Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 06, 2015

UK service sector upturn adds to signs of economy rebounding in second quarter

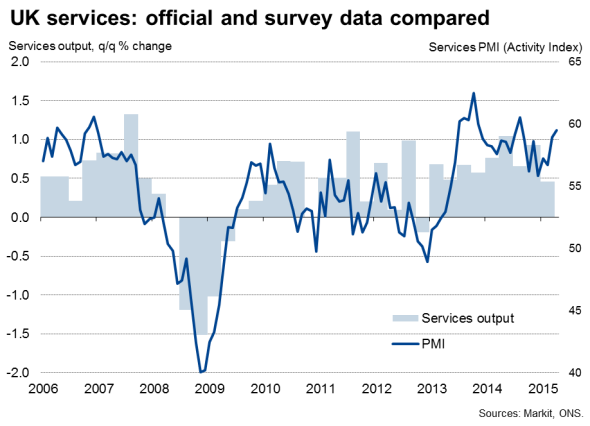

The UK PMI business surveys recorded an encouragingly robust pace of growth in April, boding well for a rebound in the economy after the weakness seen in the first quarter. Less positive are the signs that the upturn has become increasingly reliant on the service sector and consumer spending, which raises concerns about the sustainability of the expansion and a lack of rebalancing towards manufacturing. A fall in prices charged will also revive fears about deflation.

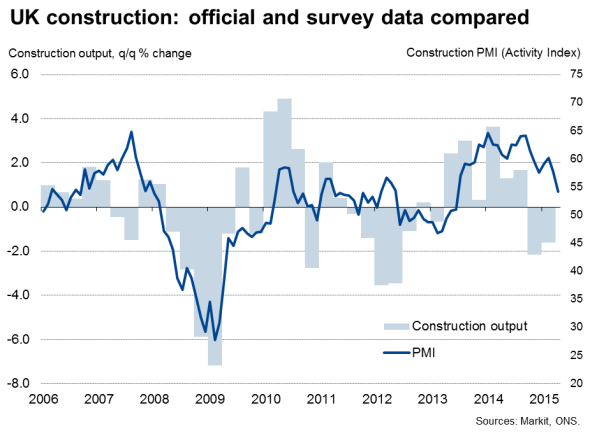

However, there is evidence that the recent weakness in parts of the economy, notably construction, is due to uncertainty ahead of the General Election. Growth could therefore pick up again given a satisfactory election result which is supportive of the economy.

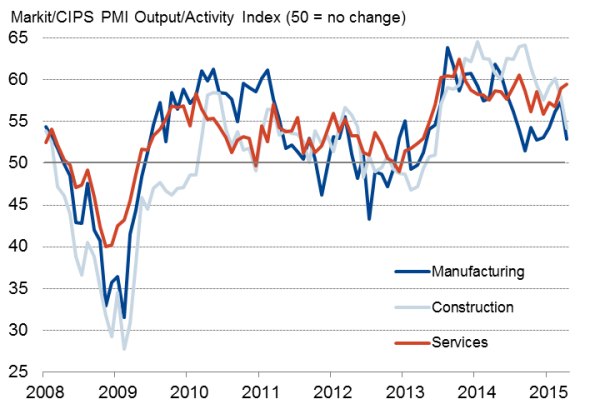

Business activity by sector

Solid start to second quarter

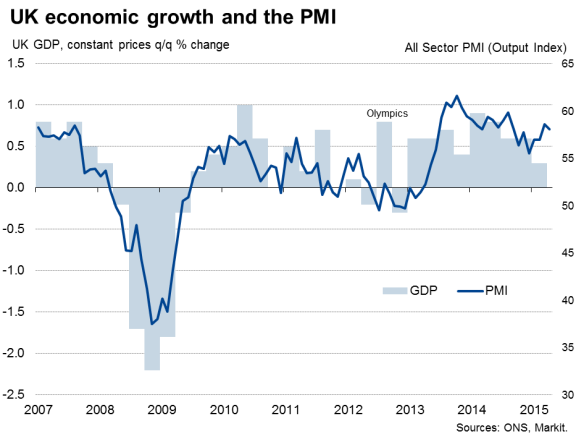

A GDP-weighted average of the three PMI surveys' output indexes remained elevated at 58.1 in April, a reading which is broadly consistent with the economy growing at a quarterly rate of 0.8%. Although down from March's level of 58.6, to indicate a slowing in the pace of expansion, April's reading was nevertheless the second-highest seen over the past seven months.

