy-leads-global-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}