Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 06, 2016

Investors flee high yield; Euro banks back in spotlight

In this week's credit wrap, investors have started to dump high yield bonds again, European financials come (back) under pressure and UK inflation linked gilt returns turn negative.

- HY bond ETFs have seen $1.55bn of outflows in May, the biggest monthly outflow since June

- Markit iTraxx Europe Senior Financials index has widened 11bps this week, back over 100bps

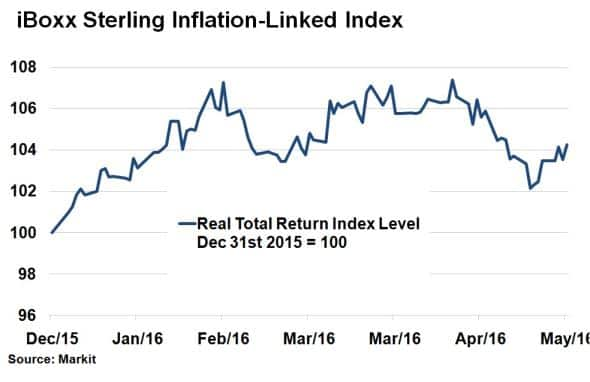

- Markit iBoxx Sterling Inflation-Linked Index returned -2.46% in April, as Brexit fears waned

High yield blues

It seems investors have had enough of high yield (HY) bonds. Exchange traded funds (ETFs) tracking the performance of the risky asset class, which incorporates bonds rated below BBB, have seen $1.55bn of outflows in the first week of May alone.

To put the extraordinary move into context, the last time outflows were on this scale (on a monthly basis) was last June, just before fears of a Chinese economic slowdown stirred volatility in global markets. Even when HY bond spreads widened significantly in December and January, outflows were only $704m and $283m, respectively.

A key driver of the HY bond market over the past year has been the price of commodities, so the recent investor behaviour could be an indication of waning positive sentiment on the direction of prices. Investors are either bracing themselves for more turmoil in HY markets or taking money off the table after the recent relief rally.

European financials

European financials are back in the spotlight after troubles earlier this year. This week saw a host of banks, from UBS to Commerzbank, report quarterly earnings to much disappointment. Add to the fray another probe (regarding the sale of Italian sovereign bonds in 2011) at German lender Deutsche Bank and a failed share offering from Italian bank Popolare di Vicenza, and investor fears have started to creep in again.

The cost to protect against the default of European financials is on the rise again. The Markit iTraxx Europe Senior Financials index, made up of 5-yr CDS spreads on European financial companies, has seen its spread widen to 101bps, having started the week at 90bps. It means that the index is back at a month wide, despite the efforts from the ECB to support corporate credit in the region (although banks are not directly included).

Gilt linkers fall flat

Inflation linked UK government gilts had a storming start to the year. The Markit iBoxx Sterling Inflation-Linked Index returned 5.38% in January on a real total return basis as fears of a ''Brexit'' dampened the strength of the pound Sterling.

Last month however, saw a reversal to the trend with UK inflation linked gilts returning 2.46%. Stronger sterling thanks to the momentum gained after US president Obama's anti-Brexit endorsement has made exports more expensive, a negative for inflation.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-credit-investors-flee-high-yield-euro-banks-back-in-spotlight.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-credit-investors-flee-high-yield-euro-banks-back-in-spotlight.html&text=Investors+flee+high+yield%3b+Euro+banks+back+in+spotlight","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-credit-investors-flee-high-yield-euro-banks-back-in-spotlight.html","enabled":true},{"name":"email","url":"?subject=Investors flee high yield; Euro banks back in spotlight&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-credit-investors-flee-high-yield-euro-banks-back-in-spotlight.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+flee+high+yield%3b+Euro+banks+back+in+spotlight http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052016-credit-investors-flee-high-yield-euro-banks-back-in-spotlight.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}