The surveys therefore point to a rebound in the pace of economic growth after official data showed GDP rose a disappointing 0.3% in the first three months of the year (although this initial estimate looks likely to be revised higher in future releases).

Hiring up, prices down

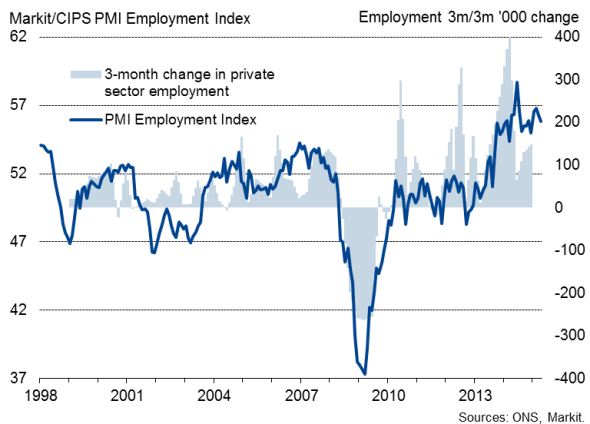

Companies are also preparing for further growth in coming months, with employment rising sharply in April, albeit at the weakest rate seen so far this year. The survey data are broadly consistent with job creation of 200,000 per quarter, a pace which is sufficiently strong to suggest that unemployment, currently down to a seven-year low of 5.6%, will continue to fall.

However, although the survey data are showing some signs of wage growth picking up (and notably a record rise in construction sector sub-contractor pay rates), there is little sign of inflationary pressures. In fact, average prices charged for goods and services dropped at the fastest rate since September 2009 as falling costs for goods and low pay pressures were passed through to customers amid intense competition.

Employment

No rush to raise interest rates

The robust pace of economic expansion and job creation signalled by the data support the view that the next policy move at the Bank of England will be a rate hike, but the lack of inflationary pressures suggests the first hike is unlikely to take place before the end of the year.

Policymakers will also be worried that growth is being driven predominantly by the service sector, and that the economy remains overly reliant on the consumer to support ongoing expansion.

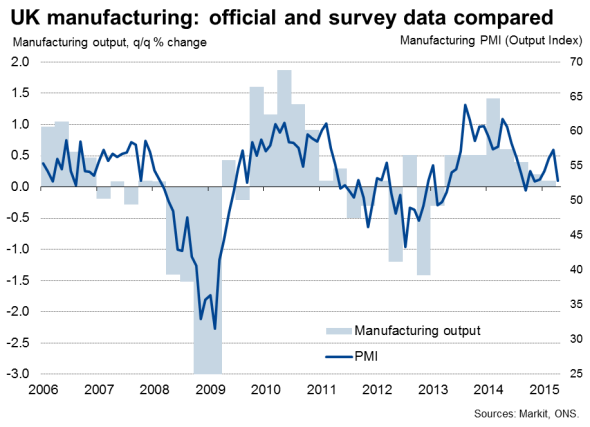

Service sector activity showed the largest monthly rise since last August, but growth of both manufacturing output and construction activity both slowed sharply in April, the latter down to the weakest for almost two years.

Furthermore, any growth in manufacturing was largely the result of rising orders for consumer goods, with orders for both investment and intermediate goods falling. Weaker demand for these goods points to a downturn in business investment spending and destocking - both signs of economic uncertainty and concern about the outlook.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-economics-uk-service-sector-upturn-adds-to-signs-of-economy-rebounding-in-second-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-economics-uk-service-sector-upturn-adds-to-signs-of-economy-rebounding-in-second-quarter.html&text=UK+service+sector+upturn+adds+to+signs+of+economy+rebounding+in+second+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-economics-uk-service-sector-upturn-adds-to-signs-of-economy-rebounding-in-second-quarter.html","enabled":true},{"name":"email","url":"?subject=UK service sector upturn adds to signs of economy rebounding in second quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-economics-uk-service-sector-upturn-adds-to-signs-of-economy-rebounding-in-second-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+service+sector+upturn+adds+to+signs+of+economy+rebounding+in+second+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06052015-economics-uk-service-sector-upturn-adds-to-signs-of-economy-rebounding-in-second-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}