Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 06, 2017

Chinese business confidence improves despite slower economic growth in January

January saw business activity and new order growth slow after a solid end to 2016. Jobs growth meanwhile remained elusive, as higher costs continued to weigh on companies' bottom lines.

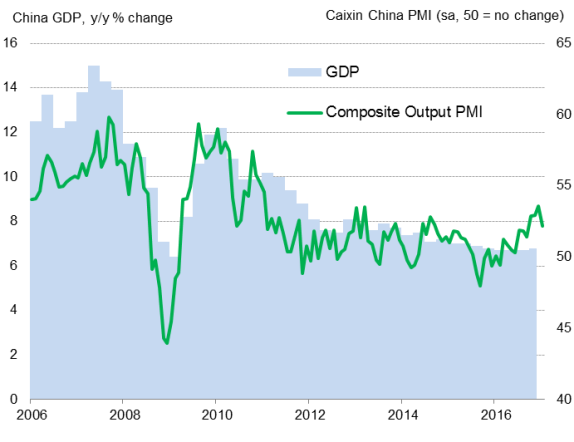

Caixin China PMI v GDP

However, business optimism reached a ten-month high, suggesting growth may pick up again in coming months.

The Caixin Composite PMI Output Index fell from 53.5 in December to 52.2 in January. The rate of expansion of new orders slowed from December as well. The upturn in demand was linked to improvements in the health of the Chinese economy and a renewed upturn in merchandise export orders.

Growing optimism

Amid stronger demand for Chinese products and services, companies were increasingly upbeat about business growth prospects in the year ahead. The newly-released Future Output Index, which tracks expectations about firms' business activity levels in 12 months' time, hit its highest in almost a year during January, suggesting that January's slowdown in business activity growth may only be temporary. Business confidence was higher in the service sector than the manufacturing industry.

Stable employment

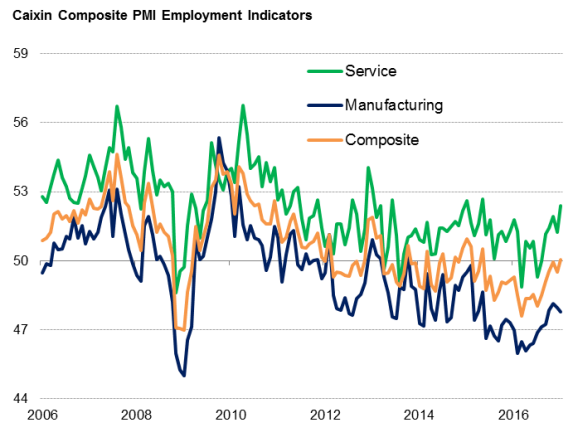

As China seeks to transform into a consumption-based economy, a key structural reform is overhauling the industrial sector, including eliminating excess capacity in heavy industries.

Job cutting is seen as a necessary consequence. The hope is that growth in the service sector will create new jobs to offset the loss of employment in the manufacturing economy. However, the survey data suggest that those plans have not yet fully materialised.

Employment trends

Manufacturing jobs continued to be culled, while the increase in service-related staff numbers was insufficient to generate an overall increase in employment.

There was also evidence that higher input costs are causing manufacturers to lay off workers. The pace of job shedding in the manufacturing industry accelerated from December.

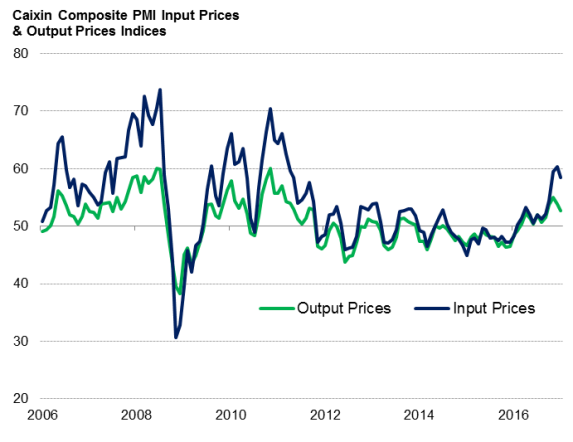

Rising inflation

The extent to which companies' costs are rising remains substantial. The January survey found the rate of input cost inflation to have been the third-strongest in over five-and-a-half years. Cost increases were especially pronounced across the manufacturing sector, linked to higher prices for raw materials such as oil and metals. The depreciation of the yuan was also reported to have lifted prices for imported inputs. Consumers will likely see price hikes as greater business costs are finding their way through to higher selling prices.

Inflationary pressures

Sources: Markit, Caixin, Datastream

Policy implications

January's slowdown notwithstanding, recent PMI survey data have indicated that a stabilisation in the Chinese economy is underway, a development that policymakers welcome as they grapple with structural reforms.

So far, unfortunately, economic expansion signaled by the surveys as well as rising confidence about the year ahead has not translated into net job creation. In part, higher costs were behind companies' reluctance to hire more staff in January. Increased uncertainty over domestic and global policies is another deterrent to hiring. There are also expectations of reduced support from fiscal and monetary fronts this year.

Amid steady growth momentum, the People's Bank of China reportedly raised short-term interest rates to signal their intentions to manage financial risks arising from high levels of corporate debt. In the absence of stronger growth, any aggressive tightening of policy looks unlikely.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022017-Economics-Chinese-business-confidence-improves-despite-slower-economic-growth-in-January.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022017-Economics-Chinese-business-confidence-improves-despite-slower-economic-growth-in-January.html&text=Chinese+business+confidence+improves+despite+slower+economic+growth+in+January","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022017-Economics-Chinese-business-confidence-improves-despite-slower-economic-growth-in-January.html","enabled":true},{"name":"email","url":"?subject=Chinese business confidence improves despite slower economic growth in January&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022017-Economics-Chinese-business-confidence-improves-despite-slower-economic-growth-in-January.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+business+confidence+improves+despite+slower+economic+growth+in+January http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06022017-Economics-Chinese-business-confidence-improves-despite-slower-economic-growth-in-January.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}