Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 06, 2016

Indian GDP growth accelerates ahead of demonetisation, but moderation is likely in December quarter

India's economy expanded strongly in the September quarter, but analysts are concerned about the impact that demonetisation will have in the upcoming quarters. Whereas growth of consumer spending is likely to be stymied as a result of cash shortages, fiscal and monetary policies are expected to provide a boost to the economy around the turn of the year. Although PMI data for the service sector plunged sharply in November, this doesn't imply that the country is falling off a cliff. In fact, business confidence improved over the month, while manufacturing held its ground and remained in expansion mode. A stuttering performance is anticipated, but India remains on course to post robust growth for the FY17.

GDP growth gathers pace in September quarter

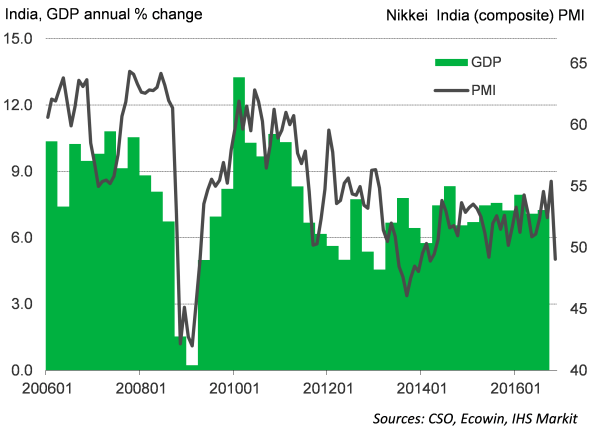

India's economy recorded a robust upturn during the July to September quarter, according to official data, with GDP growth accelerating from 7.1% in the previous quarter to 7.3%.

India GDP and the PMI

Nikkei PMI survey data, compiled by Markit, likewise highlighted solid expansions across the two sectors covered: manufacturing and services, with the respective readings averaging 53.6 and 52.9 respectively in the third quarter. Nevertheless, GDP growth is likely to slow in the forthcoming quarter as indicated by weaker PMI readings for the November surveys.

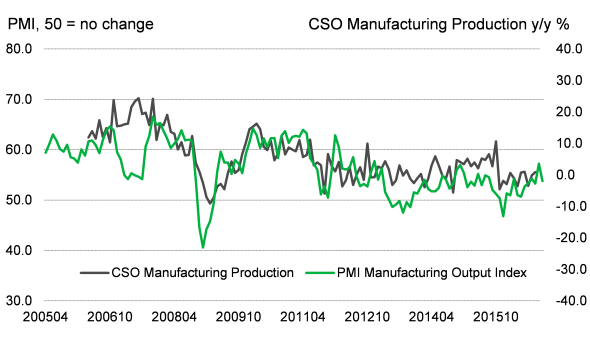

Manufacturing sector and the PMI

The survey data showed goods producers were affected by the sudden withdrawal of high-value banknotes, with output growth easing from October's 46-month high on the back of a softer increase in new work. On the other hand, services companies reported a far stronger impact of the demonetisation of the rupee, with the sector seeing the largest monthly drop in business activity for almost three years.

Manufacturing sector and the PMI

Seven out of the eight sectors covered by Mospi posted annual increases, the exception being Mining & Quarrying where a mild decline in GVA was registered. Public Administration, Defence & Other Services saw the strongest rate of expansion (+12.5%), followed by Financial, Real Estate & Professional Services (+8.2%). Within the services economy, Trade, Hotels, Transport, Communication & Broadcasting recorded a 7.1% increase in GVA, while manufacturing growth was also up 7.1%.

