Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 08, 2015

Europe ahead in global dividend race

Strong growth in third quarter dividends is expected from UK and European companies, outpacing US-based growth, while Asian dividends are stuck in reverse gear.

- 9.1% increase European dividends in Q3 with large increases from Germany and Denmark

- Oil & Gas largest contributor to aggregate dividends across Europe and the UK

- Apac sees first quarterly dividend decrease since 2010 due to Chinese Oil & Gas cuts

Markit Dividend Forecasting has released detailed dividend outlook reports for the third quarter of 2015 for the US, Europe, UK and Apac. Please contact us if you would like a copy of the full reports.

UK dividends growing

Dividends for the FTSE 350 are expected to grow by 8% to "75.9bn in Q3 2015 compared to 2014. UK investors have benefited from a stronger dollar, adding "2bn to the constant currency increase. This windfall looks set to benefit Oil & Gas, Bank and Insurer shareholders as these firms tend to set dollar denominated dividend policies.

Discount retailers continue to negatively impact UK supermarket incumbents, who are lagging in terms of dividends with Sainsbury's and Morrison's lowering payouts and Tesco suspending its dividend payment in January. Meanwhile Poundland and Pets at Home have initiated dividend payments.

Europe excluding UK

Despite the escalating Greek crisis, strong ordinary dividend growth is expected in Europe across a universe of stocks in the region, excluding the UK.

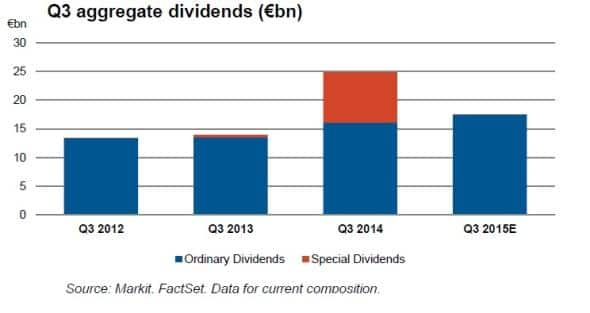

Markit is forecasting a 9.1% increase in ordinary dividends in Europe for the current quarter from July to September. Total aggregate dividends are expected to increase to €17bn.

A characteristically quiet quarter for dividends due to the summer holidays still sees approximately 40% of firms expected to increase and 30% to maintain their dividends, while only 12.5% are expected to cut. Only one major suspension is expected from Norwegian oil major Seadrill, forgoing its quarterly dividend.

Dividend paying nations

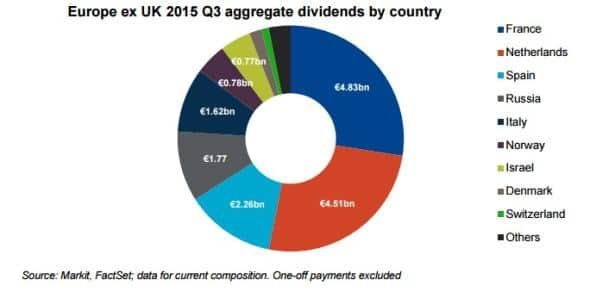

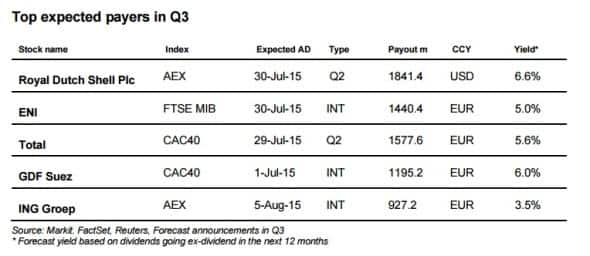

The same nations lead in third quarter payments in Europe from 2014, with France, the Netherlands and Spain having the highest aggregate payouts once again in 2015.

GDF Suez (now Engie) has boosted French payments, with total payments growing by 30%. The Netherlands' ING Groep is expected to distribute its first payment since 2008 with a total dividend of EUR 927m, making it the largest payer in the country.

More modest rise in US

Posting the lowest year on year growth in dividends since 2012, US third quarter dividends are forecast to increase by 8.4% to $97bn across the largest 500 companies. The modest slow down occurs after strong year on year increases in payouts across sectors in 2013 and 2014. 403 of the largest 500 companies are expected to pay dividends in the quarter compared to 398 in 2014.

Key sectors driving dividend growth are the health care and retail sectors with increases of more than 20% attributed to hikes from generous hikes from Amgen (AMGN), Medtronic (MDT), Home Depot (HD), Costco Wholesale (COST) and CVS Health (CVS).

Some of the largest changes to dividends are expected from American Airlines (AAL) and Tyson Foods (TSN). The former has taken advantage of the 41% fall in fuel prices to boost its dividend by 25%. This marks the first increase since the firm resumed its dividend policy in 2014 after a 34 year draught. Tyson Food's dividend increase has resulted from the acquisitive earnings growth and synergies extracted from the Hillshire Brands merger.

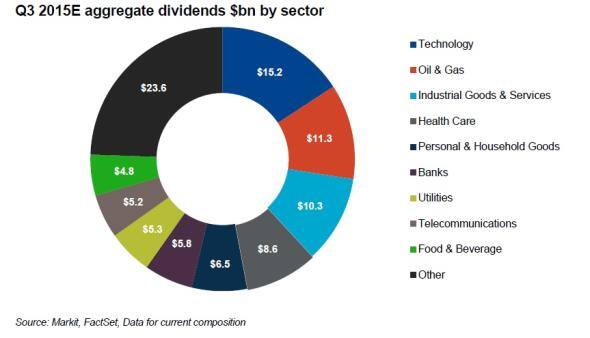

Overall the Technology sector leads in total aggregate payments, followed by Oil & Gas and Industrial Goods & Services.

Declining dividends in Apac

On the other side of the world, Markit is forecasting aggregate dividends in Apac to fall by 12% to $56bn in the third quarter; the first decrease since 2010.

Despite the lack of special dividends in Hong Kong and the depreciation in the AUD versus the USD in Australia, the two countries are still forecast to be the largest contributors of dividends in Apac.

Large cuts are expected from Chinese oil majors as the continued slump in oil prices affects firms. Cuts to interim dividends for all three state-owned oil majors; China Petroleum & Chemical (Sinopec), CNOOC and PetroChina are expected.

Meanwhile Korean dividends, bolstered by a new tax on retained earnings, are expected to surge by 60% to USD $643 with the highest number of companies paying interim dividends in five years. The increase is attributed to new regulations and increased shareholder pressure and subsequent corporate focus on shareholder returns.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-equities-europe-ahead-in-global-dividend-race.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-equities-europe-ahead-in-global-dividend-race.html&text=Europe+ahead+in+global+dividend+race","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-equities-europe-ahead-in-global-dividend-race.html","enabled":true},{"name":"email","url":"?subject=Europe ahead in global dividend race&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-equities-europe-ahead-in-global-dividend-race.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Europe+ahead+in+global+dividend+race http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-equities-europe-ahead-in-global-dividend-race.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}