Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Feb 09, 2016

Distressed bond numbers escalate at alarming pace

The number of distressed bonds in the $HY bond universe continues to increase, with European HY entering the fray.

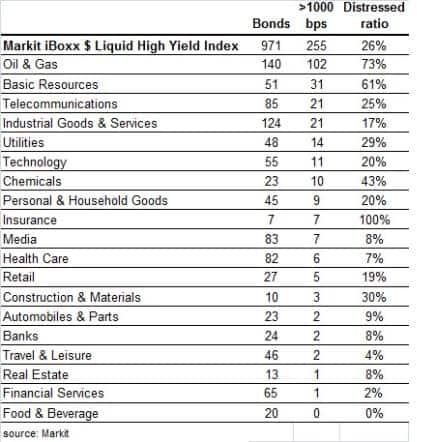

- The ratio of distressed bonds in the Markit iBoxx $ Liquid High Yield Index stands at 26%.

- 102 out of 140 $HY bonds in the Oil & Gas sector trade at spread greater than 1,000bps.

- In European HY, the distressed ratio has risen from 7% to 11% over the past two months.

Given the volatility in recent weeks, credit risk in global high yield (HY) bond markets continues to widen as investors clamber to safe havens. The spread over treasuries on the Markit iBoxx $ Liquid High Yield Index currently stands at 745bps; multiple year highs.

The pace of risk in the HY bond market and the increased number of bonds trading at distressed levels, serves as an early indicator for potential defaults among corporations. Loosely defined, a 'distressed' bond is one that trades with an annual benchmark spread of over 1000bps.

Distressed levels deepen

Using the Markit iBoxx $ Liquid High Yield Index as a proxy for the $HY market, current data shows that 255 of the 971 constituents currently trade with a spread above 1000bps, or 26% of $HY bonds. This represents the highest level post 2009 and a tripling from the levels seen at the end of 2014 when only 8% of the index was in distressed territory.

Even more alarming has been the rate at which the ratio of distressed US HY bonds has increased. When a similar report was run on December 9th last year, the ratio stood at 15% which rose to 19% by the year end after the liquidation of several high profile HY credit funds in mid-December. This level has now increased a further 7% to 26% as market uncertainty has intensified into the New Year.

Sectors

Among the distressed names, the main protagonists have been bonds in the Oil & Gas and Basic Materials sector, which make up over half of the distressed bonds in the Markit iBoxx $ Liquid High Yield Index. Downside risk in commodity prices and lingering concerns around slowing global trade have continued to dent credit profiles in the sectors. A concern among market participants has been the spill over effects of these sectors onto the wider HY market, but so far the evidence has been tepid. Only 7% of HY bonds in the Healthcare sector are in distressed territory, while this ratio falls to 1% for Financials. Not all defensive sectors are proving as resilient though, with Utilities seeing 29% of its bonds in the Markit iBoxx $ Liquid High Yield Index trading above 1,000bps.

European HY

In December's report on distressed bonds, we noted that Europe remained relatively isolated in terms of the number of distressed bonds given its minimal exposure to commodity prices and accommodative QE environment. Over the past several weeks however, European corporate credit has seen heightened levels of risk driven around concerns in the financial sector.

50 bonds in the 442 (11%) constituent iBoxx EUR Liquid High Yield Index are currently trading distressed levels, up from 32/448 (7%) on December 9th last year. While this is still less than half the percentage seen in the $HY market, the 4% difference in such a short space of time gives cause for concern.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-credit-distressed-bond-numbers-escalate-at-alarming-pace.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-credit-distressed-bond-numbers-escalate-at-alarming-pace.html&text=Distressed+bond+numbers+escalate+at+alarming+pace","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-credit-distressed-bond-numbers-escalate-at-alarming-pace.html","enabled":true},{"name":"email","url":"?subject=Distressed bond numbers escalate at alarming pace&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-credit-distressed-bond-numbers-escalate-at-alarming-pace.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Distressed+bond+numbers+escalate+at+alarming+pace http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f09022016-credit-distressed-bond-numbers-escalate-at-alarming-pace.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}