Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 07, 2017

The Rise of Private Debt

This is a preview of an IHS Markit white paper. Click here to access the full version.

The rise in demand for private debt has been aided by an ultra-low yield environment and bouts of extreme volatility in Europe's public bond markets in the years since the financial crisis. A short-term freeze in bank lending to the real economy in the crisis of 2008/9 was followed by a prolonged period of retrenchment by banks, particularly from longer-dated or riskier lending, in order to deleverage and meet stringent new capital requirements imposed by CRD IV. The post financial crisis shift from traditional bank funding models towards alternative lenders has been particularly rapid in the mid-market as SMEs continued to need fresh capital to refinance their existing loans and raise new ones to fund their business growth, hence a dislocation and funding opportunity presented itself.

Europe is heavily reliant on small to medium sized enterprises (mid-market companies) for economic growth, which makes maintaining a robust funding environment for the mid-market crucial for the region. However, lending to the mid-market has its practical challenges due to lack of quality data and underdeveloped evaluation and credit scoring methodologies.

Private lending market landscape

Private debt funds come in numerous forms and pursue a wide range of strategies with different risk/return profiles. Such funds extend loans or specialise in the purchase of already existing positions, provide senior secured lending, subordinated and unsecured financing instruments or mezzanine lending. Alternatively, unitranche lending defines a single block of financing by a private debt fund across various layers in the capital structure, from first lien to subordinated, hence potentially making the private debt fund a single source of debt financing to a business. At the high end of the risk/return spectrum private debt funds may apply distressed-for-control-strategies, or invest in other complex enterprise strategies.

The multiple types of strategies and their common risk/return profiles are described in Figure 1 above.

Growth drivers in private debt markets

The benefits of private debt extend beyond higher risk-adjusted returns. These debt instruments and funds can play a variety of roles in an institutional investor's portfolio and act as a good diversification tool due to historical low correlation benefits. The asset class also has a number of other merits, such as natural credit enhancements, relative appeal versus traditional debt, for example High Yield, and its position as a hybrid / cross-over asset. Natural credit enhancements

Direct lending offers a significant degree of structural protection. Before a loan is made, a detailed due diligence process is undertaken, and various scenarios are envisioned and tested to evaluate how the company might perform in differing market conditions, including whether they would still be able to meet all of their financial obligations. The access to company information and management facilitates very informed decision-making about credit risk.

The loans themselves have a tailored set of terms and covenants, and they can have a charge over the assets of the company that protect investors in the loan from the risk of loss with priority over other unsecured investors.

Relative appeal to more traditional debt asset classes

This form of debt is also the beneficiary of two inadvertent consequences of changes in mainstream bond market structure since the financial crisis.

With reduced liquidity in bond markets resulting from of lower sellside inventories and the restrictions on their proprietary trading since the financial crisis, there has been a material increase in the time it takes to unwind bond portfolios without incurring material price impact. This in itself has led to multiple regulatory consultations globally. These changes in the broader bond market structure have led certain asset managers to find relative appeal in private debt, which can compare favourably with bonds, especially if the liquidity profile of the two asset classes is less distinct.

Cross-over asset class

Private debt as a cross-over asset is particularly compelling after the multiple equity bear markets of the last decade turned conventional theory on its head as:

‒Buy-and-hold investing struggled as equities were outperformed by bonds over a long period

‒Actual returns diverged markedly from expected returns for most asset classes

‒Diversification became less easy to achieve, as the correlation between historically lowly correlated asset classes continued to increase. These weaknesses have, in turn, promoted innovations in institutional investors' approach to asset allocation in pursuit of broader and more realisable diversification.

These factors combine to make it attractive for pension plans, insurance companies and other institutional investors to consider increasing their strategic asset allocations to alternative investments, including private forms of lending, which compensate for factors such as illiquidity and complexity and can serve as a valuable source of risk adjusted returns and diversification.

Pricing credit across the capital structure

Given the current limited nature of the secondary market for private debt, it is vital that the asset manager fully evaluate and price the credit risk associated with the borrower's risk/return profile. They must also be able to illustrate this is correctly balanced on an ongoing basis via timely client reporting.

A significant influx of institutional capital into direct lending strategies over recent years has increased competition among lenders in parts of the market. This has led to pressure on transaction structures and margins, as well as a heightened prospect of mispricing risk, especially as leverage multiples rise. A fund with fixed return expectations is more likely to accept weaker structural protections or higher leverage multiples.

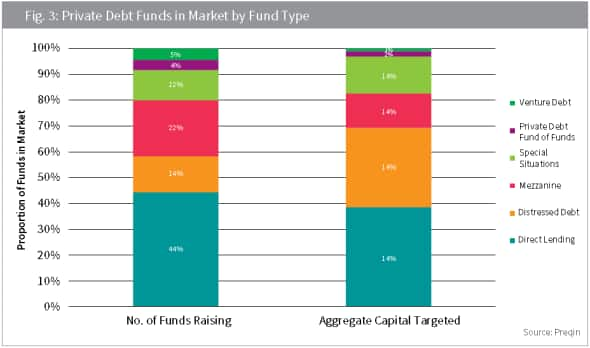

At the same time, certain areas of direct lending remain underserved and offer attractive value in comparison. Figure 3 below indicates the popularity of particular strategies.

