Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 07, 2016

Global economic growth falters in May

The following is an extract from Markit's monthly economic overview. For the full report please click the link at the bottom of the article.

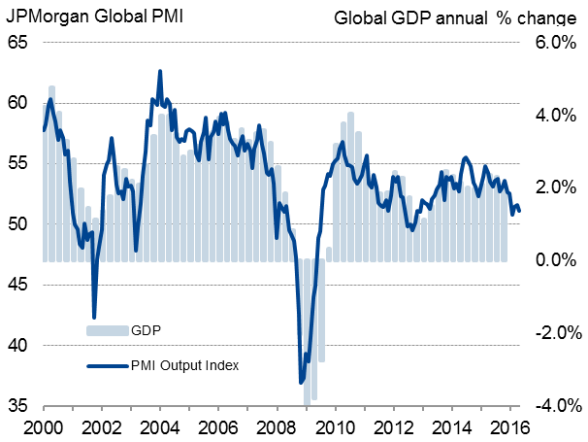

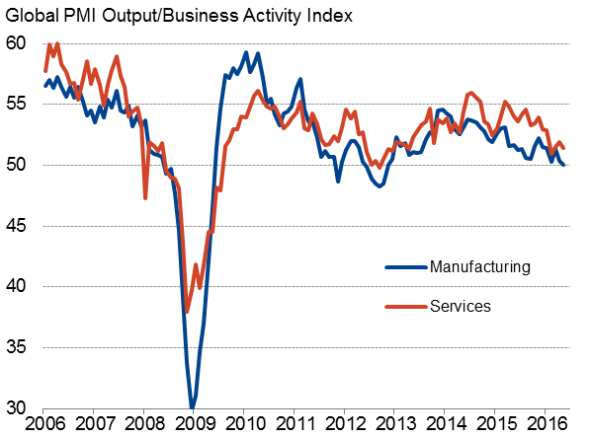

Global economic growth stumbles to second-lowest since 2012

Global economic growth stumbled in May, according to PMI data, suggesting the weak start to the year has persisted into Q2. The JPMorgan Global PMI, compiled by Markit from its worldwide surveys, fell from 51.6 in April to 51.1, its second-lowest reading since the end of 2012. Emerging markets once again led the slowdown, with the PMI signalling a return to slight contraction after two months of marginal growth. Developed world growth also remained firmly in the doldrums in May, having slowed to the second-lowest in just over three years.

Global economic growth(GDP v PMI)