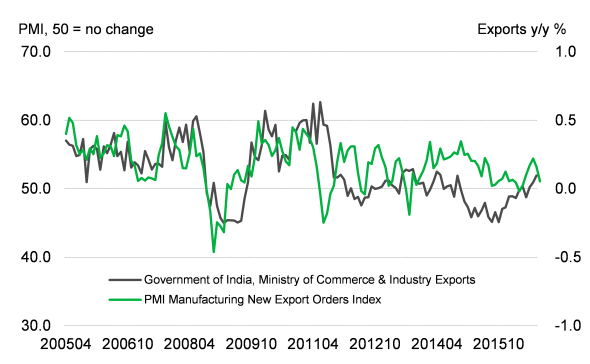

External environment contribute to upturn

The official data highlighted a mild upturn in exports over the quarter, while imports plunged 9.0% y/y. As such, the contribution from net trade to overall GDP increased. Indian total exports have risen in each month since August, with growth accelerating to 9.6% during October, according to the Ministry of Commerce & Industry. While the PMI New Export Orders Index for manufacturing points to ongoing expansion, November saw growth ease to a five-month low.

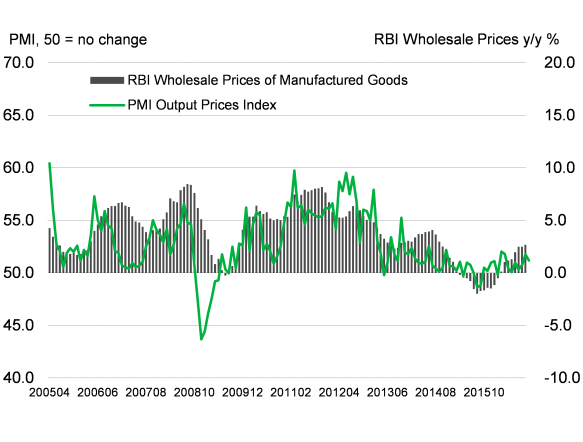

Cost inflationary pressures fade

Wholesale price data for manufactured goods, published by the RBI, pointed to a slightly faster increase in prices during October, up 2.7% y/y from +2.5% in September. Meanwhile, the consumer price index, as released by the Mospi, was at +4.2%, its lowest mark since August 2015.

Having gained speed in October, the PMI surveys indicated that the reduction in money supply curbed input cost inflation during November. Average cost burdens facing service providers were broadly unchanged, which encouraged firms to lower their selling prices. Across the goods-producing sector, both purchasing costs and factory gate charges increased again, but at softer rates.

In light of these numbers, monetary policy looks set to remain accommodative, with further cuts to the benchmark rate expected.

Inflation and the PMI

GDP growth likely to ease below 7.0% in current financial year

As a result of a slowdown in private consumption and a further likely contraction in fixed investment, the first post-demonetisation estimate of IHS Markit puts India's full year 2016 growth at 7.1% during the November quarterly forecast round. But weaker September-quarter growth means that the economy was even more fragile when it faced the demonetisation shock, implying that there is a risk that growth may actually fall below 7.0% in 2016. Much will depend on the extent to which the economy bounces back in December.

The outlook for the 2017 remains even less certain as much will depend on the policy actions the government and central bank will take to stimulate domestic demand. Fiscal policy will likely become more expansionary, as the government finds more room for spending given an expected increase in tax collection (as some undisclosed income is declared following the demonetisation). Moreover, some comfort can be drawn by PMI survey data showing businesses became more optimistic about the year ahead in November, with expectations hitting a three-month high.

Pollyanna De Lima | Principal Economist, IHS Markit

Tel: +44 149 146 1075

pollyana.delima@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122016-economics-indian-gdp-growth-accelerates-ahead-of-demonetisation-but-moderation-is-likely-in-december-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122016-economics-indian-gdp-growth-accelerates-ahead-of-demonetisation-but-moderation-is-likely-in-december-quarter.html&text=Indian+GDP+growth+accelerates+ahead+of+demonetisation%2c+but+moderation+is+likely+in+December+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122016-economics-indian-gdp-growth-accelerates-ahead-of-demonetisation-but-moderation-is-likely-in-december-quarter.html","enabled":true},{"name":"email","url":"?subject=Indian GDP growth accelerates ahead of demonetisation, but moderation is likely in December quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122016-economics-indian-gdp-growth-accelerates-ahead-of-demonetisation-but-moderation-is-likely-in-december-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Indian+GDP+growth+accelerates+ahead+of+demonetisation%2c+but+moderation+is+likely+in+December+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06122016-economics-indian-gdp-growth-accelerates-ahead-of-demonetisation-but-moderation-is-likely-in-december-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}