Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 06, 2015

Credit risk returns to fixed income market

Both CDS and bond indices indicate that US fixed income risk has picked up to multi-year highs, though Monday saw that trend retreat.

- The credit spreads in both high yield credit and investment grade corporate bonds jumped 80% from last year's lows

- Both HY and IG CDX indices registered multi-year highs last week

- Yesterday's bond rally saw credit risk retreat from recent highs

Credit risk has returned in earnest to the US bond market in the last 12 months. The market has been coming to terms with the reality that the tap of cheap credit unleashed by the last seven years of zero interest rates is coming to an end. Investors are now taking a more sceptical view of the growing debt pile sitting on company balance sheets. Idiosyncratic risk, stemming from China and the commodities slump, has also picked up markedly as the receding tide forces firms to address investor questions over their ability to repay debts taken on in rosier times.

Asset swap spreads at multi-year highs

The increased risk perception is evidenced in the asset swap spread commanded by bonds, which measure the extra yield required by investors to hold bonds over benchmark rates. The current asset swap spread of the Markit iBoxx $ Liquid Investment Grade and $ Liquid High Yield indices are now sitting at multi-year highs after climbing by over 80% from the all-time lows registered in the middle of last year.

Investors required 550bps of extra yield to hold high yield bonds, the highest level since August of 2012. Investment grade bonds tracked by the iBoxx $ Liquid Investment Grade index are sitting at an even more significant high as the 210bps of extra yield required by investors to hold the asset class last Friday marked a three and a half year high.

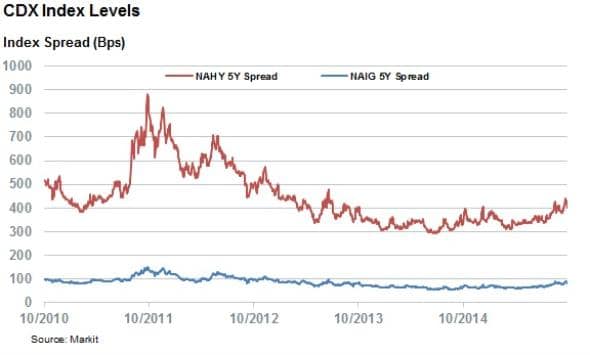

CDS indices trend higher

The growing market risk perception towards bonds is also mirrored in the credit derivative market where CDS spreads are trading at multi-year highs. The desire to insure against bond defaults has pushed CDS spreads to highs of a similar magnitude as those seen in the cash bond market. This has in turn seen the Markit CDX IG and HY indices rise significantly from the lows seen at the end of last year.

Monday tightening

While credit risk has been mostly a one way street in recent months, Monday registered one of the largest tightening swings of the last few months as both CDS indices and asset swap spreads fell from their recent highs. Ironically, this tightening comes at the heels of Friday's weak non-farm payroll number, which has led some to call for more monetary easing and to discount the immediate possibility of an interest rate hike from policy makers. This continued uncertainty regarding monetary policy and macroeconomic stability will mean that the market's risk perception will continue to fluctuate after three years of relative stability.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-credit-credit-risk-returns-to-fixed-income-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-credit-credit-risk-returns-to-fixed-income-market.html&text=Credit+risk+returns+to+fixed+income+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-credit-credit-risk-returns-to-fixed-income-market.html","enabled":true},{"name":"email","url":"?subject=Credit risk returns to fixed income market&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-credit-credit-risk-returns-to-fixed-income-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+risk+returns+to+fixed+income+market http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06102015-credit-credit-risk-returns-to-fixed-income-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}