Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 08, 2015

Pressure on Euro banks pushes spreads wider

European financials have seen their credit risk nearly double since March, steered by the prospect of less government aid for banks and the ongoing Greek crisis.

- Markit iTraxx Europe Senior Financials is at its widest level since March 2014

- British banks RBS and HSBC have led widening with a 40%+ move over the last six months

- The extra risk priced in for financials over corporate debt is at new yearly highs

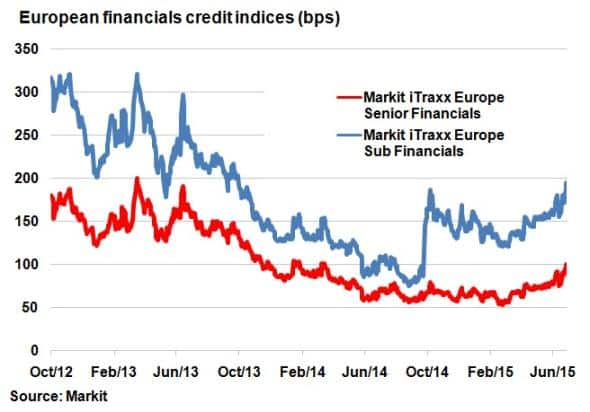

On the July 7th, the level on the Markit iTraxx Europe Senior Financials index, consisting of 30 European financial single name 5-yr CDS, ended the day at 100bps for the first time in 16 months. After reaching a multi-year low of 53bps in March, driven by European QE euphoria, the credit spread has since nearly doubled.

Credit spreads in the financial sector have been widening since March and the recent Greek turmoil only exacerbated the trend. In fact, the constituents of the Markit iTraxx Europe Senior Financials index have seen an average spread widening of 23% over the past month. The prospect of a potential Grexit could potentially spark contagion in the eurozone, with financials one of the most exposed corporate sectors to any downturn. While direct exposure to Greece is limited, banks do have exposure to European periphery debt as well as European households and corporations.

While Greece continues to dominate headlines, European banks have also had to deal with the prospect of legislation being passed that will limit government help during a time of crisis. Unlike in 2008, when banks were bailed out by the general public, the new rules will put the onus on bondholders. Naturally, those lower down the capital structure, such as subordinated bond holders, face a heightened credit risk.

It is no surprise then that the move in senior financials was also mirrored by subordinated financial debt. The Markit iTraxx Europe Sub Financials index has widened to levels not seen since October 2013.

Single name wideners

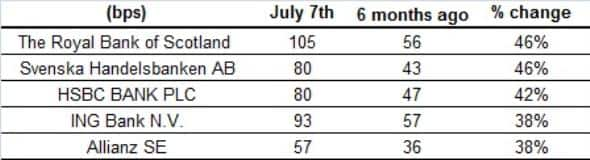

The increased risk perception is unanimous, as every single one of the 30 constituent of the Markit iTraxx Europe Sub Financials index has seen its 5-yr CDS spread widen in the last six months.

Among the biggest wideners were British and German names. S&P downgraded major UK and German banks earlier this year as it considers government support for these banks uncertain. RBS now resides just above junk status after having seen its CDS spread widen by 46% to 105bps; the biggest deterioration in the index over the last six months.

The single names that widened the least were dominated by major French Banks. Soci"t" G"n"rale saw only a 4bps change from six months earlier, while BNP Paribas and Cr"dit Agricole saw widening well below the index's 30% average over the last six months.

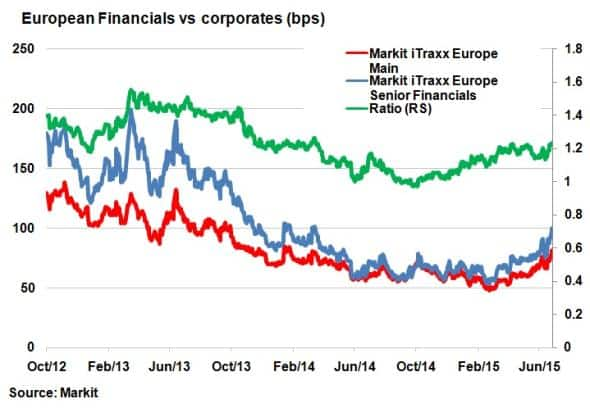

Financials' credit spreads have also started to deviate away from the broader corporate credit market. For much of 2014, the ratio between the spread levels of the Markit iTraxx Europe Main and the Markit iTraxx Europe Senior Financials was flat at 1.0. But the recent developments have seen this ratio reach 1.23. Looking back at recent years, this ratio rose as high as 1.5 in April 2013, but rarely are financials less risky than the broader corporate market, like briefly in October 2014 when the ratio fell below 1.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-credit-pressure-on-euro-banks-pushes-spreads-wider.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-credit-pressure-on-euro-banks-pushes-spreads-wider.html&text=Pressure+on+Euro+banks+pushes+spreads+wider","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-credit-pressure-on-euro-banks-pushes-spreads-wider.html","enabled":true},{"name":"email","url":"?subject=Pressure on Euro banks pushes spreads wider&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-credit-pressure-on-euro-banks-pushes-spreads-wider.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Pressure+on+Euro+banks+pushes+spreads+wider http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08072015-credit-pressure-on-euro-banks-pushes-spreads-wider.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}