Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 06, 2015

Greek regulators fighting shadows

Greek regulators rolled out a short selling ban last week, but a closer look at the data shows that Greek short sellers were few and far between.

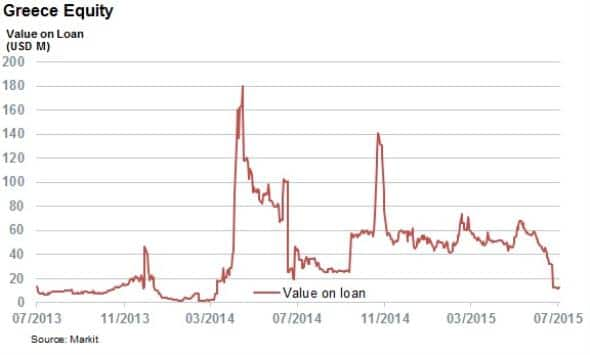

- Greek equity value on loan totalled $12m on the day the ban came into place

- Low demand is not driven by supply as over $800m of Greek equites available to lend

- Only one Greek company saw more than 1% of shares out on loan in the last 12 months

One of the less reported steps taken by Greek market regulators last week was the temporary short selling ban which forbade investors to "create or increase a net short position" on shares trading on Greek exchanges from the 30th of June to the 6th of July. The temporary emergency measure was introduced despite the Greek markets remaining shut over its duration, and appears to be a largely symbolic step as recent short selling activity in Greek equities has been relatively non-existent.

Short interest muted

The overall demand to borrow Greek equites stood at an extremely low $12m on the eve of the ban coming into place on June 29th. This low demand to borrow puts the overall value of Greek short positions firmly at the bottom of the eurozone league table, behind second to last place Ireland. Notably, Ireland still sees $400m of securities lending activity; over 30 times the activity levels seen in Greece.

This lack of demand looks to be driven by the recent market uncertainty, as the aggregate value of Greek short positions actually fell in the weeks leading up to the short selling ban coming in to place. That number had stood at $60m as late as April, just prior to the deterioration of talks.

The worsening situation also looks to have been impacting the supply of shares which lenders are willing to lend out, as total value of Greek securities sitting in lending programs has fallen by over 40% since the start of the year to $880m. This has outpaced the decline in the country's equity market, so the drop in lendable shares can be attributed to the fact that lenders are either selling their Greek holdings or removing Greek shares from lending programs.

Despite the fall in the quantity of Greek equities available to lend to short sellers, over 95% of the available pool has remained un-lent over the recent crisis as utilisation never breached the 5% mark. This means that the lack of shorting activity was driven by a lack of demand, most likely driven by market uncertainty, rather than any supply constraints.

Individual names not targeted

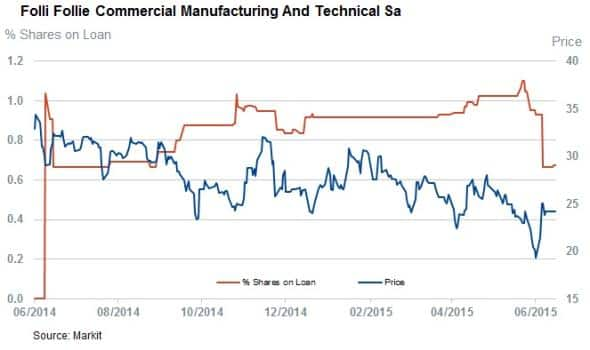

Further proof of the relative lack of shorting activity is provided by the fact that only one Greek share trading domestically has seen over 1% of its shares out on loan over the last 12 months. The firm in question, Folli Follie had 1.1% of shares out on loan on June 10th; a number that has since fallen by 40% to 0.7%.

As for the country's banks, which have been at the forefront of the recent volatility, only Eurobank Ergasias has seen over 0.5% of shares out on loan in the last 12 months.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-equities-greek-regulators-fighting-shadows.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-equities-greek-regulators-fighting-shadows.html&text=Greek+regulators+fighting+shadows","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-equities-greek-regulators-fighting-shadows.html","enabled":true},{"name":"email","url":"?subject=Greek regulators fighting shadows&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-equities-greek-regulators-fighting-shadows.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greek+regulators+fighting+shadows http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06072015-equities-greek-regulators-fighting-shadows.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}