Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 08, 2017

Global economy starts 2017 on the front foot, PMI at 22-month high

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

Global PMI at 22-month high

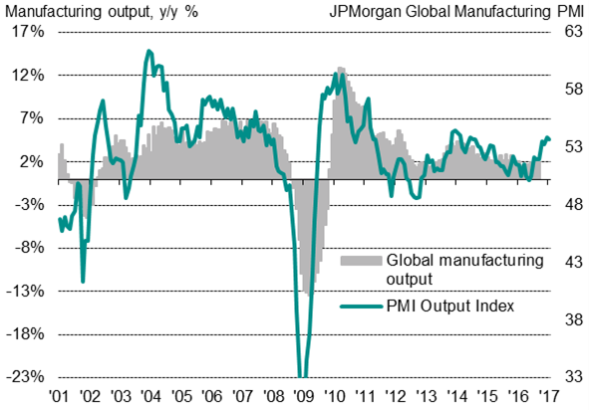

The global economy started 2017 with growth gaining momentum, according to the latest PMI survey data. The JPMorgan Global PMI", compiled by Markit from its various national surveys, rose for a fifth successive month in January to a 22-month high of 53.9. The data are consistent with global GDP rising at an annual rate of 2.5% at the start of the first quarter.

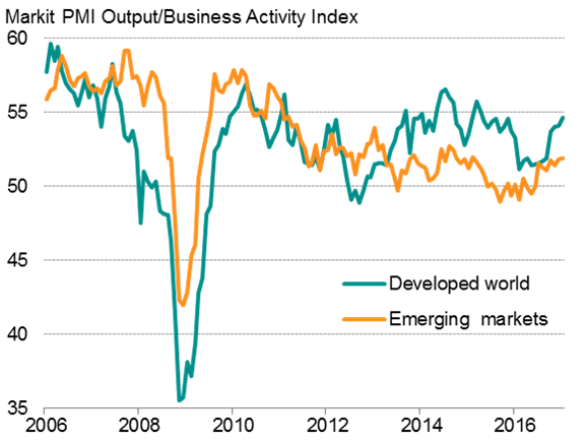

The upturn in growth was led by the developed world, where the PMI struck a 14-month high in January. Emerging market growth also edged up, rising to the highest for 23 months, but continued to underperform relative to the rich world - a trend that has been evident throughout the past three years.

Global PMI & economic growth

Sources: IHS Markit, JPMorgan

Developed & emerging market output

Source: IHS Markit.

Global business optimism rises, but so do costs

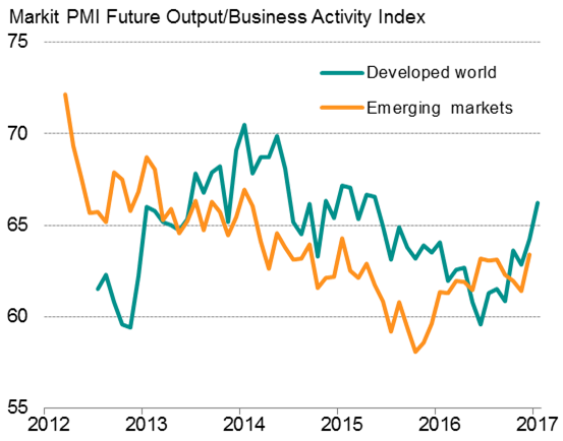

Encouragingly, a newly-launched index tracking global business optimism about future output rose to a 20-month high, with improved sentiment about the year ahead seen in both developed and emerging markets.

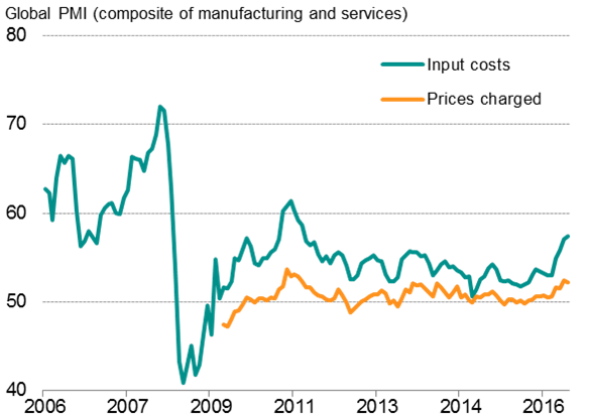

The strengthening of global economic growth continued to be accompanied by rising inflationary pressures. Average input costs showed the largest monthly increase since June 2011, widely linked to higher oil and other commodity prices (notably fuel and energy). Average prices charged for goods and services meanwhile rose again as firms increasingly passed higher costs on to customers. While selling price inflation eased slightly compared to December, the rise was nevertheless still the second-largest in over five-and-a-half years.

Future expectations

Global inflation pressures

Source: IHS Markit

Global trade lifts higher

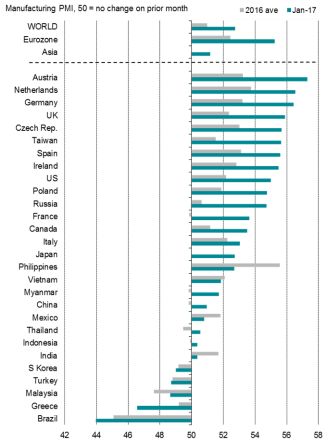

Global manufacturing growth eased slightly, though remained close to December's two-and-a-half year peak. Global exports also rose, growing at the joint-fastest rate for almost six years, suggesting trade is picking up.

European countries dominated the top of the manufacturing growth rankings, led by Austria, the Netherlands and Germany, followed by the UK. Growth was in part buoyed by weak exchange rates.

Only five of the 28 countries covered by the PMI surveys reported deteriorating manufacturing conditions, led once again by Brazil.

Sources: IHS Markit, JPMorgan, ISO, CIPS, NEVI, Nikkei, BME, Bank Austria, Investec, AERCE, Caixin, HPI, Thomson Reuters Datastream.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-Economics-Global-economy-starts-2017-on-the-front-foot-PMI-at-22-month-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-Economics-Global-economy-starts-2017-on-the-front-foot-PMI-at-22-month-high.html&text=Global+economy+starts+2017+on+the+front+foot%2c+PMI+at+22-month+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-Economics-Global-economy-starts-2017-on-the-front-foot-PMI-at-22-month-high.html","enabled":true},{"name":"email","url":"?subject=Global economy starts 2017 on the front foot, PMI at 22-month high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-Economics-Global-economy-starts-2017-on-the-front-foot-PMI-at-22-month-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+starts+2017+on+the+front+foot%2c+PMI+at+22-month+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f08022017-Economics-Global-economy-starts-2017-on-the-front-foot-PMI-at-22-month-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}