Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 08, 2017

Week Ahead Economic Preview

Next week sees December Flash PMI releases, providing insights into the health of the US, eurozone and Japanse economies at the end of the fourth quarter.

The US Fed, ECB and Bank of England meet to decide on monetary policy, though only the first is expected to hike. However, Bank of England watchers will be keenly eyeing UK inflation, retail sales, employment and wage data for further signals on the potential for future rate hikes, and the eurozone PMI numbers will help steer the ECB's appetite for 2018 rate hikes. Meanwhile, China publishes a host of data, including industrial output, retail sales, investment and credit growth.

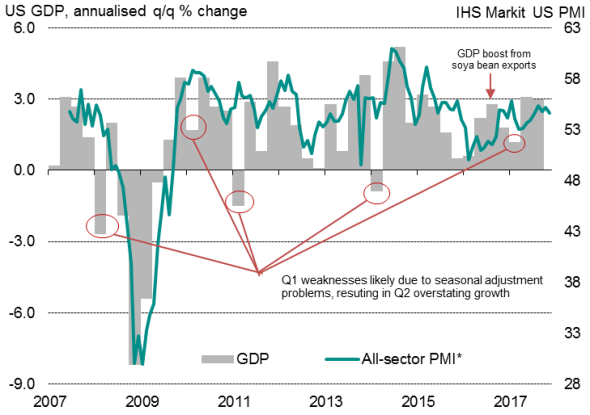

US PMI and GDP

Sources: IHS Markit, Datastream

Fed hike expected

The December flash PMI readings will provide an important steer on the health of the US economy in the closing quarter of 2017, in terms of underlying output growth, employment and inflation. November PMI data had shown another encouraging picture of US economic growth, accompanied by robust hiring, but also found signs of rising inflationary pressures.

On that note, official statistics on inflation will also provide further insights into price pressures, with market expectations of an annual rise of 1.7% for core inflation, down slightly from October. While any data are unlikely to derail the third rate hike at the FOMC meeting next week (markets are assigning a 90% probability to such a hike), the fresh batch of numbers will add to the debate on how many hikes will be seen in 2018 . Analysts are also keeping an eye out for any changes to the Fed projections of three rate rises next year from the updated dot-plot graphs.

Other notable US economic data releases include November retail sales, industrial production and business inventories.

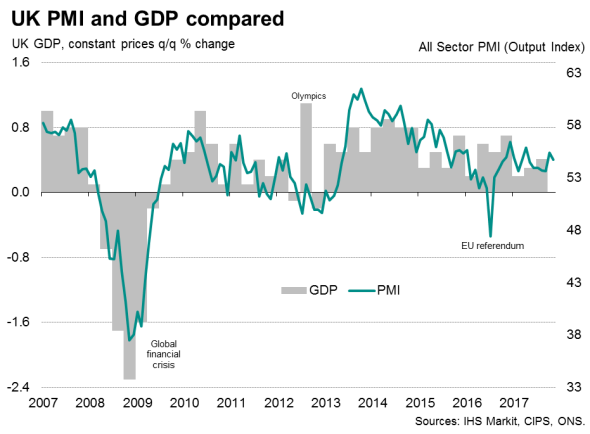

Bank of England to hold

The Bank of England is setting monetary policy next week but is expected to keep the policy rate unchanged. While the latest PMI survey indicated that the UK economy is maintaining course to sustain steady growth into the end of the year, the rate of expansion business confidence continued to be subdued by Brexit worries.

Hawkishness regarding UK interest rates may intensify as official data are widely expected to show UK inflation breaking over the 3% level in November. Stronger growth of input costs indicated by recent PMI surveys suggests that the recent oil price increase may mean the inflation peak remains some way off. Official wage data will also be released, providing a key indicator of any likely future rate hikes, with hawks looking for signs of inflation feeding through to higher pay.

Eurozone growth

With November PMI data indicating a solid eurozone growth spurt, putting the economy on course for its best quarter since the start of 2011, analysts are eagerly awaiting the December flash PMI to assess growth momentum herading into 2018.

On the same day, the ECB will decide on interest rates, though policy is expected to be left unchanged. However, ECB analysts will be keenly monitoring rehtroic relating to the future QE policy path. While growth has surpsied to the upside, core inflation remains stubbornly subdued.

China data

In China, a host of data for November will be released, including retail sales, industrial output, fixed asset investments, credit and monetary growth. Trends in industrial production and retail sales will be assessed for the strength of domestic demand, with Caixin PMI surveys presenting an overall picture of steady growth in November despite the government's crackdown on factory pollution weighing on manufacturing performance.

Download the report for charts and a full diary of key economic releases.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122017-Economics-Week-Ahead-Economic-Preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122017-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08122017-Economics-Week-Ahead-Economic-Preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}