Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 08, 2016

Investors loading up on duration risk

Investors have clamoured for government bond exposure since the start of the year, but the asset class risks losing some of its safe haven status as surging duration means returns are increasingly dictated by yield shifts.

- Duration in US treasuries and eurozone sovereign bonds stands around all-time highs

- A 13bps yield jump in the Markit iBoxx " Eurozone would wipe out its current yearly income

- Long-dated bond ETFs, which are most exposed to duration, enjoying strongest ever inflows

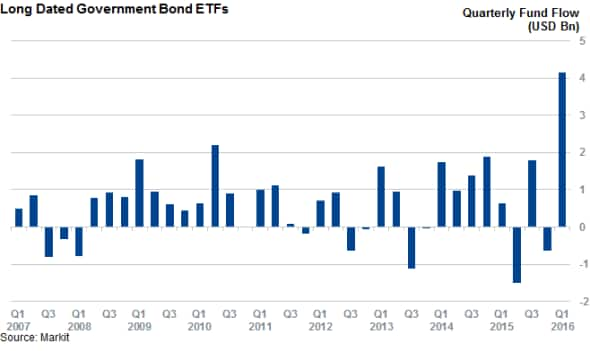

Investors have been flocking to government bond ETFs at a record pace since the start of the year, hoping to shelter from the surge in credit risk and profit as the market discounts the probability of nearing interest rate hikes. This has so far proved profitable as global government bonds have largely outperformed their corporate peers since the start of the year. But investors have also been loading up on duration risk, which could put a damper on returns, should yields start rising in earnest.

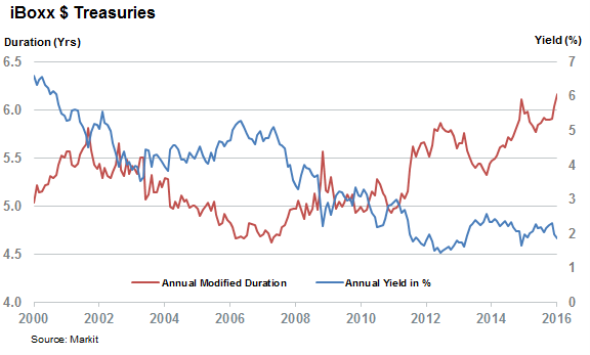

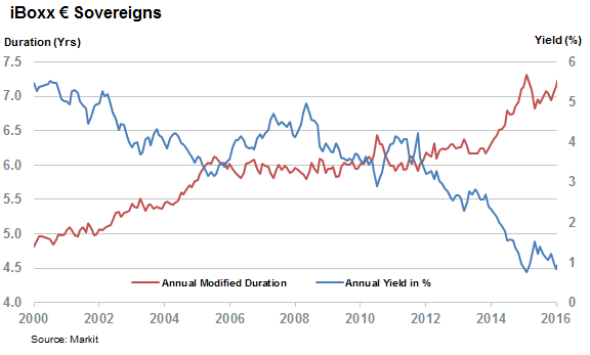

Duration is the average time it takes until all the cash flows from a bond are paid. The modified duration, a variant that measure which tracks the price sensitivity of a bond given a change in yield, has been steadily rising for over a decade, but the recent lows seen in European and US government bond yields means that this key risk metric is now hovering near record highs for both asset classes.

The latest duration of the Markit iBoxx " Sovereign is now 7.22 years, just shy of the all-time high 7.32 set in November of last year. US treasuries' duration, as gauged by the Markit iBoxx $ Treasuries, is slightly lower at 6.2 years - representing an all-time high for the asset class. Both measures stood at less than five years at the start of 2000, before the recent decade long slump in yields.

Central banks in driver's seat

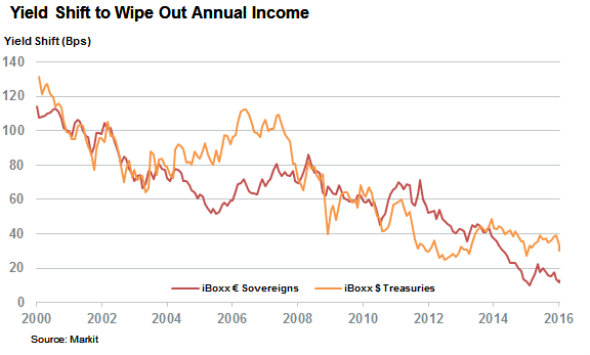

Another way to quantify duration risk is to look at the change in underlying yield which would wipe out the index's yearly income, gauged by forward yield. At the start of the last decade it would have taken more than 100bps of yield rises to wipe out the expected yearly income in both asset classes. That number has since fallen to 30bps in US treasuries and a meagre 13bps in eurozone sovereigns.

This means that a once unthinkable phenomenon is now increasingly likely. In fact the last 12 months have seen five months in which the yield of the iBoxx " Sovereigns index moved by a large enough extent over the course of a single month to wipe out its entire yearly expected income. The iBoxx $ Treasuries is also entering this territory, as a repeat of the 31bps rise in its yield experienced last February would wipe out the 1.88% forward yield it currently delivers.

Essentially, the current low yielding environment means that bond returns are increasingly dictated by macro events such as announced and expected changes in monetary policy, rather than the yields delivered by holding bonds over time. With this in mind it's not hard to see why some have likened bond investing to "picking up pennies in front of a steamroller"

Risk higher further down yield curve

This phenomenon has also been driven by investors seeking extra yields further down the yield curve. Long term government bond ETFs, which have seen a record $4bn of inflows so far this quarter, hold much more duration risk than their shorted dated peer, as the yearly yield shift required to wipe out the income delivered by the iBoxx $ Treasuries 10Y+ index is 15.7bps - roughly half that of the overall index.

Long dated eurozone sovereign bonds are arguably the most exposed to duration risk, as a 10.8bps rise in the yield of the iBoxx " Sovereigns 10+ index would wipe out the entire 1.5% which an investors stands to yield in the next 12 months.

Simon Colvin, Research Analyst at Markit

Posted 8 March 2016

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-credit-investors-loading-up-on-duration-risk.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-credit-investors-loading-up-on-duration-risk.html&text=Investors+loading+up+on+duration+risk","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-credit-investors-loading-up-on-duration-risk.html","enabled":true},{"name":"email","url":"?subject=Investors loading up on duration risk&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-credit-investors-loading-up-on-duration-risk.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+loading+up+on+duration+risk http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08032016-credit-investors-loading-up-on-duration-risk.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}