Shell merger highlights consolidation appeal

The BG Group and Royal Dutch Shell merger has sent BG bonds up sharply; raising the question of whether M&A activity could spur bond returns in the downtrodden high yield energy sector.

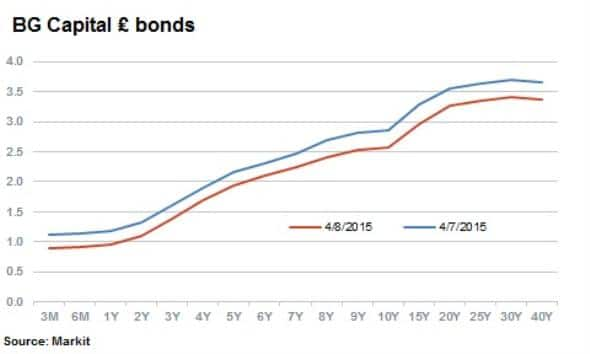

- BG sterling bond spreads tightened around 25bps, with the 5.1% 2025 issue netting a paper return of "25m on the day

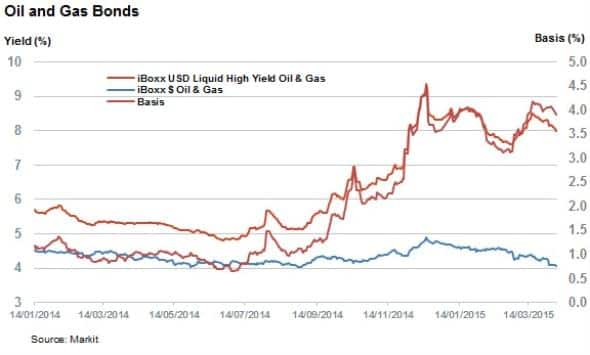

- Yields in the investment grade iBoxx $ Oil & Gas have yet to reflect the slump in oil price

- The basis between high yield and investment grade oil & gas now stands at 4%

Royal Dutch Shell, a "200bn European oil & gas giant, has acquired natural gas producer BG Group for around "47bn; a 50% premium on where its shares traded the previous day.

Energy firms across the globe have been hit hard by falling oil prices. With funding costs enjoyed by investment grade borrowers yet to reflect the slump in oil price, mergers may be a useful method to cut operational costs and diversify into other areas; as seen in Shell's new acquisition.

BG bond holders get boost

BG's shares rose 35% after the deal came to light, while Shell's lost around 2%. But while much of the focus was on how the stock price reacted, bondholders have also enjoyed positive returns.

BG's yield curve for its senior sterling denominated bonds tightened significantly on the back of the news. Spreads tightened by an average of 25bps across the curve, with the 5.125% 2025 bond now trading at 105bps over gilts; its lowest ever spread to benchmark. The bond, which has "750m of notional outstanding, provided an instant return of "25m for bond holders.

Much like the spike in BG's equity price, the tightening bond yields indicate a significant upturn in the market's perception of BG as it gets swallowed up by a larger, better capitalised entity.

Shell's single sterling issue, the 2% 2019, rose 2bps which indicates that the deal is also viewed was also well received by Shell bond investors.

Small names most exposed

With prices hovering around the $40-60 range, the low oil price environment has seen profit margins strain between investment grade energy corporations. The more leveraged, lower rated names look to be much more exposed to the recent slump, according to the extra yield required by bond investors.

The recent decline has been mostly focused in small HY names, as represented by the iBoxx USD Liquid High Yield Oil & Gas Index which has seen its average yield spike to above 8%. In comparison, the investment grade equivalent, the iBoxx $ Oil & Gas index has seen yields fall to 4%, levels seen before the oil price slump in the closing months of last year.

The basis between the two indexes now stands at 4%; four times as large as it was in July 2014. This growing disconnect could see a wave of industry consolidation as large, well-capitalised firms use their newfound market power to snap up struggling rivals. This in turn could benefit bond investors as bonds in target companies converge to reflect the new parent company dynamics.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.