Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 07, 2014

Draghi slays volatility?

Mario Draghi asserted his authority, and his intervention may dampen nascent volatility

- Markit VolX indices recently hit their highest levels since taper tantrum

- Draghi affirmed the ECB's explicit €1 trillion balance sheet expansion target

- Corporate bond purchases may be on the way if current plan proves insufficient

It is apparent to all market participants that volatility, so long dormant in this QE-saturated era, has returned in recent weeks.

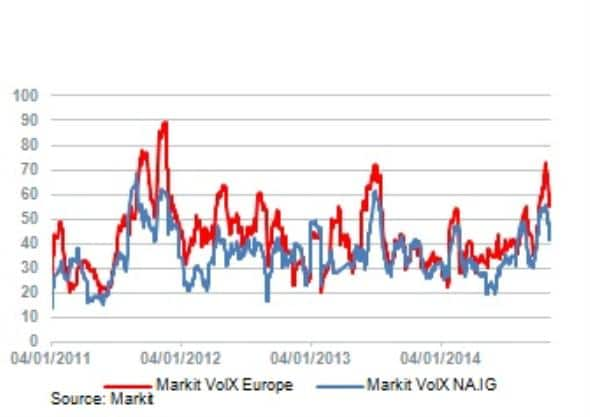

The credit asset class is no exception. The Markit VolX Europe, which measures realised volatility in the Markit iTraxx Europe index, reached its highest point since the "taper tantrum" last year and was approaching levels last seen during the eurozone sovereign crisis in 2011. North American volatility, as measured by the Markit VolX NA.IG, also rose, though it remains significantly lower than its European counterpart.

The presence of financials in the Markit iTraxx Europe, as well as the less favourable economic outlook, no doubt lay behind the basis. Investment banks welcomed the positive effect of volatility on fixed-income profits in the third-quarter, but some were more successful than others in reaping the benefits.

There are several reasons driving the increase in volatility. Geopolitical risk, mainly in the form of the simmering conflict in eastern Ukraine and the potential for a further deterioration in relations between Russia and the West, is a factor. But the worsening European economic climate referred to above is probably a more powerful instigator of volatility. Deflation is looming, a scenario that was studiously ignored in the recent bank stress tests.

If the ECB is unable - or unwilling - to prevent prices from falling, and Germany refuses to increase move away from its reliance on external demand and increase domestic consumption, then deflation may well set in. Such an outcome will be highly damaging for the region's banks, and will probably result in Europe continuing to show higher volatility than the US.

Will volatility extend through until year-end? Mario Draghi may ensure that it doesn't. Yesterday's press conference hosted by the ECB president gave investors every reason to believe that the ECB is serious about preventing deflation. He affirmed that the €1 trillion target for balance sheet expansion is explicit and not just a throw away comment.

Reports this week suggested that other members of the ECB Governing Council were unhappy with Draghi for voicing the target - it appears that he has asserted his authority. But there are still doubts that the combination of TLTROs, covered bonds and ABS purchases will be sufficient to achieve the desired expansion in the balance sheet. The take-up of the first TLTRO was disappointing and there are no guarantees that the next operation in December will be significantly larger. The amount of eligible ABS is also open to question.

If the ECB's plans fall short and inflation continues to decline, then we should see the next stage in unconventional policies. It is likely that the central bank will buy corporate bonds before resorting to purchasing government debt; the obstacles to implementing the latter remain formidable. If the ECB does go down the route of "corporate QE", then it will probably drive spreads tighter and reduce volatility.

The last couple of months are traditionally strong for risk assets, and it would be no surprise to see spreads grind tighter in a relatively narrow range. The VolX in both Europe and North America have dropped in recent days. But pronouncements from ECB governors always have the potential to upset positive sentiment, and the precipitous slide in the Russian rouble is concerning. Volatility may not be ready to return to its slumber just yet.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-credit-draghi-slays-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-credit-draghi-slays-volatility.html&text=Draghi+slays+volatility%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-credit-draghi-slays-volatility.html","enabled":true},{"name":"email","url":"?subject=Draghi slays volatility?&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-credit-draghi-slays-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Draghi+slays+volatility%3f http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07112014-credit-draghi-slays-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}