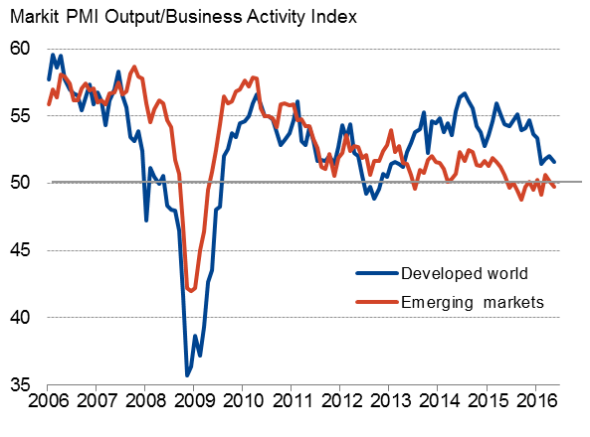

Developed v emerging markets

Sources: JPMorgan, Markit, Thomson Reuters Datastream

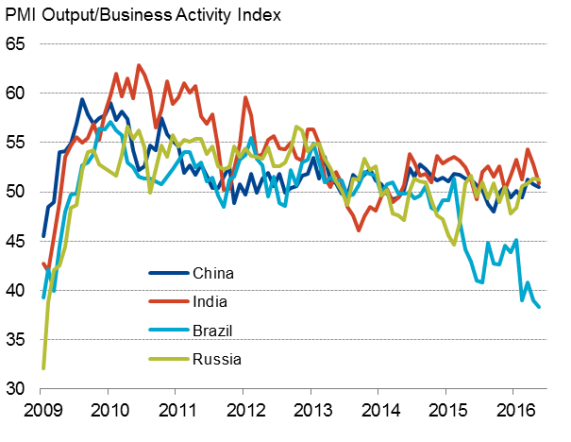

Developed and emerging markets stuck in low gears

Emerging markets decoupled from the developed world upswing in 2013 and have since disappointed relative to the advanced economies. The May PMI reading of 49.7 in May, down from 50.2 in April, is historically consistent with GDP across the emerging markets rising at an annual rate of just 4%; well below the double-digit rates seen prior to the financial crisis. At the same time that the emerging markets continued to languish, the developed world remains stuck in the lower gear it downshifted into back in February, with GDP rising at a sub-1% rate again in May.

Developed markets growth (GDP v PMI)

Emerging markets growth (GDP v PMI)

Sources: Markit, Thomson Reuters Datastream

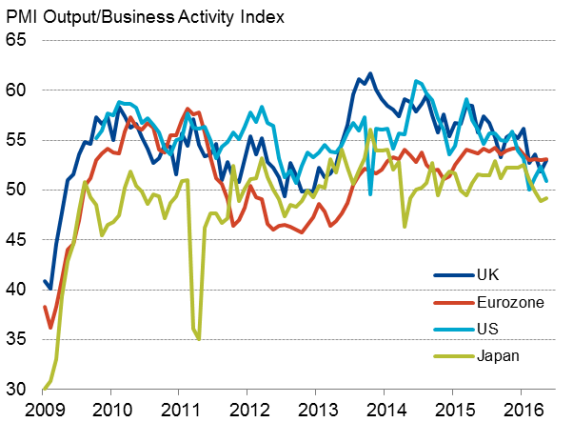

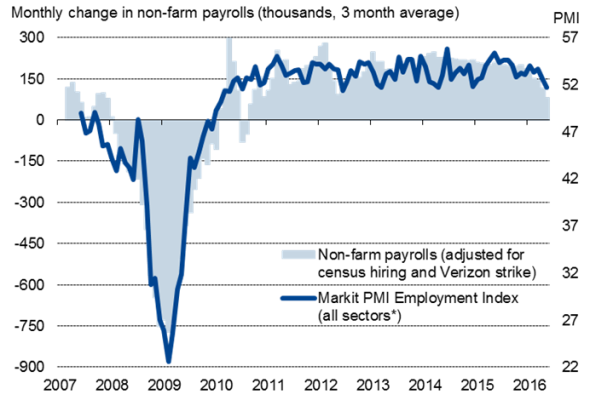

US PMI and payrolls point to second quarter malaise

Among the developed work economies, the big change so far this year has been a slowing in the US economy, which Markit's PMIs indicate persisted into May. The PMIs point to US GDP rising in the second quarter at a similarly meagre rate to the annualised 0.8% pace seen in Q1. Amongst other factors, uncertainty over the presidential election was found to have been cooling demand. The PMIs also forewarned of a shock slowdown in the official measure of hiring so far in Q2, which was widely seen as having taken a June Fed rate hike off the table.

US economic growth (GDP v PMI output)*

US payrolls v PMI employment

Sources: Markit, U.S. Department of Commerce, U.S. Bureau of Labor Statistics.

Use the download link below to access a full overview of the May PMI surveys, including details of all major economies, policy implications and the market impact.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Economics-Global-economic-growth-falters-in-May.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Economics-Global-economic-growth-falters-in-May.html&text=Global+economic+growth+falters+in+May","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Economics-Global-economic-growth-falters-in-May.html","enabled":true},{"name":"email","url":"?subject=Global economic growth falters in May&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Economics-Global-economic-growth-falters-in-May.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economic+growth+falters+in+May http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f07062016-Economics-Global-economic-growth-falters-in-May.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}