Valuation considerations (data, model infrastructure, expertise and efficiency)

All firms have valuation policies that outline the methodologies followed for a given asset class and an overview of their governance structure which enables them to meet their stated valuation objectives. This leads to common practices such as calibrating the transaction price to appropriate valuation methods and comparators. However, the way firms execute this in practice is extremely varied.

Whilst IPEV guidelines and accounting standards are longstanding and hence generally understood, AIFMD is in its infancy and could change materially (both in technical amendments and practical implementation). However, the presence of AIFMD has definitely increased the acceptance in the industry of the use of third party valuation providers. The most common role of a valuation agent is to provide valuations into an internal validation process as governed by AIFMD. As execution of valuations must be formally segregated from the deal team or anyone remunerated by performance of the fund, those performing valuations need assistance. This is normally in the form of positive assurance or independent valuation. To do this well without the assistance of an independent third party is challenging even for funds with seasoned valuations analysts. Most firms have internal guardians of this valuation policy in the form of the internal valuation committee that challenges the valuation movements, approaches and rationales between valuation dates. Members of the committee are common touch points for third party valuation agent.

Governance and capital attraction

Many overseas real-money accounts view the AIFMD External Valuer policy as the highest standard of valuation governance and push the manager to seek an External Valuer to the fund. Though regulation compels people to change processes, business is clearly responsive when change delivers a commercial advantage to those who act and in this case that can manifest itself in being more attractive to overseas capital.

The vigorous governance expected under the directive is now seen by investors as a blueprint for good governance on the topic of valuation, even for firms that fall outside AIF classification. Firms should spend a significant amount of time documenting approaches, authenticating assumptions and adjustments-both quantitative and qualitative-behind the valuation provided by the third party. This is to the benefit of internal stakeholders, investors, auditors and regulatory bodies where applicable.

Valuation challenges

For asset valuations that would be considered level one or level two under, for example, IFRS 13, it's relatively easy to build a valuation approach, especially if there are regular transactions or volume behind firm bids and offers associated with an asset at a certain point of time. But with level three assets (such as private debt) one naturally has to incorporate different techniques in order to build a robust valuation process for the asset due to the transactionless nature of the assets (in secondary terms). Hence observed transactions are mostly in additional rounds of funding (new debt issuance), recaps or proxies to the portfolio company asset.

Various techniques and sources of market data could be used to create proxies for a particular mix of risk attributes which form a Bespoke Beta very comparable in terms of aggregate risk to the portfolio company debt. Even then it's possible the valuer still needs to employ specific adjustments to best reflect the risks embedded in the deal structure. This could include sub-sector adjustments, credit ratings adjustments, duration adjustments, region of risk adjustments, etc. Bespoke Beta is normally achieved via tailored baskets of referenceable assets. Alternatively, it can be done using curves generated by multi-variant factor curves or term structures of comparable entities and then adjusting for the points of difference. All these techniques really act as mechanisms to incorporate a variety of views to create a robust valuation which draws on best available data and techniques in capital markets.

For senior mid-market loans, often the best place to find suitable discount factors is among syndicated or more visible mid-market loans. Alternatively, for mezzanine loans and distressed debt, methodologies may include Enterprise Valuation based on a market approach (multiples) or an income approach (DCF) to establish if the value breaks into the debt capital structure and if so how deep is the value break. If there is sufficient value in the equity classes and no break into the debt, the valuation agent (and fund policy) may choose to use a market approach again on the debt to account for dynamic credit risk reflected via the spreads of comparable assets. Within a given approach, the best practice is to corroborate multiple techniques and assumptions to gain a point of centrality to the valuation or justify the chosen methodology through a range of values. Having the ability to view asset valuation from multiple vantage points is clearly a benefit of Fair Value.

It's important to note that the key difference when dealing with private debt valuations is the heavily analyst-driven approach to valuation. Valuations analysts in the private debt space must have the aptitude to understand legal documentation of the deal, corporate finance theory, analysis of financial statements and disclosures and modelling skills to ensure these are appropriately captured at inception and throughout the life of the deal to assess divergence and degradation of performance. Due to the heterogeneous nature of investments, this requires significant access to the correct market data, model infrastructure, people and control oversight.

Although investment strategies change as attractiveness of the private debt investment continuum evolve and access to the market becomes easier, firms that are committed to quality of process and independence use third party valuation services.

This is a preview of an IHS Markit white paper. Click here to access the full version.

Leon Sinclair, Director, Private Equity, Debt, and Alternatives

Tel: +44 20 3367 0491

leon.sinclair@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-In-My-Opinion-The-Rise-of-Private-Debt.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-In-My-Opinion-The-Rise-of-Private-Debt.html&text=The+Rise+of+Private+Debt","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-In-My-Opinion-The-Rise-of-Private-Debt.html","enabled":true},{"name":"email","url":"?subject=The Rise of Private Debt&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-In-My-Opinion-The-Rise-of-Private-Debt.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Rise+of+Private+Debt http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07082017-In-My-Opinion-The-Rise-of-Private-Debt.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}