Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 06, 2017

Brexit-exposed sectors in Ireland see rebound in first half of 2017

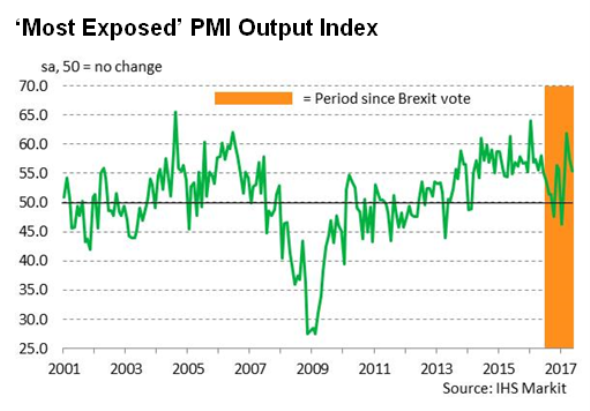

Sectors in Ireland most exposed to Brexit have seen a swift rebound in output growth in the first half of 2017 after being hit hard in the immediate aftermath of the UK's vote to leave the EU.

Latest PMI data compiled by IHS Markit for Investec suggest that growth has returned to pre-referendum levels ahead of the start of the crucial negotiations between the UK and EU later this month.

'Brexit-exposed' sectors see rebound

In November last year our research indicated that those sectors in Ireland most exposed to Brexit suffered in the wake of the UK's referendum, seeing output, new orders and employment all decline. These sectors include manufacturing of food and metal products as well as transport industries.

Updating this analysis with the most recent PMI data, however, shows that these sectors have recovered well, with growth rates back to where they were pre-referendum. Output has now risen for four consecutive months up to May, with growth having even hit a 14-month peak in March.

These heavily exposed sectors have reported rises in output on the back of renewed growth of new orders, which had fallen in September and October last year. New export orders are also on the up, with May seeing the strongest monthly expansion since September 2015.

Confidence among firms in those sectors most exposed to Brexit has also recovered the ground it lost in the wake of the referendum, with May seeing the strongest optimism around the prospects for output growth since April 2016.

Rising workloads and improving business confidence have encouraged these firms to take on extra staff. Employment now has increased for eight successive months following a decline in September 2016, with strong hiring recorded throughout 2017 so far.

Divergence with 'Less Exposed' sectors narrows sharply

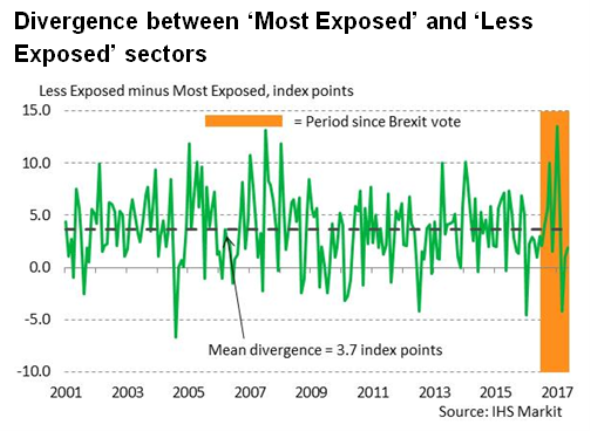

The gap in performance between the 'Most Exposed' and 'Less Exposed' sectors is now much narrower than in the months following the UK's referendum. May saw the Output Index for 'Most Exposed' sectors just 1.9 points below that for the 'Less Exposed', a lesser divergence than the average of 3.7 seen since the start of 2001.

The divergence with regards to new orders has also narrowed, while export growth in the 'most exposed' sectors has outpaced the 'less exposed' sectors in four successive months. Rates of job creation were broadly similar across the two groups in May, as was business sentiment.

It looks, therefore, as though Brexit worries have moved to the back of the minds of both Irish companies and their customers as 2017 has progressed. However, those firms in sectors most exposed to Brexit will be watching the start of negotiations in a few weeks' time closely for any signs as to how the future trading relationship with the UK might end up.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062017-economics-brexit-exposed-sectors-in-ireland-see-rebound-in-first-half-of-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062017-economics-brexit-exposed-sectors-in-ireland-see-rebound-in-first-half-of-2017.html&text=Brexit-exposed+sectors+in+Ireland+see+rebound+in+first+half+of+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062017-economics-brexit-exposed-sectors-in-ireland-see-rebound-in-first-half-of-2017.html","enabled":true},{"name":"email","url":"?subject=Brexit-exposed sectors in Ireland see rebound in first half of 2017&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062017-economics-brexit-exposed-sectors-in-ireland-see-rebound-in-first-half-of-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit-exposed+sectors+in+Ireland+see+rebound+in+first+half+of+2017 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06062017-economics-brexit-exposed-sectors-in-ireland-see-rebound-in-first-half-of-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}