Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 07, 2016

China drag on Hong Kong economy shows signs of easing

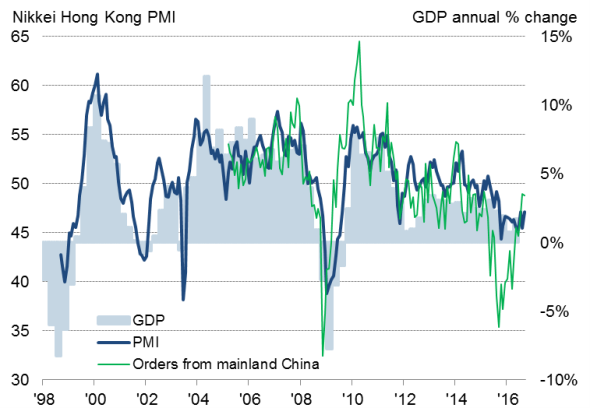

Hong Kong's private sector economy showed signs of stabilising during September, with the latest Nikkei PMI data pointing to a further easing in the rate of decline and renewed growth of purchasing activity. This upturn was accompanied by signs of an improvement in Chinese manufacturing activity.

The survey therefore suggests that Hong Kong economic growth in the third quarter may be buoyed by a recovery in demand from mainland China.

Hong Kong economic growth

Downturn easing

At 49.3 in September, the Nikkei Hong Kong PMI signalled the slowest pace of deterioration in operating conditions in 18 months. At 48.5, the average PMI reading in the third quarter is up from averages of 46.0 in the first and second quarters of the year, rising to a level which - although signalling a downturn in private sector activity - is historically consistent with gross domestic product rising modestly (see chart).

Both new orders and output continued to fall across the economy, but rates of decline remained far less severe than earlier in the year.

Key to this easing has been a substantial slowing in the rate at which new business from mainland China has been falling. The rate of loss of business from China reached a peak back in September of last year, falling at a similar pace to that seen at the height of the global financial crisis, but has since slowed such that the average decline in the past two months has been only modest and the smallest since early-2015.

Furthermore, although workforce numbers continued to be trimmed, the rate of decline in September was the slowest in three months. Some firms reported staff layoffs in an effort to cut costs.

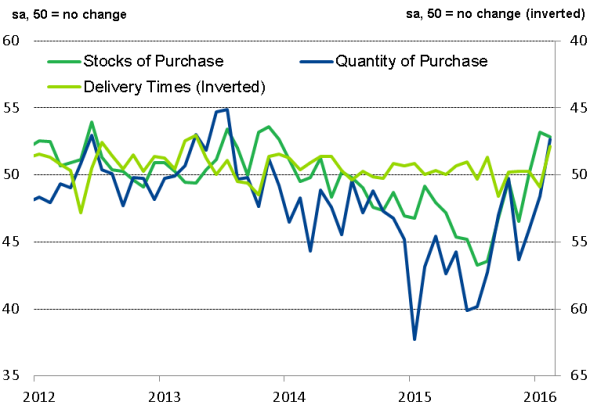

Purchasing activity higher for first time in over two years

Purchasing activity rose for the first time in over two years. As a result, pre-production inventories increased further. This was linked to new product development. Greater demand for inputs contributed to a lengthening of average lead times. The increase in delivery times was the sharpest since November 2013. On a related note, the latest survey data pointed to higher average cost burdens for the third month in a row. This limits the room to stimulate demand through further price discounts.

Higher purchase activity despite weak client demand

Sources: IHS Markit, Nikkei.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-China-drag-on-Hong-Kong-economy-shows-signs-of-easing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-China-drag-on-Hong-Kong-economy-shows-signs-of-easing.html&text=China+drag+on+Hong+Kong+economy+shows+signs+of+easing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-China-drag-on-Hong-Kong-economy-shows-signs-of-easing.html","enabled":true},{"name":"email","url":"?subject=China drag on Hong Kong economy shows signs of easing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-China-drag-on-Hong-Kong-economy-shows-signs-of-easing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+drag+on+Hong+Kong+economy+shows+signs+of+easing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07102016-Economics-China-drag-on-Hong-Kong-economy-shows-signs-of-easing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}