Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 09, 2016

Kenya leads the way in Africa at start of 2016

The latest batch of PMI data for Africa, compiled for Standard Bank by Markit, pointed to divergent trends across the continent in January. Kenya's private sector was the standout performer, with growth accelerating to a 13-month high. In contrast, companies in Nigeria saw a substantial slowdown while those in South Africa reported a further downturn.

Standard Bank Africa PMI

Looking at 2015 on average, Kenya was the fastest-growing despite suffering a temporary blip early in Q4. GDP figures updated to the third quarter of last year show a similar trend, with growth relatively weak in Nigeria and South Africa amid currency volatility.

Together, these three economies account for 55% of Sub-Saharan African GDP.

Kenya PMI surges to 13-month record

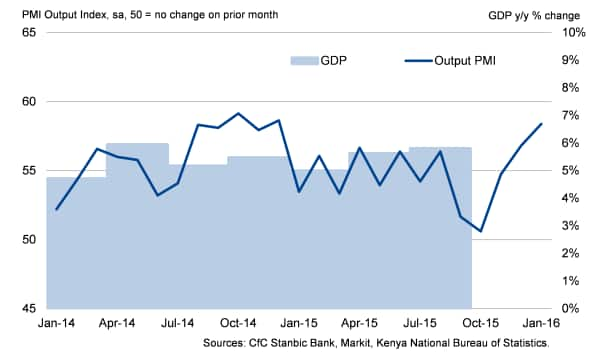

With business conditions improving at the fastest pace in over a year, Kenya's private sector kicked off 2016 in good health. At 56.4, the headline CfC Stanbic Bank PMI signalled marked growth, underpinned by sharper expansions in output, new orders and employment.

Kenya Output PMI vs GDP

Cost pressures meanwhile eased. Overall input prices rose at the slowest pace since March 2015, linked to lower global commodity prices and the currency having stabilised against the US dollar in recent months.

Nigeria starts 2016 in low gear

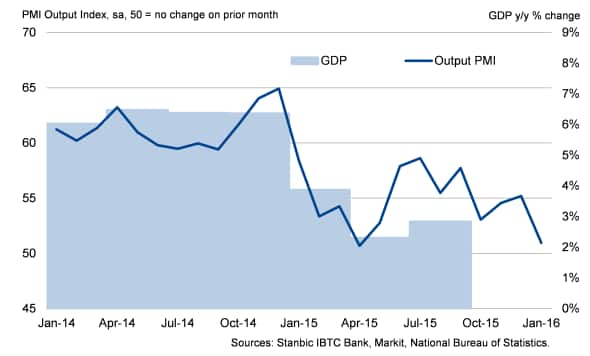

While Kenyan private sector growth accelerated in January, the rate of expansion in Nigeria's private sector slowed. The seasonally adjusted Stanbic IBTC Bank PMI slipped to a nine-month low of 51.3 in January, with output rising only slightly amid subdued client demand.

Nigeria Output PMI vs GDP

Nigeria, Africa's largest economy and a major oil exporter, is facing a number of economic challenges. Notable among these is pressure on the government to devaluate the naira, a topic exacerbated by the ongoing global oil price slump. With oil a key export for a number of private sector firms, new business from abroad fell solidly in January.

Nigerian Exports: PMI vs Official data

South African downturn sustained

Despite the slowdown in Nigeria, South Africa was still the worst-performing of the three major African economies monitored by Standard Bank's PMI surveys. The headline index has signalled contraction in the private sector for the past eight months, though the latest reading of 49.6 indicated that the rate of contraction had eased to show only a marginal decline.

Nonetheless, with new orders and employment still falling, and the rand continuing to struggle against the US dollar, the outlook for 2016 in South Africa appears highly uncertain.

South Africa Output PMI vs GDP

Exchange rate vs US dollar

PMI rankings in line with outlook

The comparative rankings of the three African PMI surveys in recent months matches the latest economic outlook data published by the International Monetary Fund.

In Kenya, growth is estimated to have been 6.5% for 2015 with 6.8% projected for this year. With the PMI ticking up in recent months, 2016 is set to be a positive year for Kenyan private sector firms. Outlooks were less upbeat in Nigeria and South Africa, with 2015 growth expected to have been 4% and 1.4% respectively. A modest acceleration is projected in Nigeria during 2016 (4.3%), but growth is set to slow further in South Africa (1.3%).

For more information on African PMI data, please contact economics@markit.com.

Philip Leake | Economist, Markit

Tel: +44 149 146 1014

philip.leake@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-economics-kenya-leads-the-way-in-africa-at-start-of-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-economics-kenya-leads-the-way-in-africa-at-start-of-2016.html&text=Kenya+leads+the+way+in+Africa+at+start+of+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-economics-kenya-leads-the-way-in-africa-at-start-of-2016.html","enabled":true},{"name":"email","url":"?subject=Kenya leads the way in Africa at start of 2016&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-economics-kenya-leads-the-way-in-africa-at-start-of-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Kenya+leads+the+way+in+Africa+at+start+of+2016 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-economics-kenya-leads-the-way-in-africa-at-start-of-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}